The pound-dollar pair dives down again. Judging by the dynamics of the downward movement, traders today can update the monthly price low (1.2155), which was reached on May 13. In this case, the next targets for the GBP/USD bears will be the 1.2100 and 1.2073 targets (a two-year low reached in May 2020).

The pound-dollar pair is falling for two main reasons. Firstly, this is the general strengthening of the US currency, which has significantly strengthened its position after the publication of the May inflation report. The data was published last Friday, on the eve of the next meeting of the Fed, the results of which we will know on Wednesday, that is, the day after tomorrow.

Secondly, GBP/USD is diving down amid a disappointing report on the growth of the British economy. Almost all components of the data came out in the "red zone," significantly falling short of the forecast levels. In addition, at the moment we can already talk about certain trends, and of a very negative nature. The growth rate of the UK economy has been slowing for the second month in a row, and, as the statistical office clarified, "every major sector of the country's economy contributed to the overall April result." The service sector, manufacturing, and construction sectors—all these industries showed a disappointing result, while the volume of industrial production in the UK decreased by 0.6%.

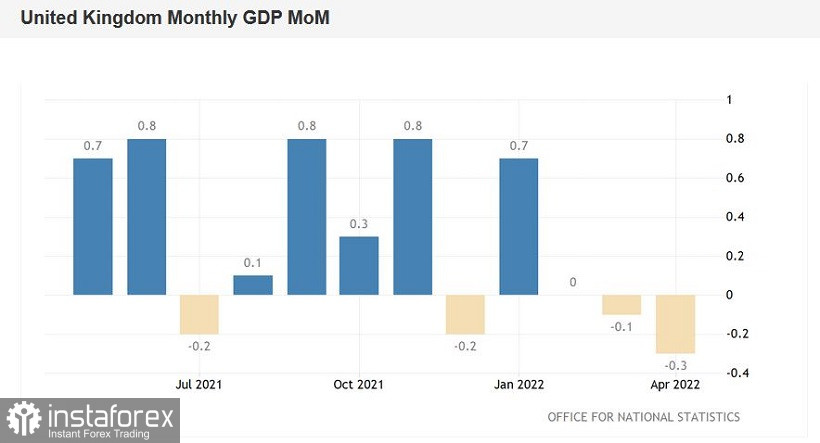

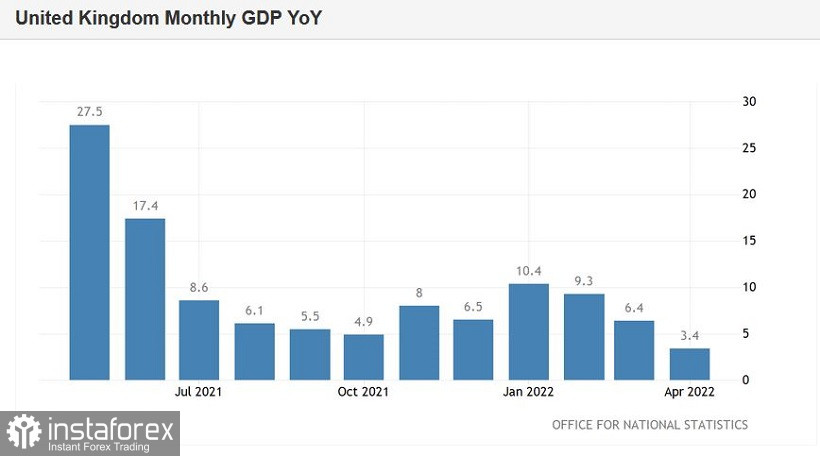

On a monthly basis, the decline in UK GDP in April was 0.3%. At the same time, most experts expected a minimal, but still an increase in the indicator by 0.1%. This component of the report has been in negative territory for the second month in a row: in March, the economy also contracted by one-tenth of a percent. In annual terms, the GDP growth rate has been slowing for the third month in a row. For the third month in a row, this component is in the "red zone," falling short of the forecast levels. For example, in the previous month, experts expected to see an increase to 9.0%, while the indicator came out at 6.4%. This month, analysts were more restrained in their assessments (to put it mildly): the consensus forecast was at 3.9%. However, the British economy did not reach this target here either (the indicator came out at 3.4%).

The sphere of production suffered quite strongly: according to representatives of many enterprises, the deplorable result was due primarily to high prices for fuel and energy.

In general, rising inflation against the backdrop of a slowdown in economic growth is becoming more and more pronounced. The word "stagflation" is mentioned by economists more and more often, especially after the pessimistic results of the last meeting of the English regulator. Recent PMI reports only added to the gloomy picture. For example, the composite index of business activity collapsed in May to 51 points against the forecast of a decline to 57 points. A similar situation has developed with the index of business activity in the UK services sector—in May, a fall was recorded from 58 to 51 points.

In other words, against the backdrop of a record growth in British inflation, all other economic indicators are declining, and at a stronger pace compared to the forecasts of most experts. Given these trends, there are growing doubts on the market that the English regulator will maintain a "sporting pace" in terms of tightening monetary policy.

Note that the next meeting of the Bank of England will take place on June 16, Thursday. Therefore, it is not surprising that investors are fleeing from the British currency: the failed report on economic growth was published just before the June meeting of the British central bank. Experts do not rule out the possibility that the central bank will revise the interest rate forecast, taking into account recent trends. The regulator is likely to raise the rate by 50 points at the June meeting, but at the same time may show hesitation about further actions. The first signals in this regard began to arrive in the previous month. So, following the results of the May meeting, BoE Governor Andrew Bailey, said that the members of the Committee "do not agree with those people who believe that they should raise interest rates at a more aggressive pace." According to the head of the regulator, "the central bank is concerned about the effects of the next round."

Meanwhile, the dollar is strengthening its positions for the opposite reasons: the market is growing hawkish expectations about the Fed's next steps. Most experts are inclined to think that the Fed will raise interest rates at every meeting this year, maintaining the 50-point step. Some of them do not rule out a 75-point increase following the results of the September meeting.

The possible divergence of the Fed and the Bank of England is pushing the GBP/USD pair down to new price lows. From a technical point of view, the pair on the D1, W1, and MN charts is either between the lower and middle lines of the Bollinger Bands indicator, or on its lower line, which indicates the priority of the downward movement. The price demonstrates a pronounced bearish trend, which is confirmed by the main trend indicators—Bollinger Bands and Ichimoku, which on all the above timeframes (except MN) has formed a strong bearish signal. All lines of the trend indicator are above the price chart, thus demonstrating pressure on the pair. The immediate target of the downward movement is 1.2100 (lower line of the Bollinger Bands indicator on the weekly chart).