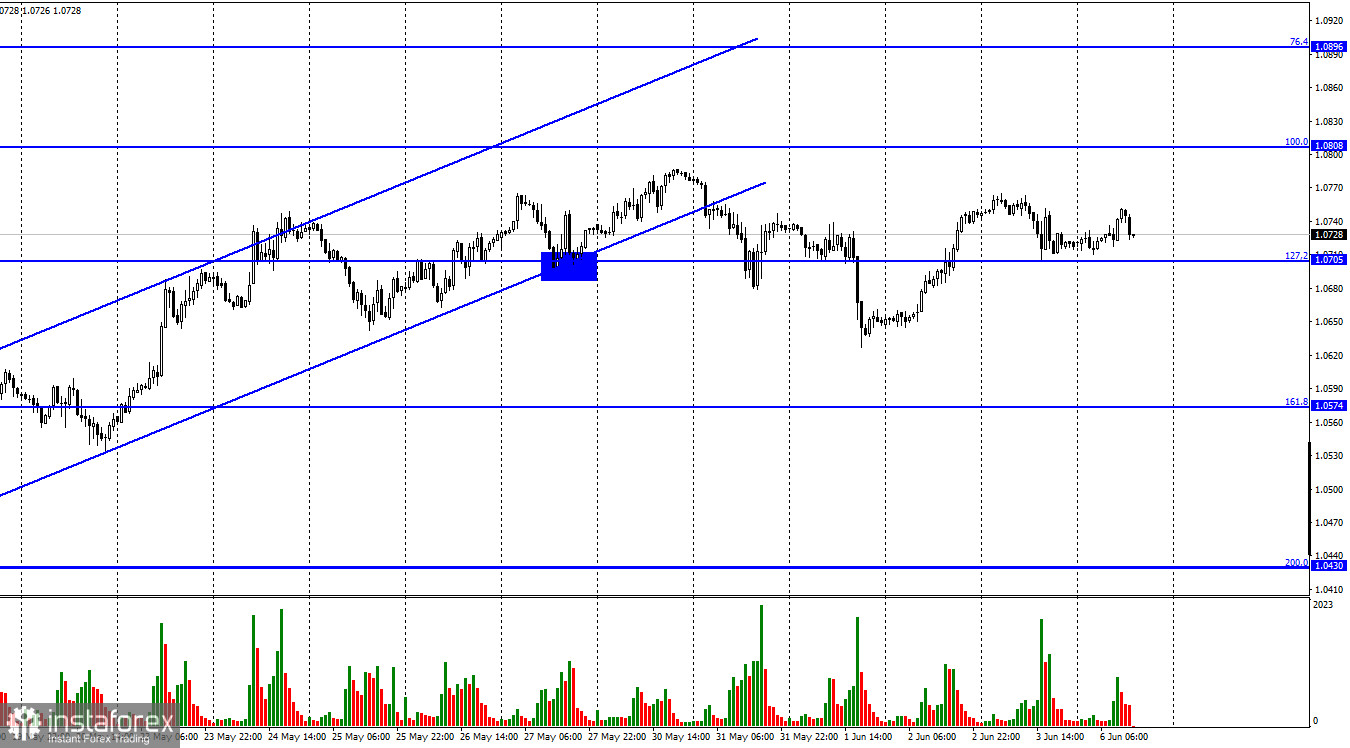

The EUR/USD pair performed a reversal in favor of the US dollar on Friday and performed a fall to the corrective level of 127.2% (1.0705), about which it has been trading in the last two weeks. The rebound from this level allowed the European currency to grow slightly on Monday, but not significantly. Closing the pair's exchange rate below the level of 1.0705 will increase the probability of the euro falling towards the next Fibo level of 161.8% (1.0574). At the moment, I can characterize the graphic picture as follows. The euro currency has rebounded from its minimum values, but it is incapable of anything more now. Bull traders made a march, but very soon began to doubt their actions, since the information background is not too good for the euro currency now. Bear traders, mindful of the minimum values for a couple of years, are afraid of new sales of the pair. And the pair has been moving in a narrow price range for two weeks, continuing to expect new growth or fall factors.

