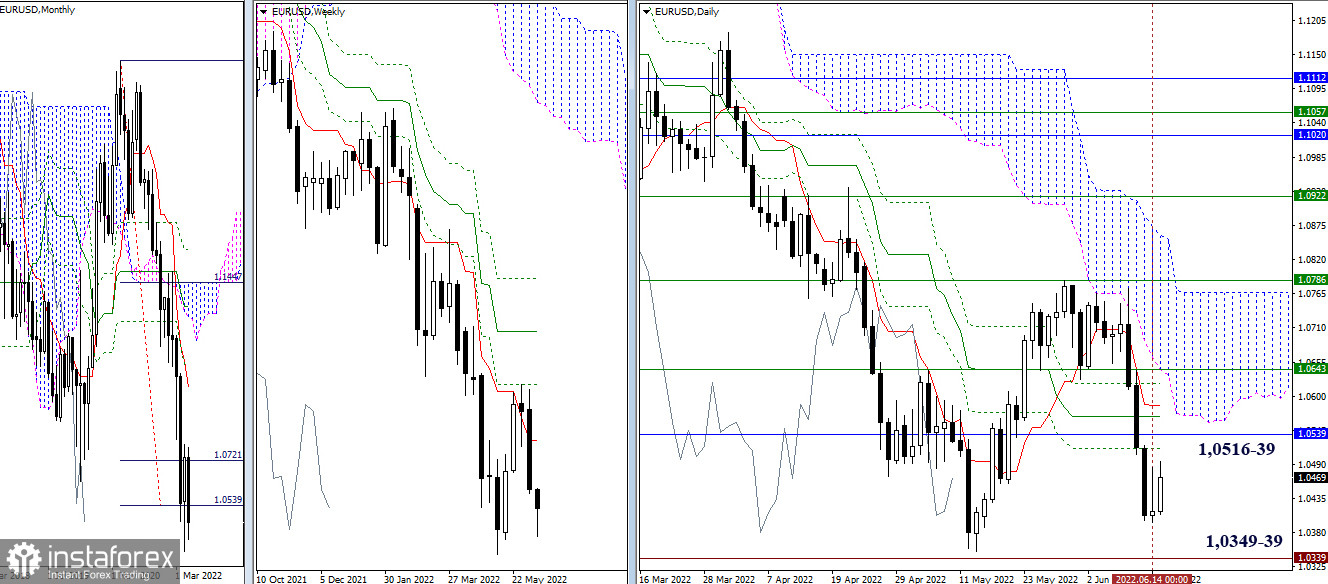

EUR/USD

Higher timeframes

On the last working day, the pair marked a slowdown and bears failed to continue the decline. Today, bulls will most likely consolidate and develop success. The main resistance to this scenario will be provided by a fairly wide resistance zone, located slightly higher and including levels of different timeframes 1.0516–39–68-85 – 1.0620–43. The failure of bulls will allow the opponent to return to plans to restore the downward trend to the local lows of May 2022 and January 2017 (1.0339-49).

