The global sell-off intensified after an unexpected rise in US inflation, which will put pressure on the Federal Reserve to tighten monetary policy. Treasury bond yields traded at multi-year highs.

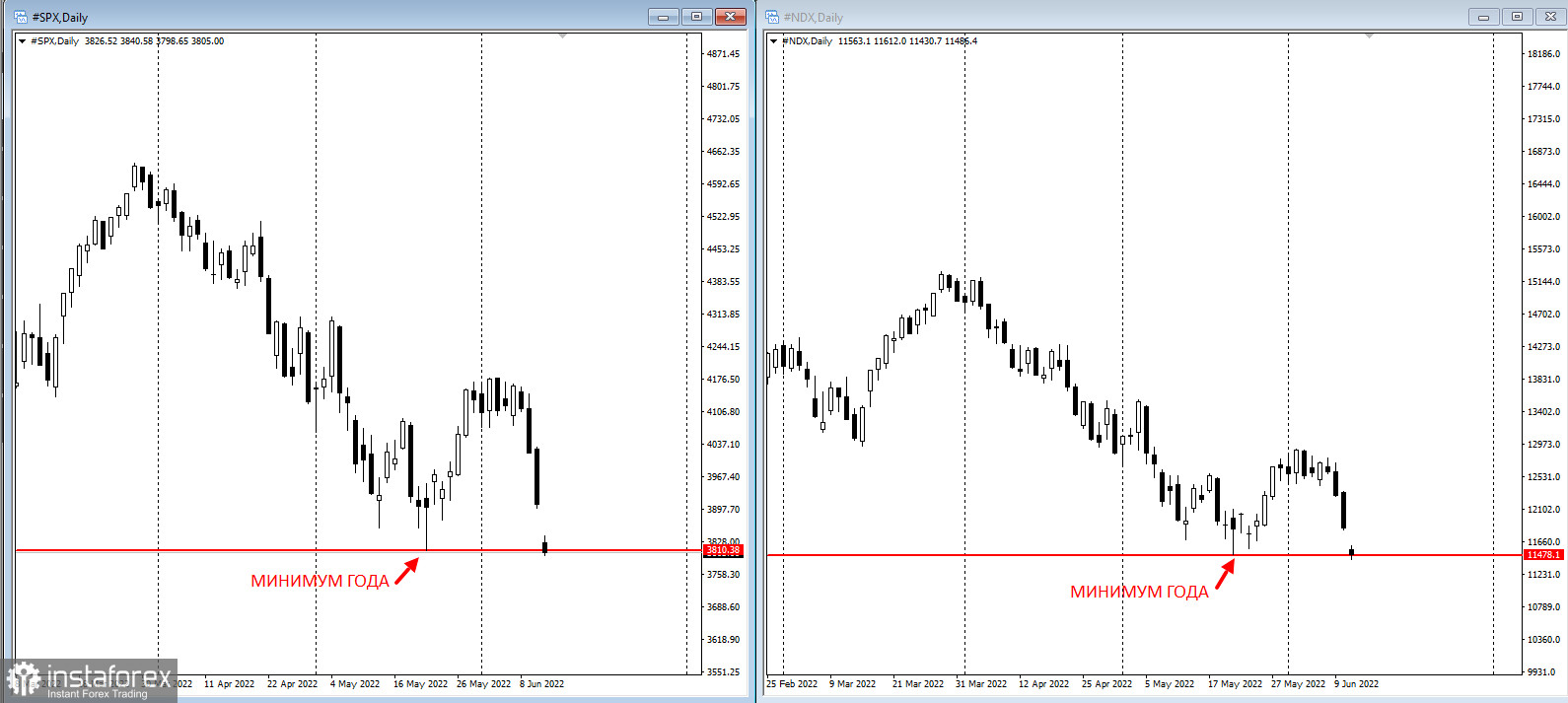

S&P 500 futures dropped by more than 10%, while Nasdaq 100 contracts fell even further. Indices plunged after Friday's consumer price shock report triggered a sell-off of more than $1 trillion. Today they reached new annual lows.

