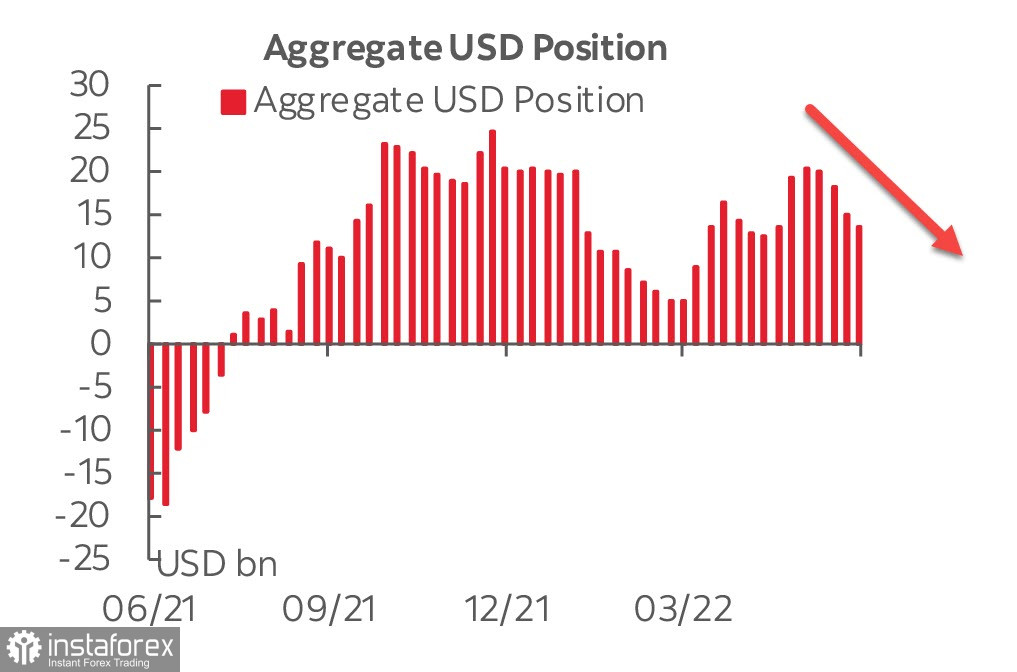

The CFTC report shows the fourth consecutive decline in the aggregate US dollar position, amounting to 1.5 billion. The total long position now stands at 13.5 billion in major currencies, which is already a third less than the high in early May.

Speculators were not inspired by the possibility of more aggressive actions by the ECB, and the net long position on the euro decreased (more on that below). In general, we can say that the market does not see convincing evidence of the dollar's leadership.

The publication of the consumer price index in the US should be considered the main event last week. Inflation turned out to be higher than expected, and the markets reacted by strengthening expectations on rates.

The report itself contains data that is rather unpleasant for the Fed. Core inflation coincided with April figures instead of the projected decline, inflation in basic goods increased, and inflation in basic services did not slow down much, remaining above the level of last year. This means that core inflation—the main criterion for monetary policy—will not fall to the level that the Fed would like it to be in the near future. This means that the forecast for the rate should be much more hawkish, which happened.

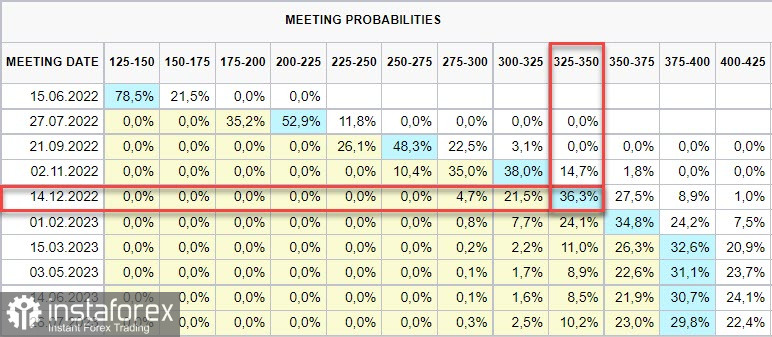

Prior to the release, three consecutive 50 basis point increases were expected starting with the FOMC decision next Wednesday, but now the forecasts have become more aggressive. In particular, as follows from the total position on rate futures, an increase of 0.75% is likely by July, and in December the rate will move into the range of 325/350p, that is, expectations have become much more hawkish. Moreover, a rise of 0.75% on Wednesday is not ruled out, and if this happens, the dollar may react with strong growth.

It is clear that the Fed's leadership in rate growth will also lead to an increase in demand for the dollar, but on one condition—there should not be an additional threat to economic stability, because if the likelihood of a recession increases, then instead of normalization, the Fed will get stagflation, which will stop the strengthening of the dollar.

In addition to the Fed, the central banks of England, Japan, and Switzerland are holding meetings this week.