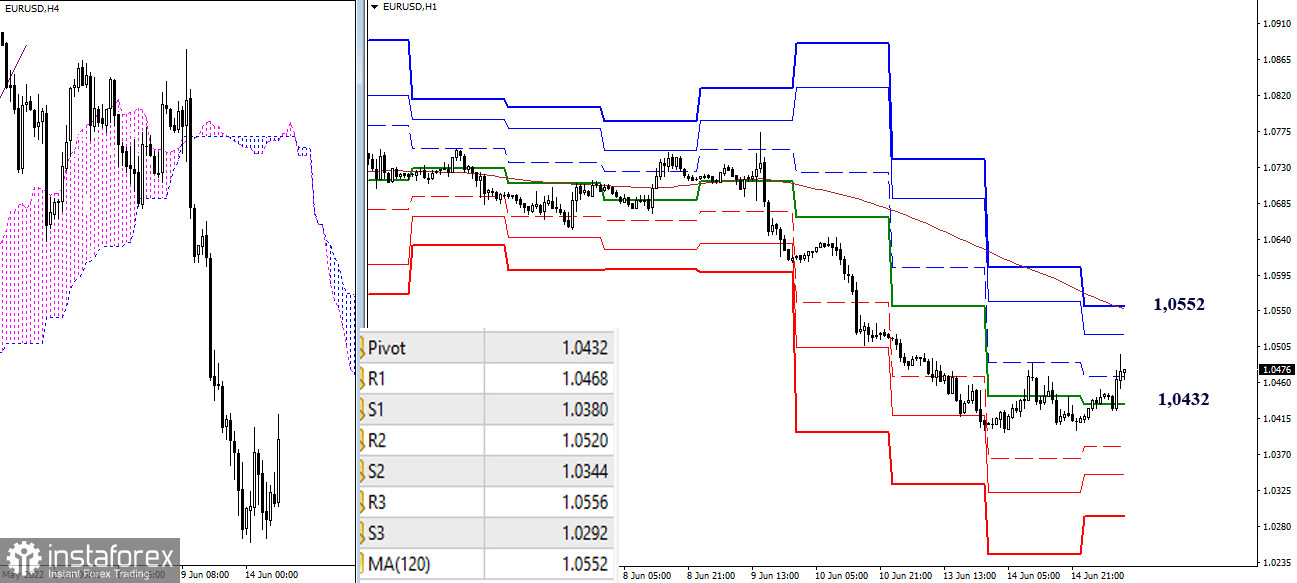

H4 – H1

As of this writing, a corrective rise is developing on the lower timeframes. Bulls have risen above the central pivot point of the day (1.0432) and now the main reference is the weekly long-term trend (1.0552). Consolidation above will change the current balance of power and form new guidelines. Completion of the correction (1.0397) will restore relevance to the support of the classic pivot points, which serve as reference points in the lower timeframes, which are today located at 1.0380 – 1.0344 – 1.0292.

