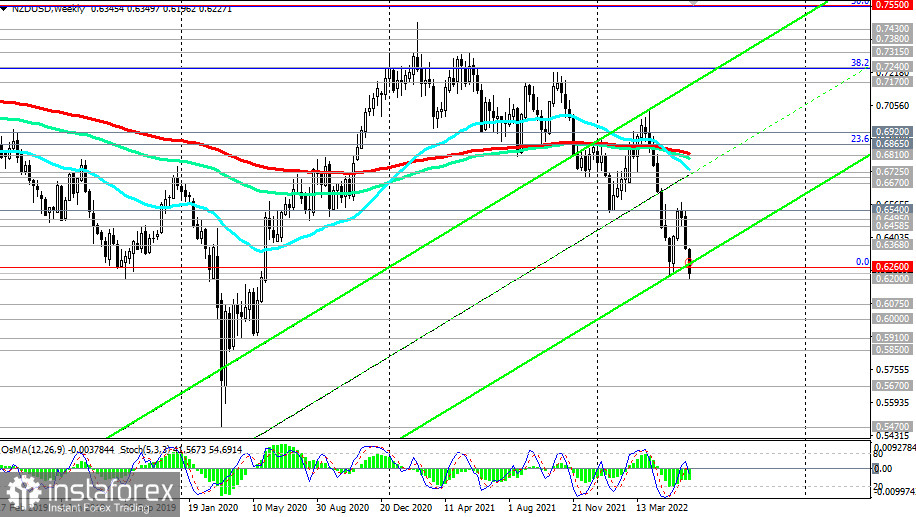

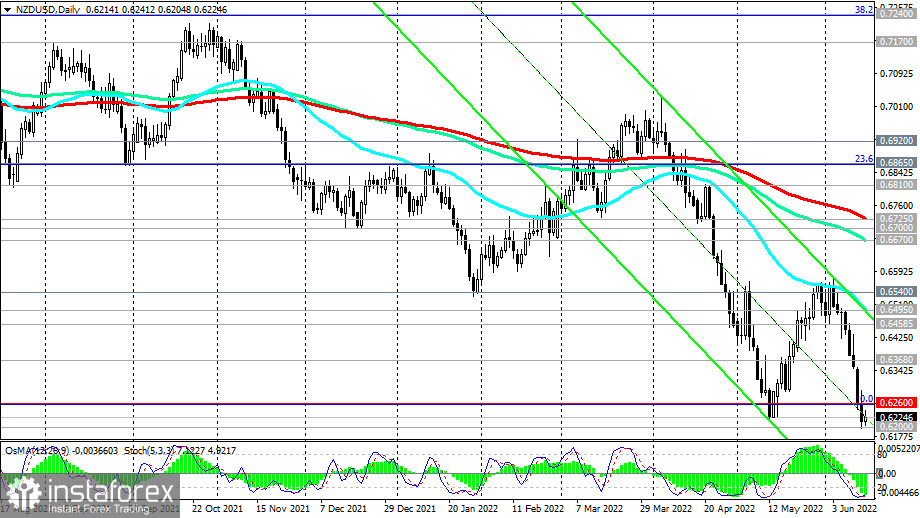

For the third month in a row, NZD/USD has been trading in the bear market zone, remaining below the key resistance levels 0.6865 (the 23.6% Fibonacci retracement in the global wave of the pair's decline from the level of 0.8820), 0.6810 (200 EMA on the weekly chart), and 0.6725 (200 EMA on the daily chart).

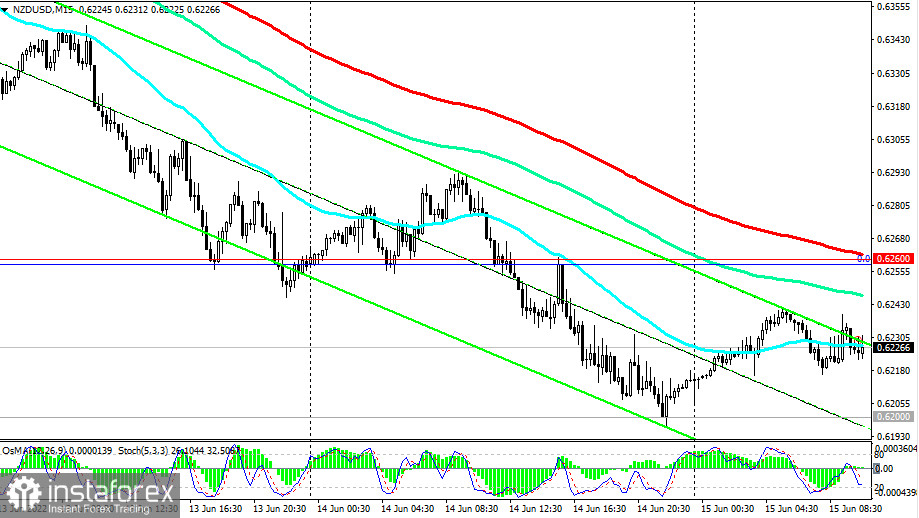

Yesterday, the price hit an almost 2-year low breaking through 0.6200. Even though the price bounced off this mark, and at the beginning of today's Asian trading session, NZD/USD made an attempt to grow, the pair is under pressure from the "totally strengthening US dollar."

If today the Fed makes tougher decisions regarding the prospects for its monetary policy or similar related statements are made, then after the retest of the local support level of 0.6200, the price will move lower towards the lower border of the descending channel on the daily chart, which is currently passing near the 0.6000 mark.

In an alternative scenario, NZD/USD will head towards the resistance levels 0.6368 (200 EMA on the 1-hour chart), 0.6458 (200 EMA on the 4-hour chart), 0.6495 (50 EMA and the upper limit of the descending channel on the daily chart), and the first signal for the realization of this scenario may be a breakdown of the important short-term resistance level 0.6260 (200 EMA on the 15-minute chart and the lows of the pair's decline wave in 2014-2015 from the level of 0.8820).

In the current situation, the determining factor in the dynamics of NZD/USD is likely to be the course of the monetary policy of the central banks of the United States and New Zealand. And, most likely, the conditional "scales" will tilt towards the currency of the country whose central bank takes a tougher position. In general, the downward dynamics of NZD/USD prevails.

We will also remind you about the Fed meeting, which will end today with the publication of the interest rate decision.

Support levels: 0.6200, 0.6100, 0.6000

Resistance levels: 0.6260, 0.6300, 0.6368, 0.6400, 0.6458, 0.6495, 0.6540

Trading Tips

Sell Stop 0.6190. Stop-Loss 0.6270. Take-Profit 0.6100, 0.6000

Buy Stop 0.6270. Stop-Loss 0.6190. Take-Profit 0.6300, 0.6368, 0.6400, 0.6458, 0.6495, 0.6540, 0.6600