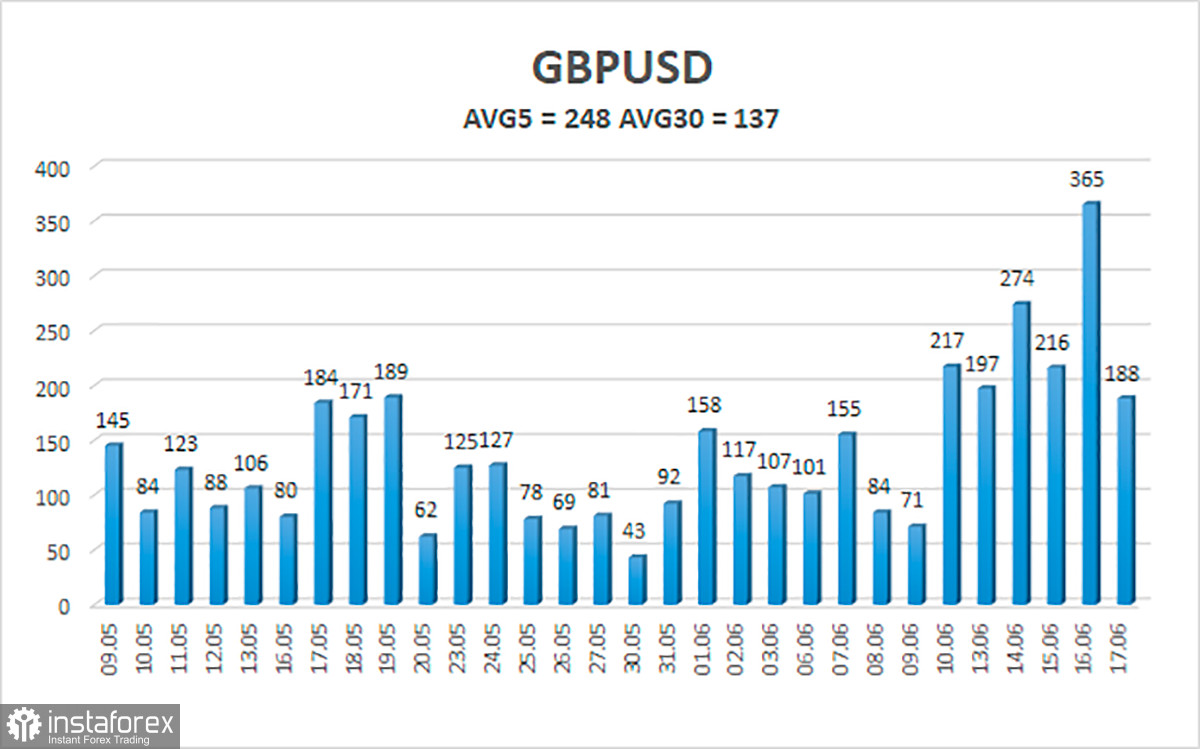

The GBP/USD currency pair was also adjusted on Friday. There were practically no important events on the last trading day of last week, and both central banks meetings were already behind us. Thus, the market had enough time to fully work them out and on Friday, having already analyzed all the information received "on a cold head", traded more consciously. It is no secret that during the announcement of the results of the Central Bank meeting, the market acts impulsively, on emotions. Therefore, we often observe either extremely volatile movements or illogical movements. However, after 1-2 days, everything falls into place. And at this time, despite the super-volatility of the pair, things have already begun to fall into place. At the moment, the price is only 300 points away from its 2-year lows. 300 points was a lot for the pound before February 24, but in the last few months, volatility has increased and is now 137 points per day. Therefore, the pound can go 300 points down in two days completely calmly. Well, in a week, but it doesn't change anything.