A whole package of important statistics was released in the US on Friday. The Nonfarm Payrolls report was by far the most significant, which showed 390K new jobs created, not counting the agricultural sector. This is above market expectations. The unemployment rate remained at 3.6%, and wages rose in line with traders' expectations. Thus, in my opinion, this package of statistics can be unambiguously recorded in the asset of the US currency. Bear traders had an excellent opportunity to push through the 127.2% level but did not take advantage of it. I would not make loud conclusions in connection with this situation. It should be remembered that the situation in the world remains very unstable, not to mention the markets that are going through hard times and are afraid of a new escalation of the conflict in Ukraine or new shocks related to energy resources, inflation, and sanctions. And so far, they regularly receive these new shocks. Last week, the European Union approved the sixth package of sanctions against the Russian Federation, which involves a partial embargo on supplies. A gas embargo may be adopted soon, and a corresponding package of sanctions is already being developed in Europe.

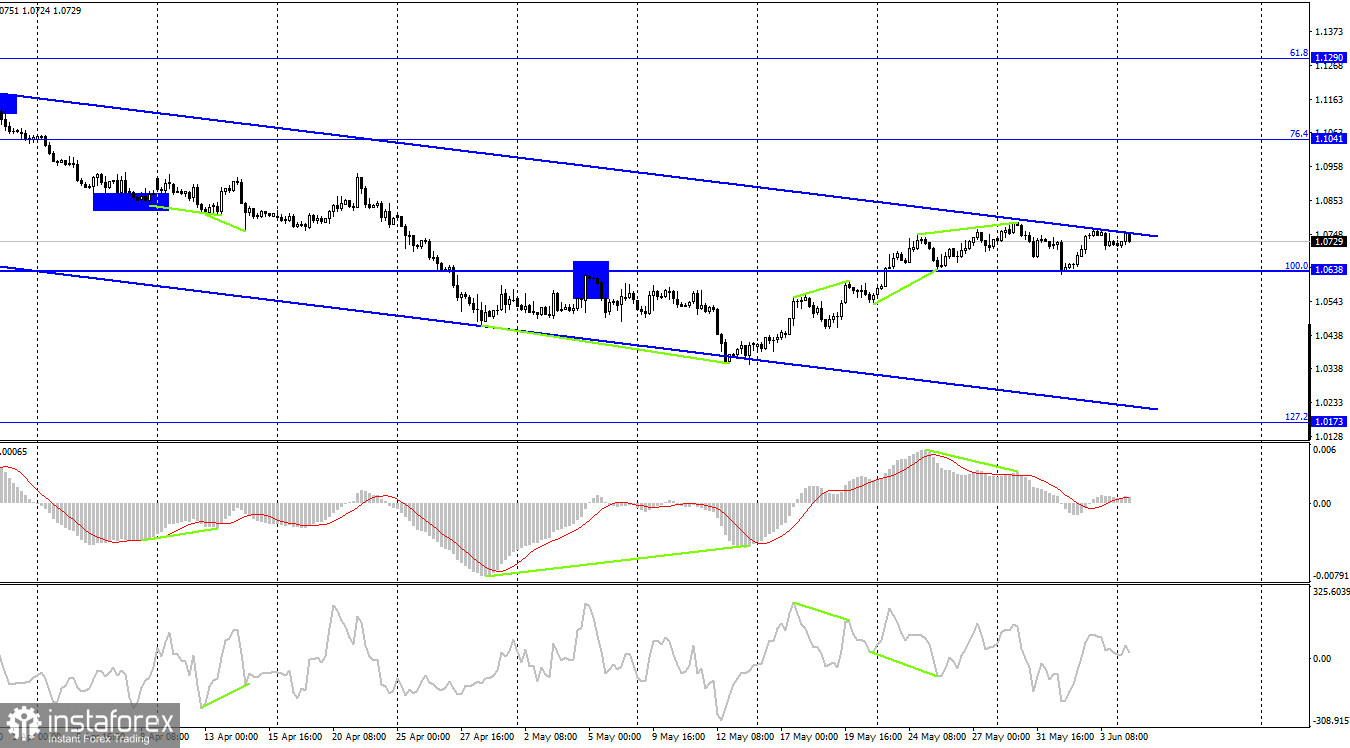

On the 4-hour chart, the pair performed a rebound from the corrective level of 100.0% (1.0638) and returned to the upper line of the descending trend corridor, which continues to characterize the current mood of traders as "bearish". Fixing the corridor will work in favor of the EU currency and its continued growth in the direction of the Fibo level of 76.4% (1.1041). Fixing the pair's exchange rate below the level of 100.0% will increase the probability of a further fall in the direction of the corrective level of 127.2% (1.0173).

