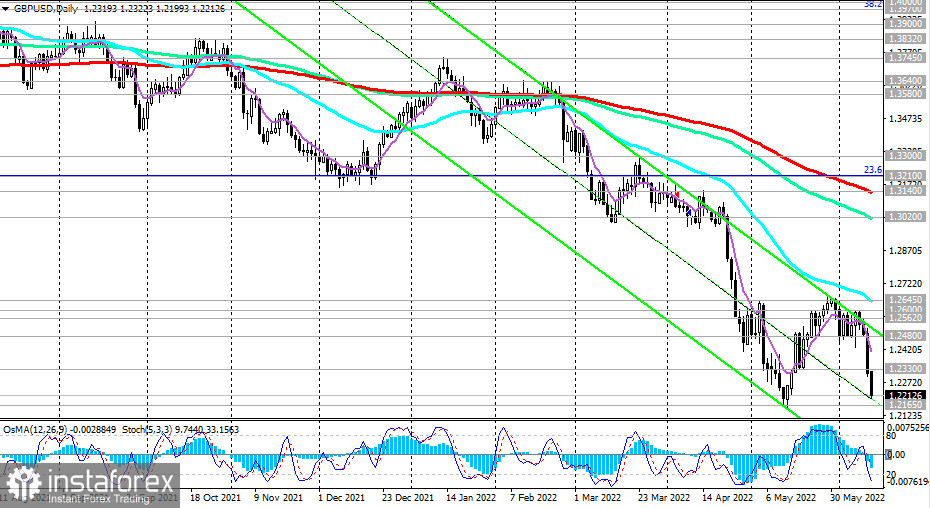

The dollar is actively gaining ground at the start of the new trading week, while the pound is falling, and the pound is likely to remain under pressure throughout the day and beyond if there will be no new positive news from the UK.

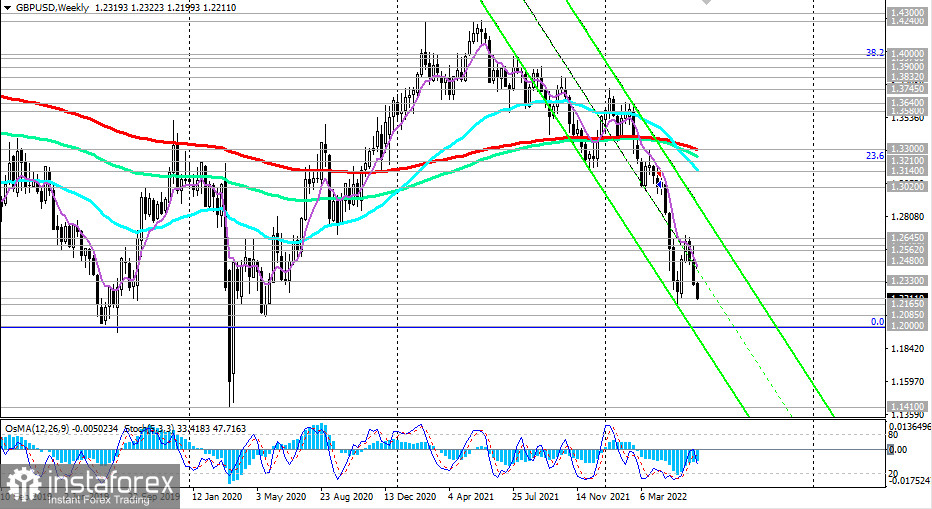

The expected breakdown of the local support level 1.2165 (lows of the year and May) will completely cross out the results of the upward correction observed in the previous month.

As we also assumed, after the breakdown of the support level of 1.2165, GBP/USD may move towards the level of 1.2000 (the lows of the GBP/USD decline wave that began in July 2014 near the level of 1.7200).

In an alternative scenario, from the current levels and near the support level of 1.2165, GBP/USD will again attempt a correction, especially if the dollar gives it a reason.

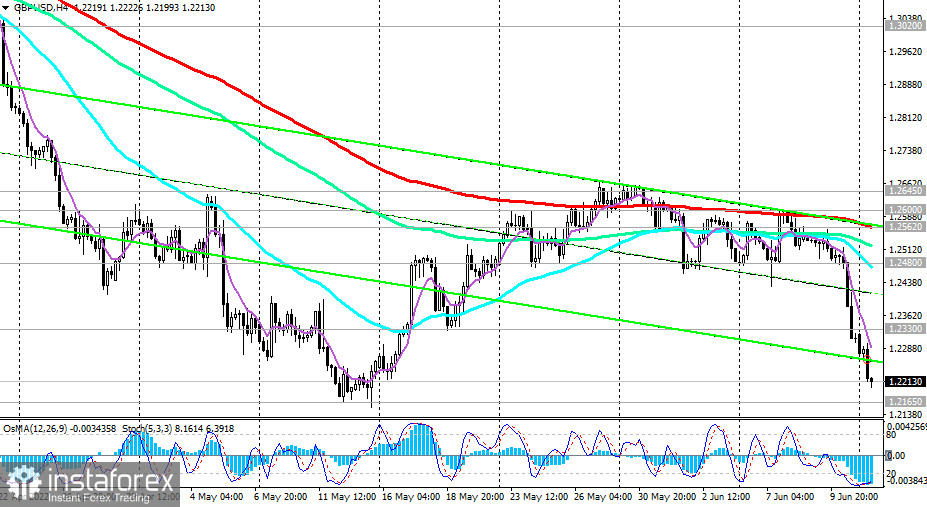

As expected, on Wednesday, Fed officials will again raise interest rates by 0.50% and confirm their inclination to continue aggressive monetary tightening.

If the market evaluates the accompanying statements of the Fed leaders as "soft," then the dollar may come under pressure against the backdrop of fixing part of long positions on it. In this case, our alternative scenario will work just fine.

The first signal to open long positions will be the breakdown of the local resistance level 1.2330, and the confirming one is the breakdown of the resistance level 1.2480 (200 EMA on the 1-hour chart).

Support levels: 1.2165, 1.2100, 1.2085, 1.2000

Resistance levels: 1.2330, 1.2480, 1.2562, 1.2600, 1.2645, 1.2700, 1.3000, 1.3020, 1.3100, 1.3140, 1.3210, 1.3300

Trading Tips

Sell Stop 1.2185. Stop-Loss 1.2315. Take-Profit 1.2165, 1.2100, 1.2085, 1.2000

Buy Stop 1.2315. Stop-Loss 1.2185. Take-Profit 1.2330, 1.2480, 1.2562, 1.2600, 1.2645, 1.2700, 1.3000, 1.3020, 1.3100, 1.3140, 1.3210, 1.3300