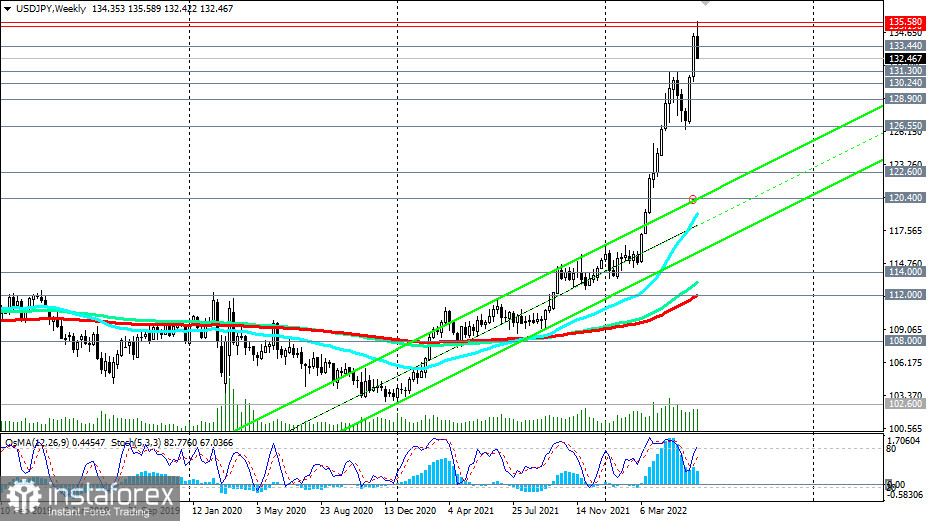

As was suggested in our previous reviews dated 04/11/2022 and 06/07/2022, the divergence in the monetary policy rates of the Fed and the Bank of Japan is likely to increase, creating prerequisites for further growth of USD/JPY. In this case, the pair will head towards multi-year highs near 135.00, reached in January 2002.

Our forecast was fully justified, and the set targets (Buy Stop 125.50. Stop Loss 124.40. Take-Profit 125.65, 126.00, 127.00, 128.00, 134.00, 135.00) were achieved. Moreover, the price rewrote the all-time high of 135.19, reaching 135.58 on Tuesday.

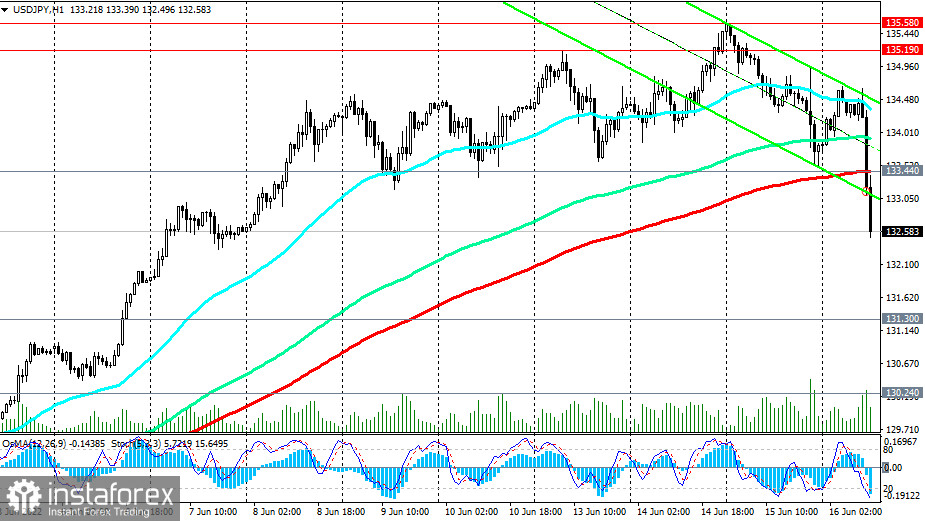

At the moment, there is a pullback in the dynamics of USD/JPY. The price has broken through the important short-term support level 133.44 (200 EMA on the 1-hour chart), making a kind of request for further decline.

If it really takes place, then within this downward correction, USD/JPY will go inside the rising channel on the daily chart and to the support levels 131.30 (local highs), 130.24 (200 EMA on the 4-hour chart, the lower line of the rising channel on the daily chart) and, possibly towards the support level 128.90 (50 EMA on the daily chart).

In the main scenario, we expect a rebound and resumption of growth from the current support level 133.44. There is a strong upward momentum, fueled, among other things, by the growing divergence in the direction of the monetary policies of the Fed and the Bank of Japan. However, volatility in USD/JPY may sharply increase again tomorrow at 03:00 (GMT), when the decision of the BoJ on the interest rate will be published. If there are no unexpected decisions from the Bank of Japan in the direction of tightening its policy, then we should expect a resumption of growth in USD/JPY.

Support levels: 133.44, 131.30, 130.24, 128.90, 126.55

Resistance levels: 135.00, 135.19, 135.58, 136.00

Trading Tips

Buy Stop 133.50. Stop Loss 132.25. Take-Profit 134.00, 135.00, 135.10, 135.50, 136.00

Sell Stop 132.25. Stop Loss 133.50. Take-Profit 132.00, 131.30, 130.24, 128.90, 126.55