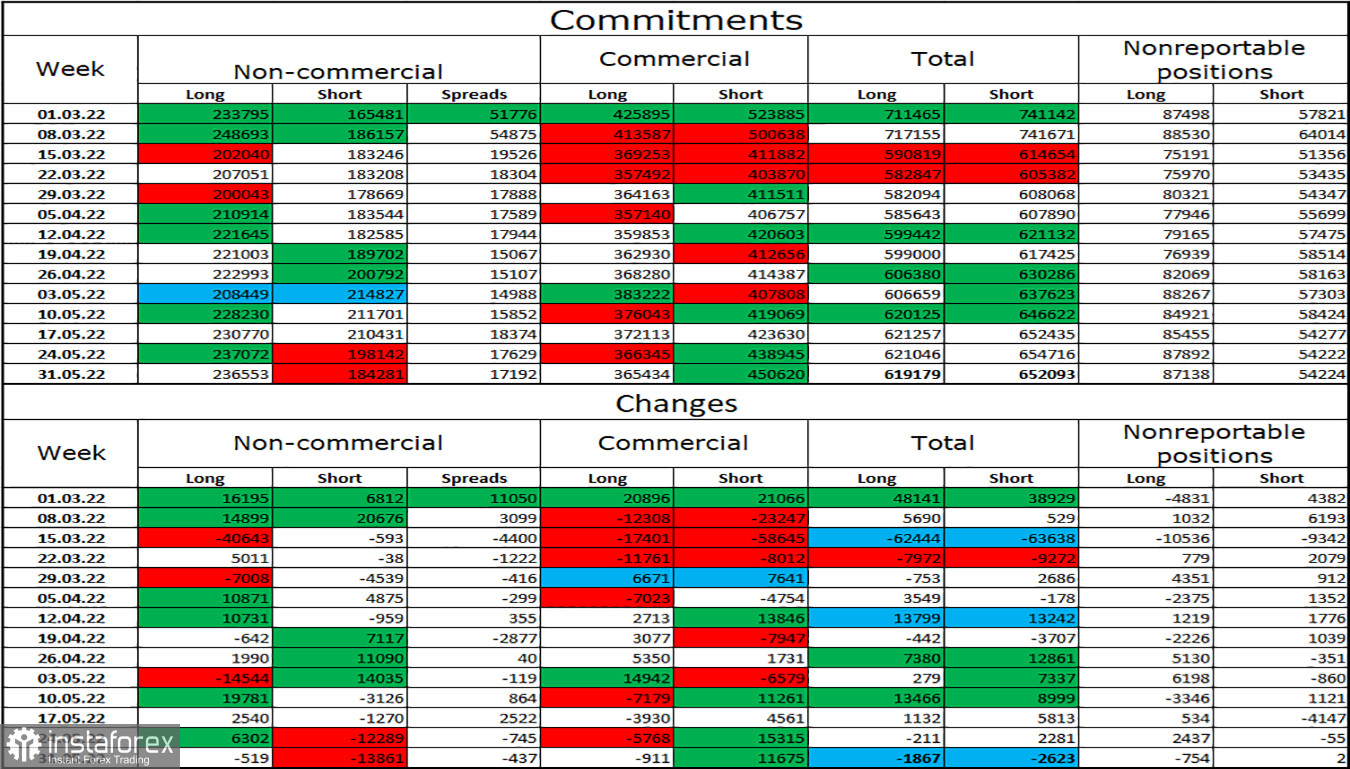

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 519 long contracts and 13,861 short contracts. This means that the bullish mood of the major players has intensified again. The total number of long contracts concentrated on their hands is now 236 thousand, and short contracts - 184 thousand. As you can see, the difference between these figures is not very big and you can't even say that the European currency has been falling nonstop in recent months. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, but this did not help the EU currency. Now the prospects for the euro currency are improving every day, as major players continue to buy more than sell, and the euro itself has grown slightly. If bull traders do not start to retreat sharply from their intentions in the near future, the euro may seize the initiative from the dollar for a long time.

News calendar for the USA and the European Union:

On June 6, the calendars of economic events in the European Union and the United States do not contain a single interesting entry. Thus, the information background will not have any impact on the mood of traders today.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when closing below the level of 1.0638 on a 4-hour chart with targets of 1.0574 and 1.0430. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.