The EUR/USD currency pair started a downward pullback on Friday, after showing impressive growth in the previous two trading days. Although the European currency rose when few expected it to, we cannot conclude that now the downward trend is over, and the market mood will change dramatically. On the 4-hour TF, the growth of the European currency last week does not even look convincing. It's just a small upward correction, but the downward trend persists. How the long-term downward trend persists. Recall that the 20-year minimum of the pair is located near the 1.0340 level. At this time, the price is located near the 5th level, that is, only 160 points from the multi-year low. Thus, we believe that in the coming weeks, the bears will again try to push the pair down below 20-year lows. It's not that there is no other scenario for the development of the event now, but the fundamental, geopolitical backgrounds remain, to put it mildly, not in favor of the European currency.

Last week, the euro showed growth, although no optimistic data was received from the European Union. But the Fed raised the rate immediately by 0.75%, which was supposed to provoke a powerful strengthening of the dollar. But, since the US dollar rose "upfront", even before the announcement of the results of the Fed meeting, on Wednesday and Thursday we saw a reverse movement. But this movement has already been completed, and the resonant meeting of the Fed is in the past. And what about the future? And in the future, we are waiting for another meeting of the Fed, already next month, when the regulator is likely to raise the key rate by 0.75% once again. Yes, we believe that in July the rate will be raised by 0.75% at once because the FOMC is leaning more and more towards the "James Bullard plan", which a few weeks ago called on the committee to raise the rate as quickly and strongly as possible to control inflation in 2022. At first, the members of the monetary committee did not take seriously the recommendations of the harshest "hawk" in their team, but then, when the inflation reports continued to come out as "one more beautiful than the other," it seems that they still listened to the opinion of the head of the St. Louis Fed.

The ECB remains far behind the locomotive.

And what does all this mean for the euro/dollar pair? Only that the Fed will continue to tighten monetary policy, but the ECB, it's hard to say anything here. Christine Lagarde and her colleagues seem to have made it clear to the market that one or two rate hikes will occur in 2022. Maybe there will be even more of them, but the point is different. So far, the ECB has never raised the rate, and its level is in the "negative zone". If the Fed started rising from 0.25%, then the ECB will start raising (sometime in the future) from -0.5%. That's how much the deposit rate is now. In any case, even to reach more or less normal rates, the European regulator will need much more time than the Fed. In Europe, there is no longer even a question of bringing inflation under control. This cannot be done in conditions where the APP program continues to function, and the rates remain ultra-low. Consequently, one or two or several rate increases in 2022 will not have a particularly strong impact on price growth. Thus, the ECB continues and will continue to take an ultra-soft position, and the euro currency will not receive any tangible support from its issuer.

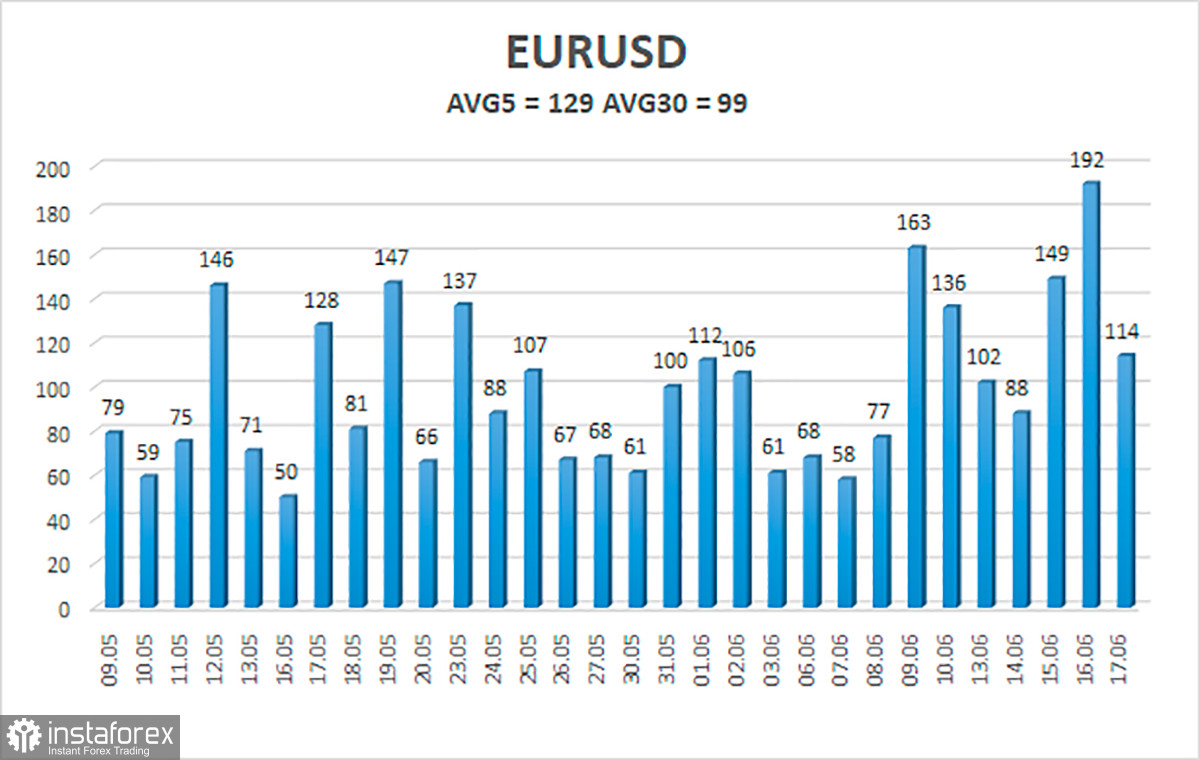

In the new week, traders will have almost nothing to turn their attention to in the European Union. Only on Thursday, a few minor reports will be published and that's it. We are talking about business activity indices in the service and manufacturing sectors, which, according to experts' forecasts, will not change much by the end of June. Thus, we are not waiting for the market reaction to these events. Moreover, now the volatility of the pair is at record levels. Recall that the average value of volatility is now 99 points in the context of the last 30 days. This is a lot, and most importantly, it is a trend. Volatility has not just increased by a few days due to important events, it has been so for a month and a half. This means that traders find a reason to move the pair actively and without macroeconomics.

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 20 is 129 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0366 and 1.0624. The reversal of the Heiken Ashi indicator backup signals an attempt to continue the upward correction.

Nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The EUR/USD pair quickly began to grow and quickly ended it. Thus, it is now possible to stay in short positions with a target of 1.0376 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.0620 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.