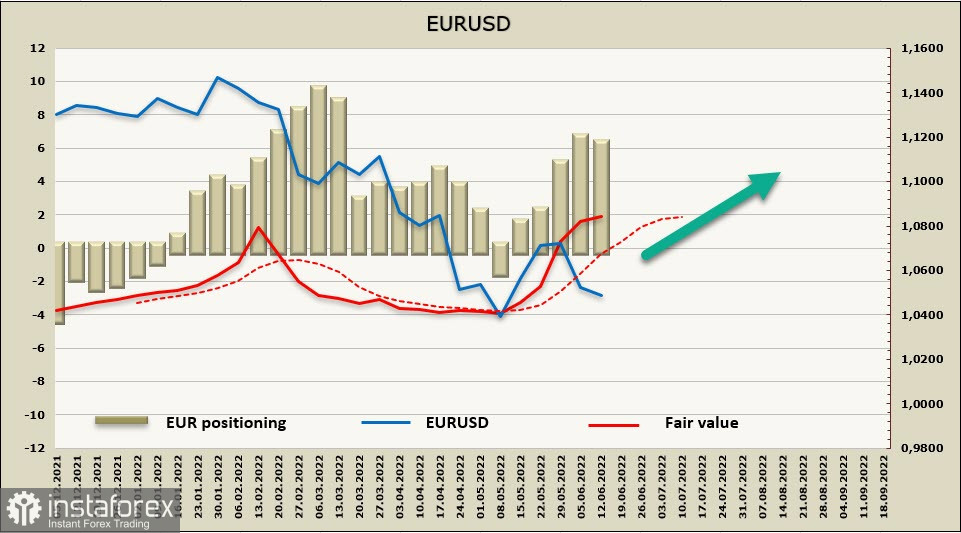

EURUSD

The ECB meeting was the main event of the past week. There were no big changes that the market did not take into account in advance, along with the completion of the Asset Purchase Program (APP) from July 1, the ECB previously announced an increase in interest rates by 25 bps at the September meeting, the size of which will depend on the medium-term inflation forecast. So far, the market sees a 50p increase more likely than a 25p increase.

Reports that a series of hikes would begin after September led to a slight uptick in euro purchases, which quickly petered out.

As follows from the CFTC report, the net long position on the euro decreased by 252 million to 6.762 billion, the correction is minimal, and the settlement price is still above the long-term average and is directed upwards.

We assume that the rapid decline in EURUSD on Friday will be used by players to resume purchases, the support is the 1.0460/70 zone, where you can enter a long position with an eye to returning to the trade line, approximately to the 1.0680/1.0720 zone.

There are a few internal reasons in the eurozone for sharp fluctuations in the euro exchange rate: reports on the trade balance and industrial production in April will be published on Wednesday, and movement is possible only on Friday, as the May inflation report will be released.

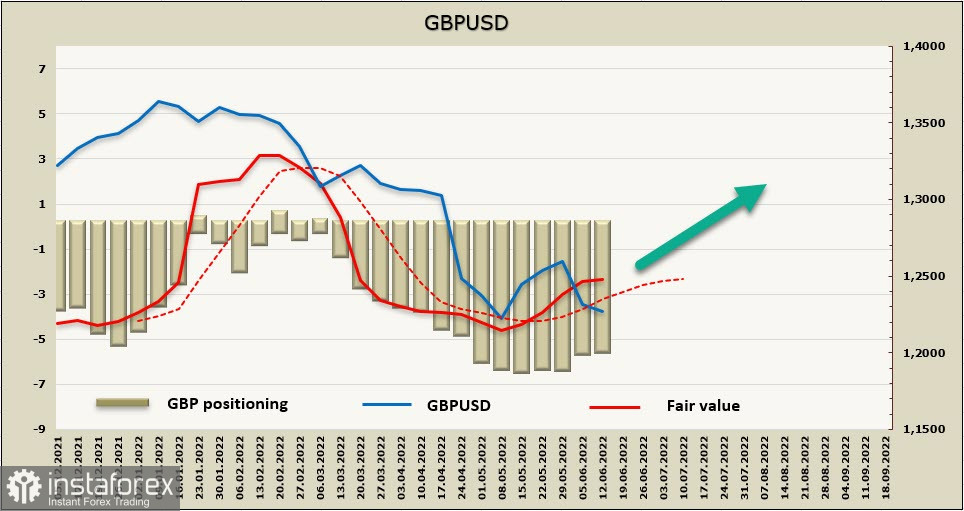

GBPUSDThe beginning of the week will be very busy for the pound, so a high level of volatility is almost inevitable. Today, data on industrial production, trade balance, and GDP growth rates will be released. On Tuesday, a report on the labor market is expected, which will focus on the growth rate of average wages as one of the factors supporting high inflation.

On Thursday, the Bank of England is expected to raise the rate by a quarter point, the probability of an increase of 0.5% is regarded as extremely low. In general, it should be assumed that the BoE will lag behind the Fed, in any case, at the current stage, the market thinks this way, which means that the probability of a USDCAD reversal upward will be higher by the end of the week.

The net short position on GBP, as follows from the CFTC report, has slightly decreased again (by 264 million to -5.57 billion), the dynamics remains, but it does not look stable.

As in the case of the euro, we consider an update of the local low unlikely. This can happen only if weak macroeconomic data is released, the 1.2250/60 zone as the last support before the low just acts as a convenient level for purchases in order to update the local low at 1.2665. We consider a move to 1.2155 unlikely.