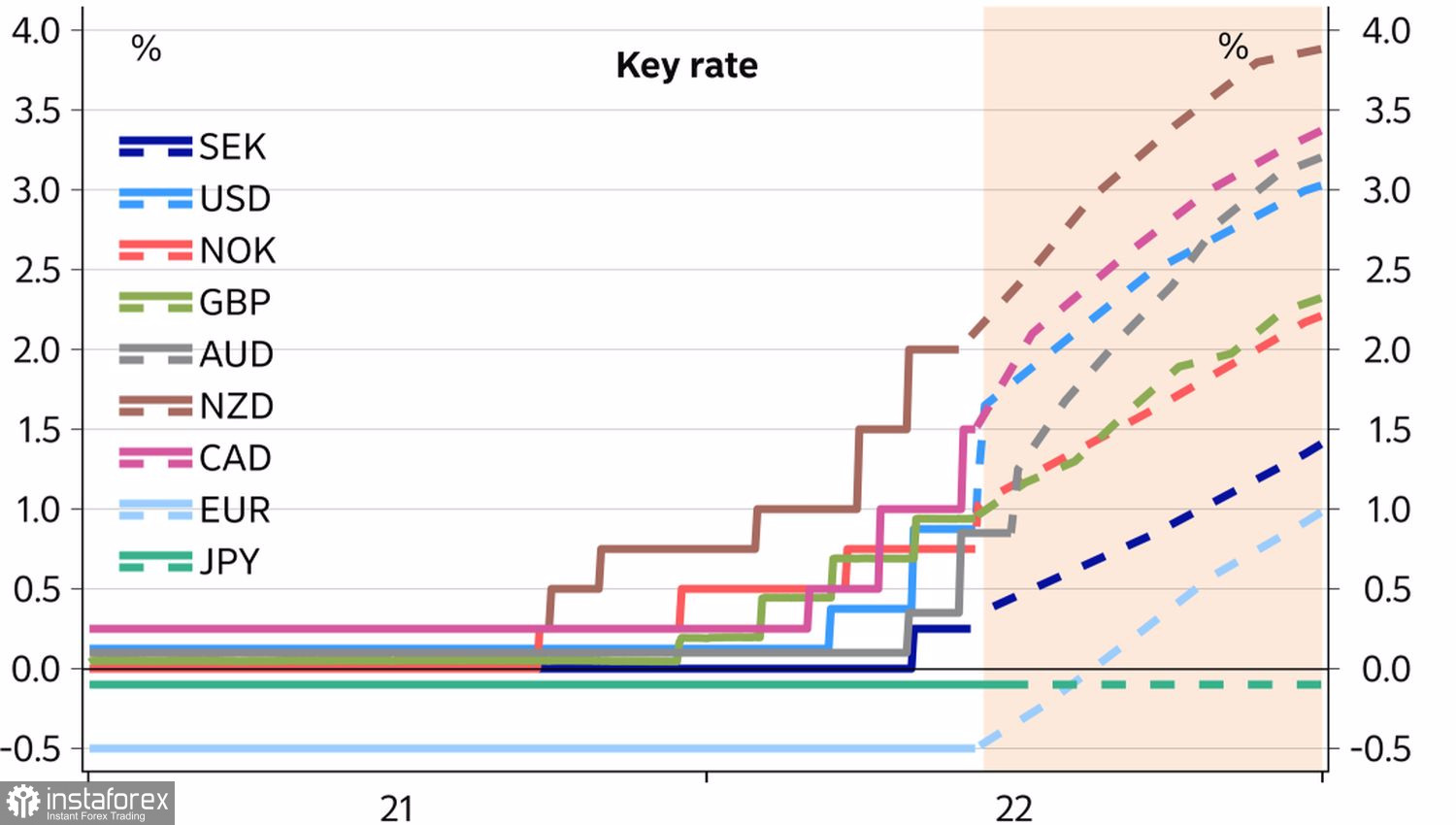

At a time when inflation is accelerating to 40-year highs, raising rates by 50 bp at the meetings of central banks-issuers of G10 currencies becomes a new reality. The Reserve Bank of Australia surprised investors with a big move, its counterparts in New Zealand and Canada have done it more than once, and even the traditionally dovish European Central Bank has hinted at a 50 bp increase in borrowing costs in September. Such aggressive monetary restriction supports the euro and other currencies, but the demand for the US dollar does not weaken. Nobody wants to go against the US central bank, while Federal Reserve Chairman Jerome Powell and his colleagues have a quite transparent goal - to curb inflation.

Dynamics of rates of central banks issuing G10 currencies

The same inflation in May that presented an unpleasant surprise to the opponents of the US currency. Instead of expanding at the previous rate of 8.3%, consumer prices jumped to 8.6%, and the growth rate of the base CPI slowed down less (+6%) than Bloomberg analysts expected (+5.9%). If, before the release of important statistics, only 23 out of 85 analysts surveyed by Reuters expected a 50 bps increase in the federal funds rate in September, then after the release of inflation data, their number would certainly have increased.

