The euro-dollar pair ended the trading week at 1.0517, reflecting increased demand for the US currency. The greenback turned out to be "on the horse" again, amid the growth of the oil market and the strengthening of hawkish expectations about the Federal Reserve's further actions. If we look at the W1 timeframe, we will see that the bears of the pair not only stopped the large-scale corrective growth, but also turned the situation in their favor, regaining some of the lost positions. In the second half of May, the pair grew steadily for two weeks. Then traders stopped and traded flat for several days, as if they were at a crossroads. However, last week the choice was still made: the price turned downwards, descending to the base of the 5th figure.

The main events of the past week unfolded on Thursday and Friday. First, we learned the results of the European Central Bank's June meeting, and on the last trading day, key data on the growth of inflation in the United States were published. These events, so to speak, resonated: The ECB did not support the euro, while the inflation release provided significant support to the greenback. As a result, the EUR/USD bears still broke the blockade in the form of the 1.0640 mark (the Tenkan-sen line on the D1 timeframe) and settled within the 5th figure.Let's start with US inflation. The report was, in a sense, decisive. The inflation release is important in itself, whereas in this case its importance has increased even more.

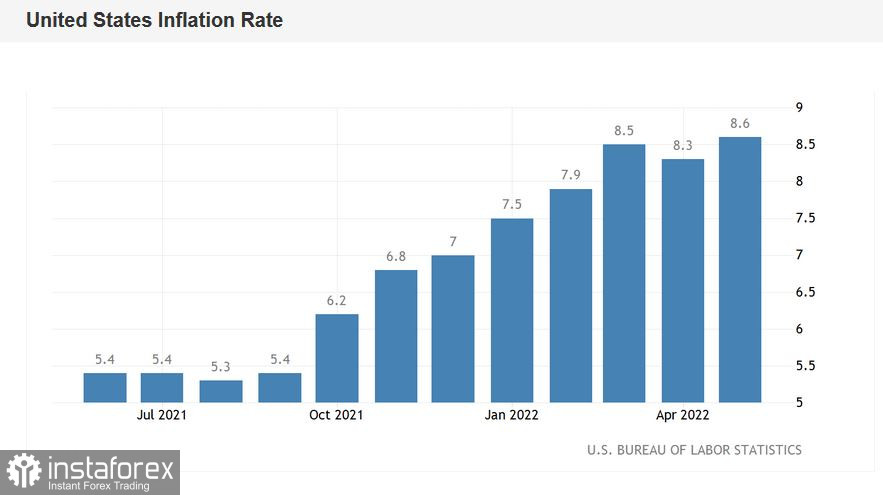

The fact is that in the previous month, the consumer price index interrupted its consecutive multi-month growth. The April CPI came out at 8.3%, which is slightly weaker than the March result (8.5%). This component has demonstrated consistent growth for seven months, so a logical question arose in the market: can the April release be considered as the first sign of stabilization (or slowdown in growth) of inflation, or is it a temporary retreat?

The report dispelled the last doubts of traders on this score: the US continues to go up, updating more and more new horizons. Thus, the overall CPI in annual terms jumped to 8.6% (the highest value of the indicator since February 1982), while the core index rose to 6% with a forecast of growth to 5.8%. Separately, it is worth noting the growth of the overall CPI on a monthly basis – if in the previous month it came out at 0.3%, then yesterday the index was at 1.0%. In general, all components of the report came out in the green zone, exceeding the forecast estimates.

All this suggests that the Fed will continue to actively raise interest rates. Thoughts began to sound more often in the market that the US central bank would increase the rate at each meeting this year, and in 50-point steps. It is likely that after Friday's release, some Fed officials will again talk about the need for a 75-point increase – in July or September.

And one more important point: the inflation report offset traders' fears about a possible pause in the process of tightening monetary policy. Let me remind you that the minutes of the Fed's May meeting alerted dollar bulls. After all, the members of the central bank made it clear that they did not rule out the option of revising their aggressively hawkish position: "after several rounds of interest rate hikes, the Fed may take a pause to re-assess the state of the economy in the context of further actions." Obviously, taking into account the latest inflation data, such concerns do not have any objective grounds.

Such hawkish prospects (at least four 50-point increases by the end of the year) are clearly at odds with the ECB's plans. And although the ECB is still involved in the process of tightening monetary policy, but so far only verbally. Following the results of the June meeting, the central bank announced one 25-point increase in July, and another in September. Further – vague. The market clearly expected more decisive signals from the ECB, given the record increase in inflation in the eurozone, which has been recorded for several consecutive months. Therefore, it is not surprising that despite the formally hawkish results of the June meeting, the euro was under significant pressure. To resume the growth of EUR/USD, the ECB had to announce not a hawkish, but an "ultra-hawkish" scenario, which would include a guaranteed 50-point rate hike (in July or September). Alternatively, the ECB could increase the deposit rate by 25 points in June, indicating a further increase to 0.25% by September.

But to the disappointment of the EUR/USD bulls, the ECB did not surprise market participants in any way. The euro remained "one on one" with the dollar, which received significant support from the inflation report on Friday.

Thus, at the moment there are all prerequisites for a further decline in the EUR/USD pair in the medium term. Hawkish expectations regarding the Fed's further actions will only increase, especially against the background of the growth of the oil market and the next quarantine restrictions in China. Therefore, it is advisable to use any upward spikes in the pair to open short positions.

From a technical point of view, the EUR/USD pair on the daily chart is located between the middle and lower lines of the Bollinger Bands indicator under all the lines of the Ichimoku indicator, which shows a strong bearish "Parade of Lines" signal. The main support level (the target of the downward movement) is the 1.0450 mark – this is the lower line of the Bollinger Bands indicator on the same timeframe.