***

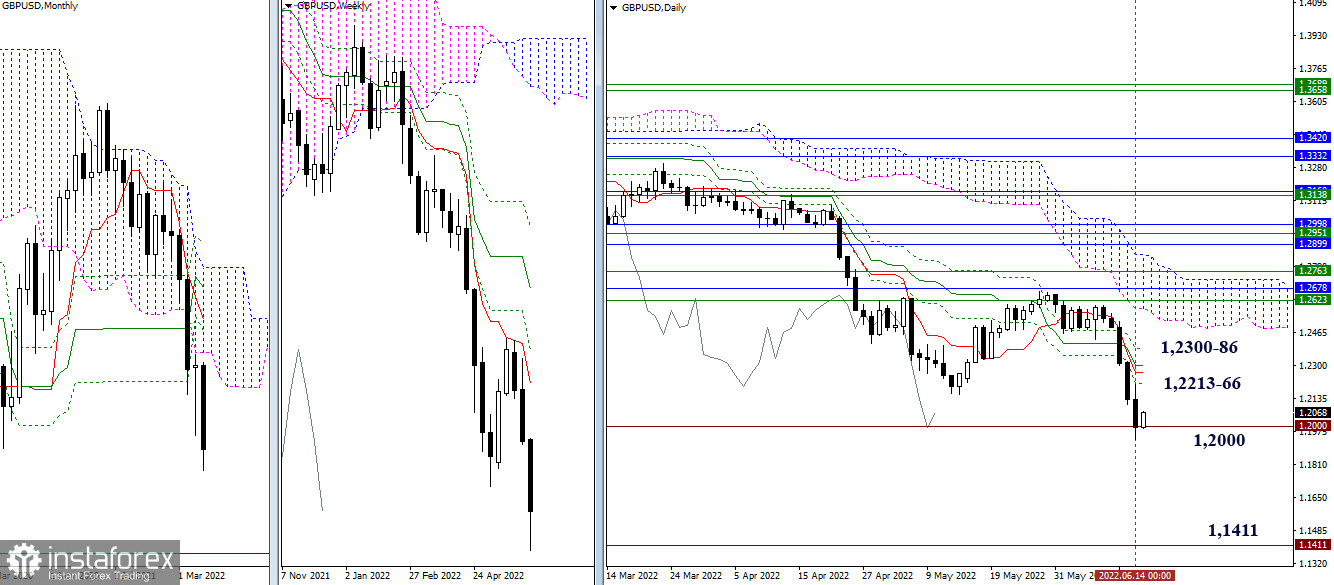

GBP/USD

Higher timeframes

Sellers continued their decline yesterday and tested the psychological level of 1.2000 for strength. The level is noticed, and the result of the interaction is still being formed. Breakdown and continued decline will shift the attention and desire of the bears to the historical low of 2020 (1.1411). At the moment, the development of a corrective rise is possible, as a result of which the nearest resistances of the daily Ichimoku cross will become reference points, which are today noted at 1.2213 – 1.2266 – 1.2300 – 1.2386.

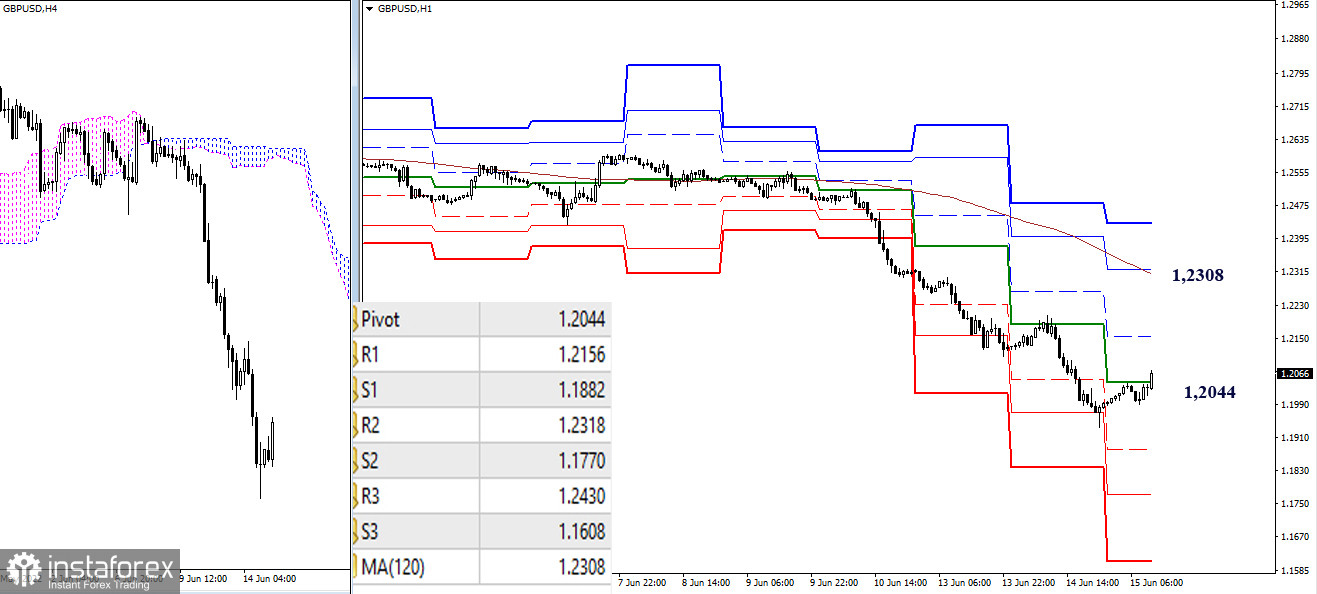

H4 – H1

The decline slowed down after reaching 1.2000 in the lower timeframes. The pair is now in a correction zone and is trying to overcome the resistance of the first important level 1.2044 (the central pivot point of the day). Further, a stop is possible in the area of the first support of the classic pivot points 1.2156. The main reference point in the current situation with the development of the rise is the weekly long-term trend (1.2308). Downward reference points are not relevant yet, today they are located at 1.1882 – 1.1770 – 1.1608 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)