The futures market predicts that the Fed rate will rise to 3% by the end of 2022, but if the FOMC decides to take a big step three consecutive times, borrowing costs will rise even higher. It seems that neither Treasury bond yields nor the US dollar have yet exhausted their potential, which is bad news for EURUSD bulls.

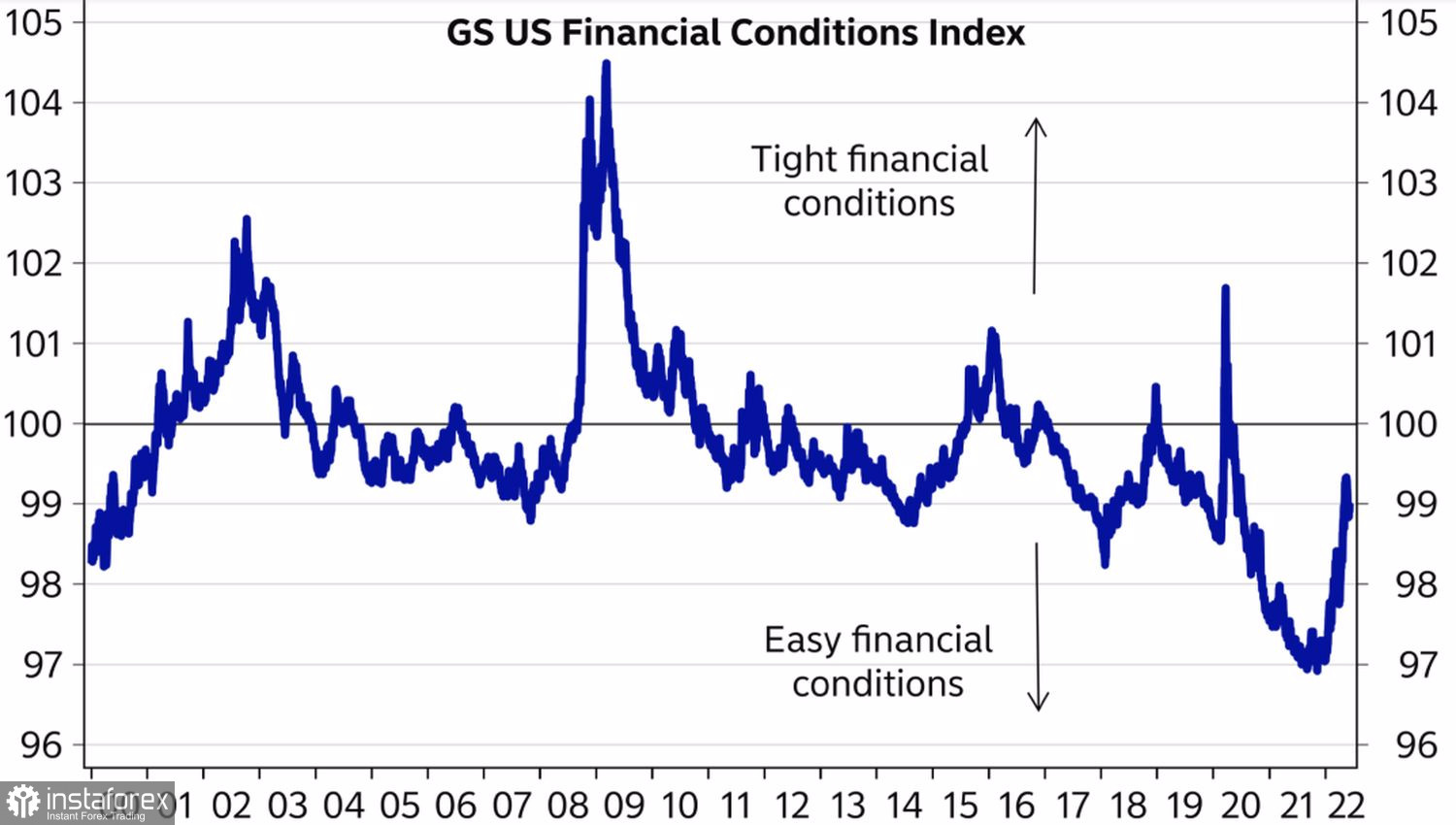

The unexpected acceleration of consumer prices in the United States in May ahead of the meeting of Powell and his colleagues opens the door for a further fall in the main currency pair. The FOMC meeting is the key event of the week by June 17. The issue of raising the rate by 50 bp has already been resolved, it remains only to find out at what level officials see it in the medium and long term. Probably at a high level, which will give a new impetus to long positions on the US dollar. Moreover, the Fed has every reason to be a hawk: recently, the dynamics of the most important indicator of financial conditions is not going as the central bank would like.