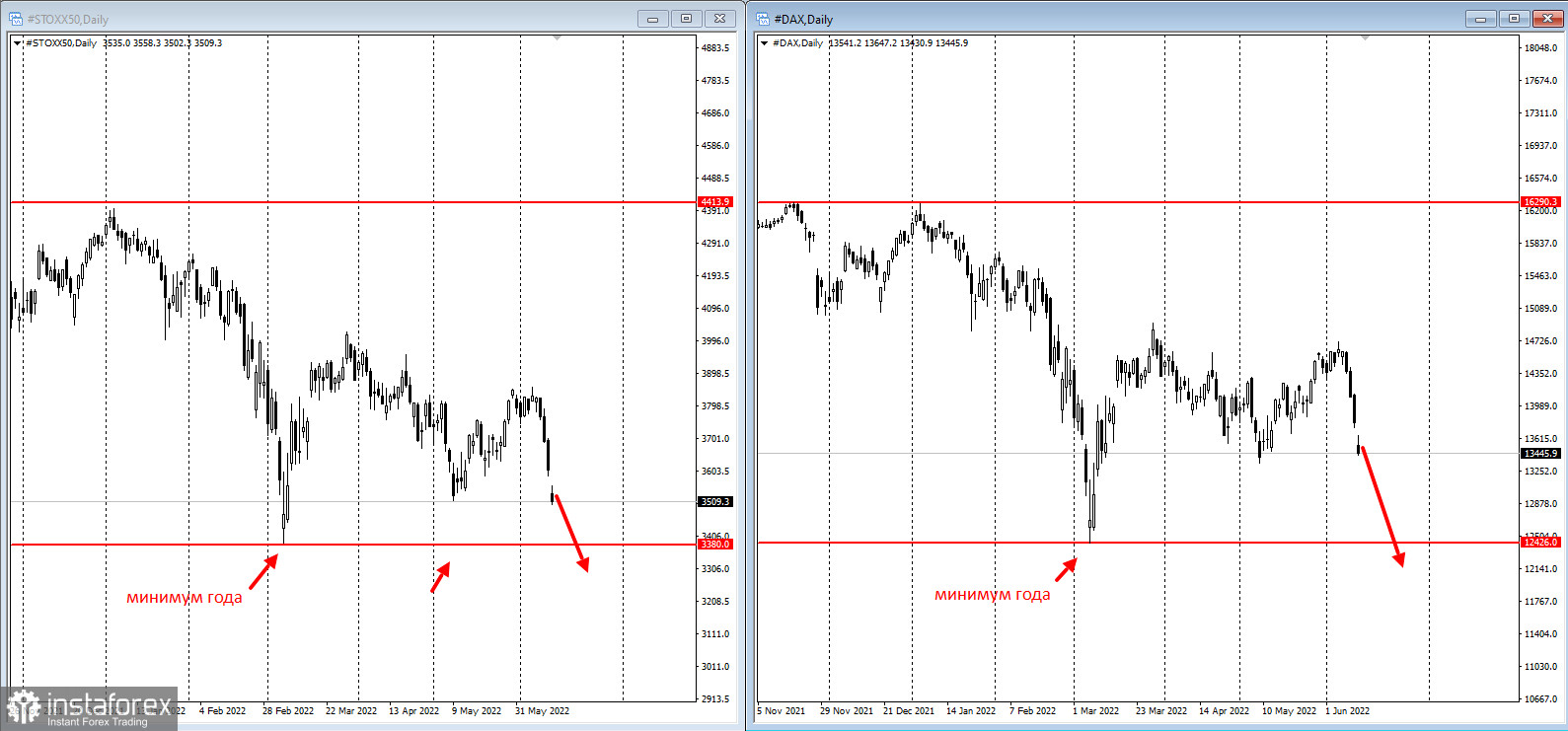

The Stoxx50 traded at its lowest level since early March. It seems set to hit the year's low:.

Traders are wagering on 175 basis points of tightening from the BOE by its September decision. This includes two half-points and one 75-basis-point increase. If that comes to pass, it would be the first time since 1994 the Fed resorted to such a draconian measure.

Meanwhile, European Central Bank Governing Council member Peter Kazimir said that he clearly saw the need for a 50-basis-point rate hike in September

What to watch this week:

US PPI, Tuesday.

- FOMC rate decision, Chair Jerome Powell briefing, US business inventories, empire manufacturing, retail sales, Wednesday.

- ECB President Christine Lagarde due to speak, Wednesday.

- Bank of England rate decision, Thursday.

- US housing starts, initial jobless claims, Thursday.

- Eurozone CPI, Friday.

- Industrial production, Friday