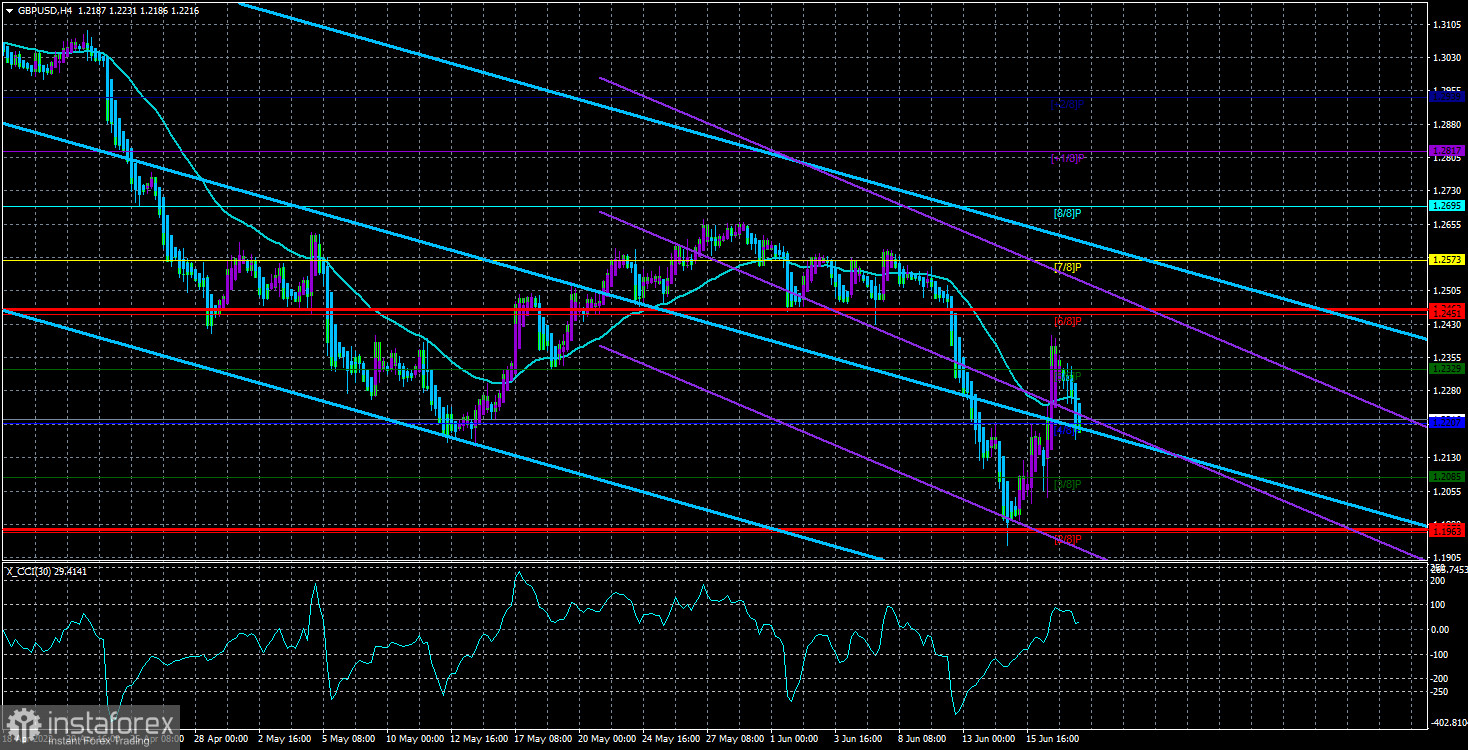

The fact remains that the British currency does not have the necessary level of market support. It does not have the support of macroeconomics, foundations, or geopolitics. We cannot say that absolutely everything is bad for the pound right now, but still, most factors do not speak in its favor. Already, the pair has consolidated back below the moving average line, and both linear regression channels are directed downwards. Thus, all trend indicators on the 4-hour TF point to the south. And it is better not to look at the 24-hour TF at all, since the picture for the pound is even worse. Thus, we continue to assume that the global downward trend may end for some time, but at the same time, if we try to find at least some clear reasons for this, serious problems arise.

Jerome Powell's new performances are unlikely to provide new information.

In the new week, the most important event will be the UK inflation report, which will be published on Wednesday. According to experts' forecasts, it will once again grow from the current 9% to 9.1-9.2% by the end of May. This is a small increase, but again it does not change anything at all. Slight acceleration is also an acceleration, and the official forecast of maximum inflation for 2022 from the Bank of England is 11%. Does anyone have any doubts that the consumer price index will continue to grow? Also on Thursday, business activity indices in the services and manufacturing sectors of the UK will be published, but these are far from the most important indicators right now. Although a month earlier, business activity in the service sector collapsed from 58.9 points to 53.4, and by the end of June, it may decrease to 52.8. That is, there is already a certain trend on the face. Any value above 50 is considered positive, but the index in the service sector is confidently moving to the area below this level. On Friday, the retail sales report for May will be released and it is expected that it will be "negative". All the recent macroeconomic reports from the UK turned out to be weak and it seems that this trend will continue this week. Therefore, the fall of the pound is very likely.

In the States, all the fun starts on Wednesday. There will be a speech by Jerome Powell, although this event can only be called important by a stretch. Recall that only last week the Fed meeting took place, and after it, Powell told the market everything that he needed to know. Therefore, it is unlikely that the head of the Fed will shock the markets with new information in just a week. On Thursday, there will be a new speech by Powell and the indices of business activity in the services and manufacturing sectors, which are unlikely to change much compared to their previous values. That's all. Two speeches by Powell are not of the nature of important events and ordinary business activity indices.

The average volatility of the GBP/USD pair over the last 5 trading days is 248 points. For the pound/dollar pair, this value is "very high". On Monday, June 20, therefore, we expect movement inside the channel, limited by the levels of 1.1970 and 1.2463. The upward reversal of the Heiken Ashi indicator signals a possible new attempt to form an upward correction.

Nearest support levels:

S1 – 1.2207

S2 – 1.2085

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2451

R3 – 1.2573

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe very quickly consolidated back below the moving average line. Thus, at this time, it is necessary to remain in sales orders with targets of 1.2085 and 1.1970 until the Heiken Ashi indicator turns up. It will be possible to consider long positions again if the price is fixed above the moving average with targets of 1.2329 and 1.2451.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.