Dynamics of financial conditions in the US

Even the ECB failed to shake the strong positions of the US currency, which signaled the start of the process of tightening monetary policy in June and a possible increase in the deposit rate by 50 bps in September. The markets were waiting for such news, and after they arrived, EURUSD sold off on the facts.

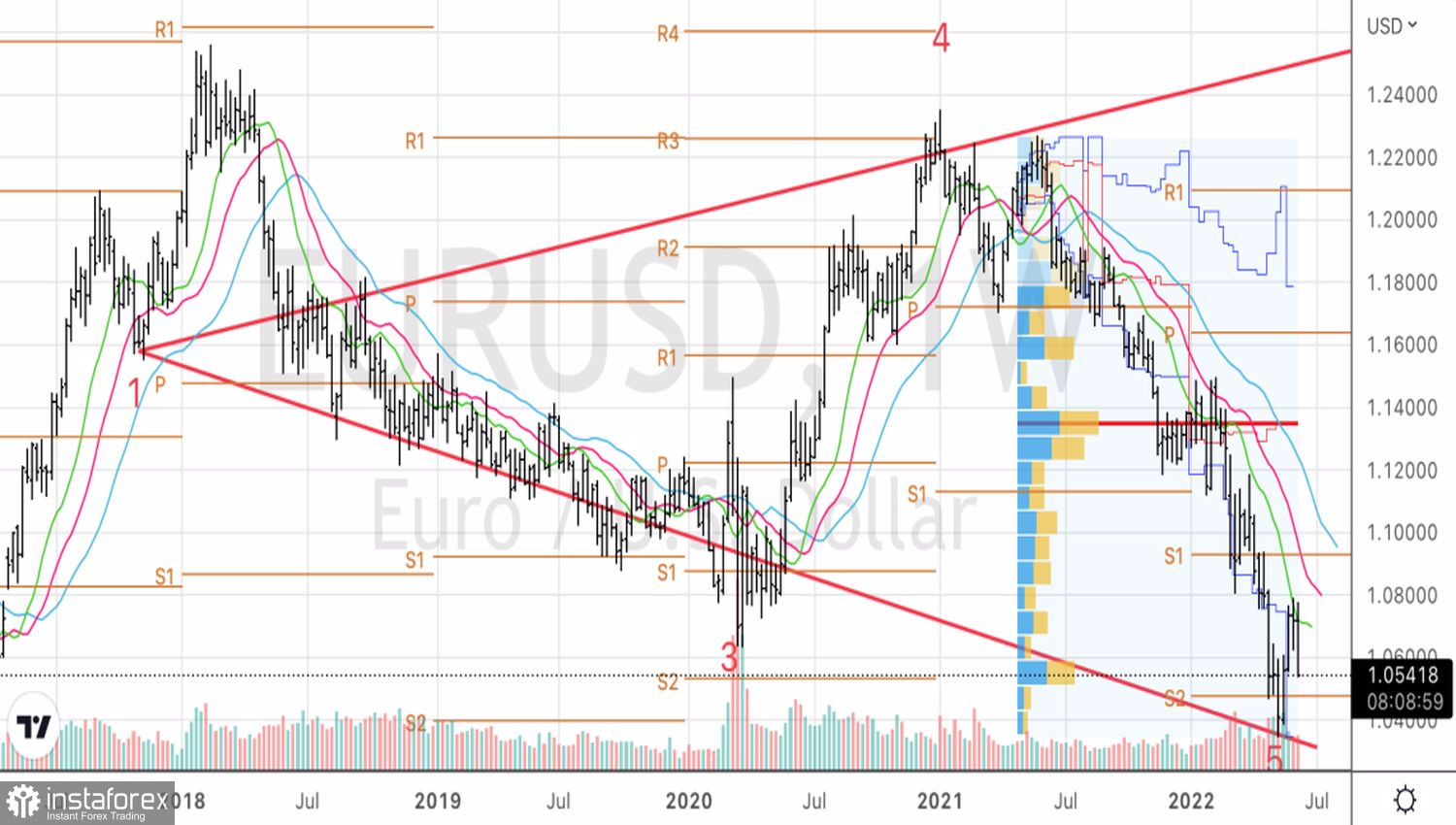

Technically, as we assumed a week ago, the rebound from resistance in the form of the first of the moving averages included in Bill Williams' Alligator, followed by the return of EURUSD below the base of the previous bar at 1.063 within the framework of Linda Raschke's Holy Grail strategy became the basis for the formation of short positions. We hold them and increase them on rollbacks. There is a high probability that the main currency pair will be able to return to 1.04. Here is our target.

EURUSD, daily chart