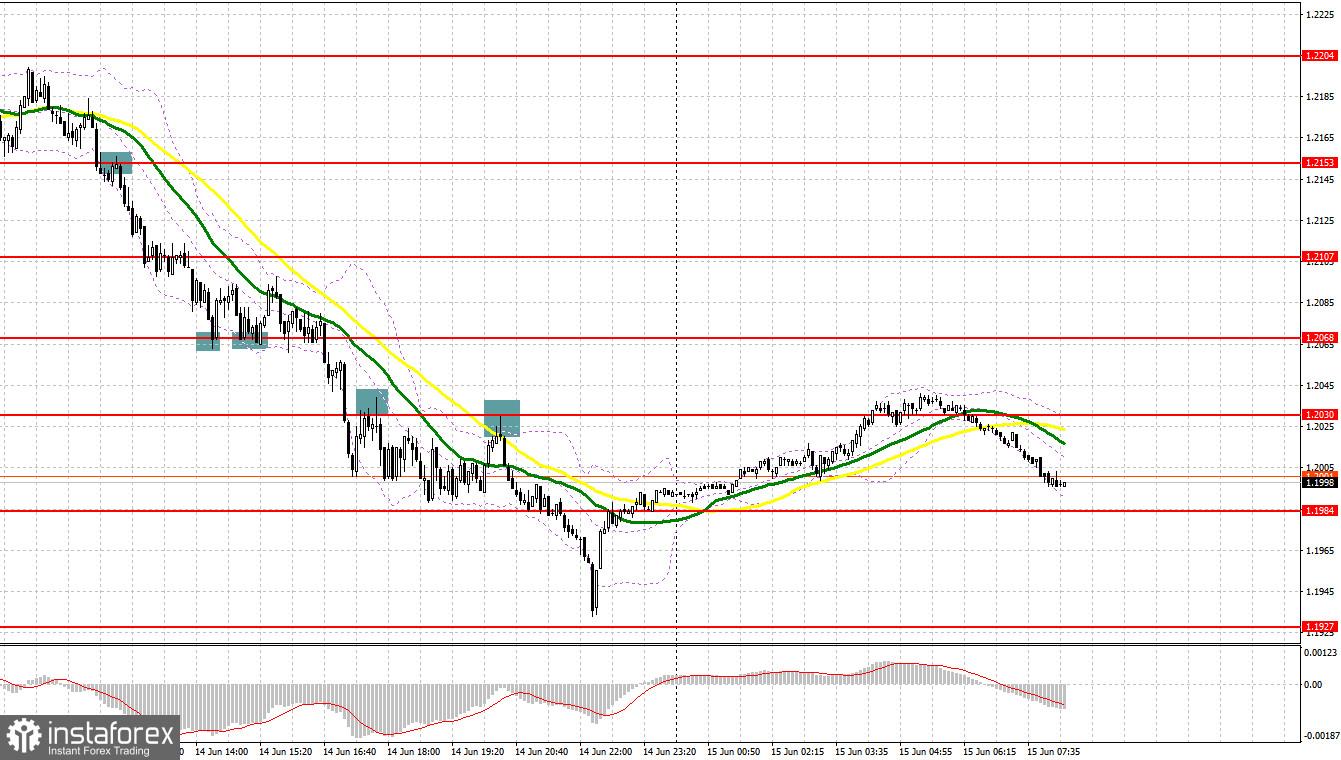

Yesterday, quite a lot of signals were formed to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to 1.2156. At the first test of this range, the bulls achieved a false breakdown, which led to a signal to open long positions. As a result, the pair went up about 40 points - quite good considering the bear market. Then the sellers achieved a breakdown and a reverse test of 1.2156 - a sell signal according to my morning strategy. As a result, the pound collapsed to 1.2107 but did not stay there for long, confidently testing 1.2068 at the beginning of American trading. This allowed us to take more than 80 points of profit from the market. In the afternoon, several false breakouts at 1.2068 led to buy deals, but each time after moving up by 30 points, the pressure on the pair returned. The breakthrough of 1.2068 took place without a reverse test, so it turned out to sell further along with the trend only after fixing below 1.2030, which led to another sell-off and a fall in the pound by another 100 points. And what were the entry points for the euro?

To open long positions on GBP/USD, you need:

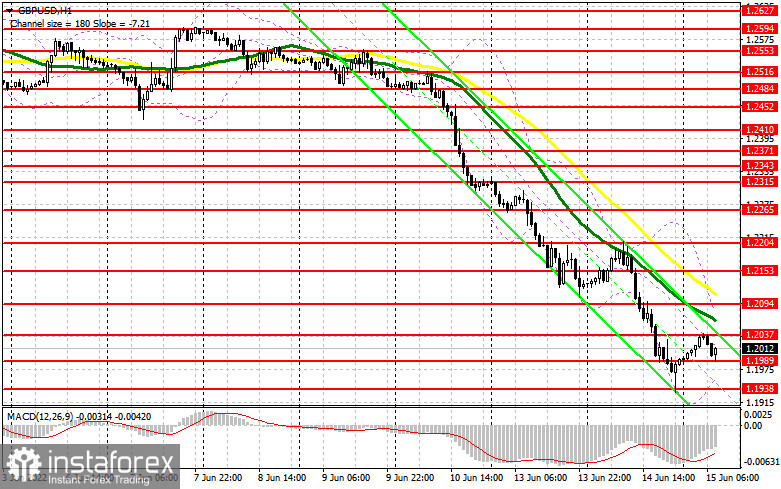

The labor market data disappointed and the bulls had no choice but to look at all this from the outside. Today is a meeting of the Federal Reserve System, and tomorrow the Bank of England. So I would not count on the growth of the pound in particular. The maximum is a small correction that will force speculative sellers to return "from heaven to earth". Most likely, in the first half of the day, we will see another pressure on the pound, so buyers will need to put a lot of effort to protect the new support of 1.1989. The level is intermediate, so I won't put much on it. Only the formation of a false breakdown will give a signal to open long positions based on an upward correction to the nearest resistance of 1.2037. An equally important task for the bulls will be to return this level to control, which will only slightly reduce the pressure on the pair but will not lead to a change in market sentiment. A breakthrough and a top-down test of 1.2037 will give a buy signal based on the update of 1.2094, where I recommend fixing the profits. There are moving averages that play on the sellers' side. A more distant target will be the area of 1.2153, but it will be possible to reach there only after the meeting of the Federal Reserve System. If GBP/USD falls and there are no buyers at 1.1989, the pressure on the pair will only increase. This will allow us to continue the path to new annual lows and reach 1.1938, from where it is best to enter the market after a false breakdown. You can buy GBP/USD immediately for a rebound from 1.1876, or even lower - around 1.1816 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Bears control the market and will certainly attempt to break 1.1989 in the first half of the day. Given that there is no data for the UK today, there may be a slight upward correction before the Fed meeting. The absence of active sales at 1.1989 will be the starting point for the pair's recovery. Only a consolidation below 1.1989 and a reverse test from the bottom up will give an entry point into short positions with the prospect of updating this year's minimum of 1.1938. A more distant target will be the 1.1876 area, where I recommend fixing the profits. A major drop in the pair will occur only if the Fed's policy is revised in a more aggressive direction. But it seems that the pound has already won back all the new decisions, and no matter what the Central Bank says today, it is unlikely that something will cause a new movement of GBP/USD down. With the option of the pound's growth, the bears will probably manifest themselves already in the area of the nearest resistance of 1.2037, and a false breakdown at this level will give a good entry point into short positions in the expectation of a resumption of the downward trend. If there is no activity at 1.2037, a small upward jerk may occur against the background of the demolition of stop orders of speculative sellers. In this case, I advise you to postpone short positions until 1.2094. But I advise you to sell the pound there only if there is a false breakdown. Short positions can be made immediately for a rebound from 1.2153, or even higher - from 1.2204, counting on the pair's rebound down by 30-35

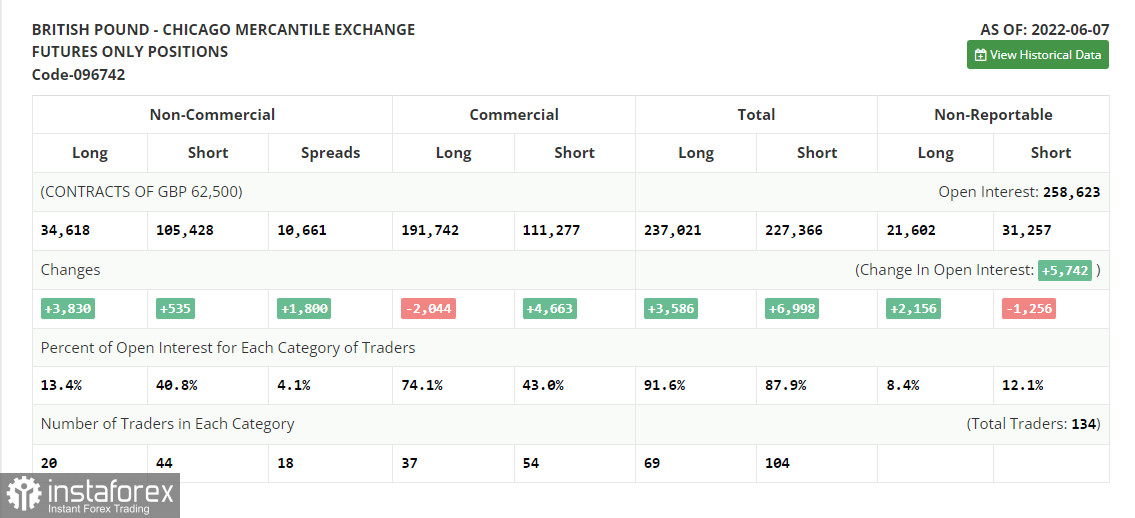

The COT report (Commitment of Traders) for June 7 recorded a large increase in long positions and only a small increase in short ones. However, as I think you understand, at the moment, the picture is completely different: the last three trading days have turned the market upside down. The further direction of the pair, which is in the area of annual lows, depends on the meeting of the Federal Reserve System and the decisions taken at it. A more aggressive policy will push GBP/USD further down, as the UK economy, as the latest data showed, is gradually reducing the growth rate, which does not give confidence to investors. The meetings of the Bank of England are unlikely to help the pound in any way since the regulator will not abandon the policy of raising rates. I very much doubt its further aggressive actions aimed at combating inflation by sacrificing the growth rate of the economy. Although the governor of the Bank of England, Andrew Bailey, continues to say that the regulator is not going to give up on raising interest rates yet, however, there are also no hints of a more aggressive approach to monetary policy. The COT report indicates that long non-commercial positions increased by 3,830 to the level of 34,618, while short non-commercial positions increased by 535 to the level of 105,428. This led to a decrease in the negative value of the non-commercial net position from the level of -74,105 to the level of -70,810. The weekly closing price rose from 1.2481 to 1.2511.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.