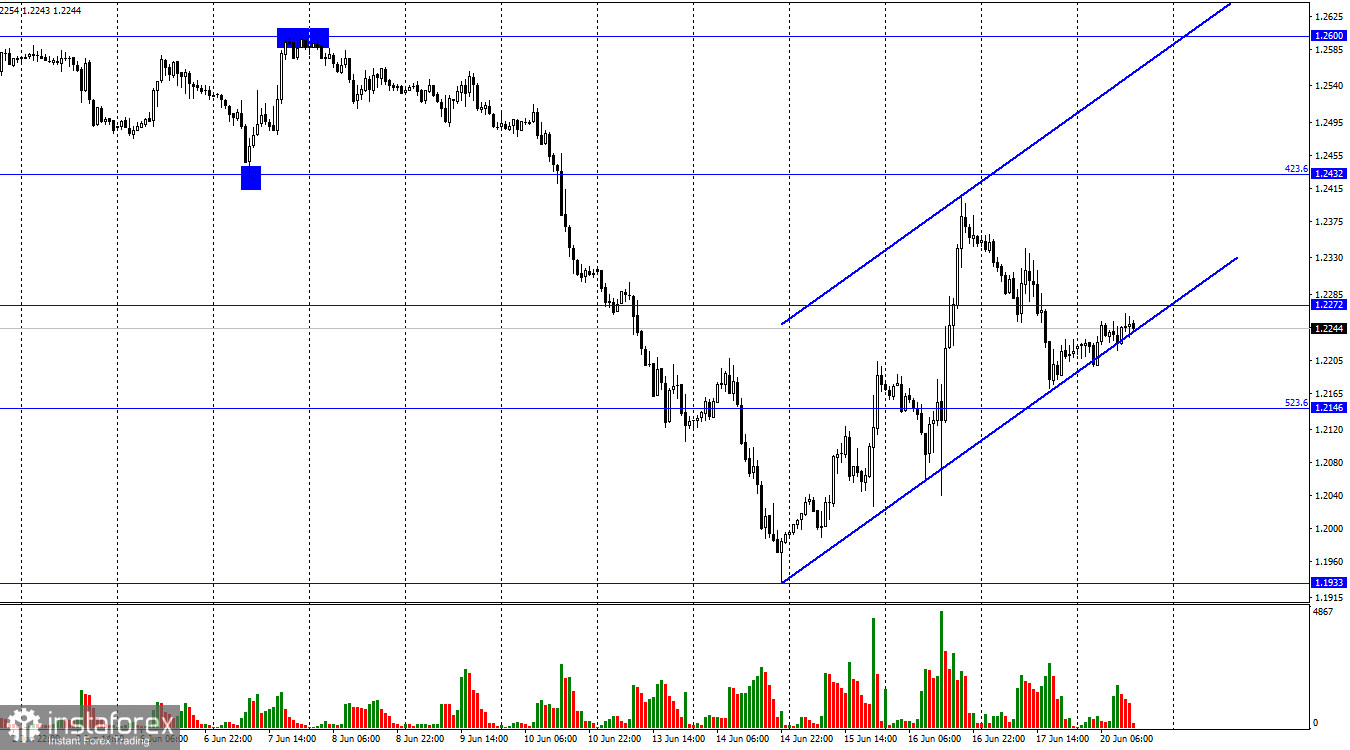

According to the hourly chart, the GBP/USD pair performed a fairly strong drop on Friday, but also performed a reversal in favor of the British and began a new growth in the direction of the corrective level of 423.6% (1.2432). I have built an upward trend corridor that characterizes the mood of traders as "bullish". Fixing the pair's exchange rate under this corridor will work in favor of the US currency and resume falling towards the levels of 1.2146 and 1.1933. Consolidation may occur in the near future. Meanwhile, a report on industrial production was released in the United States on Friday. It turned out that in May the indicator increased by 0.2%, although traders expected a higher value. The US dollar has been rising for most of Friday, so I don't see any connection between this report and the pair's movement. It should be noted that +0.2% m/m is a fairly ordinary increase. It shows that the industry is growing, but its growth is not high. There have been much worse months over the past year, and there have been better ones.

Thus, the fact that traders did not pay attention to it does not surprise me. Now many more interesting and important topics in the world can have an impact on all markets for a long time. Let me remind you that the special operation of the Russian Federation in Ukraine continues. Recently, the world community has lost interest in this topic, but it has not gone away, and politicians around the world are trying by all means to resolve at least some of the issues related to the military conflict. One of such issues is the export of grain from Ukraine. Of course, there will be no famine in the world, since Ukraine is not the only country that exports crops, but the fact that some food products in some countries may become scarce and, consequently, will increase in price is a fact. The European Union has already imposed six packages of sanctions against Russia and is preparing to consider the seventh. Thus, the general economic situation can only worsen further, and inflation can remain at high values.

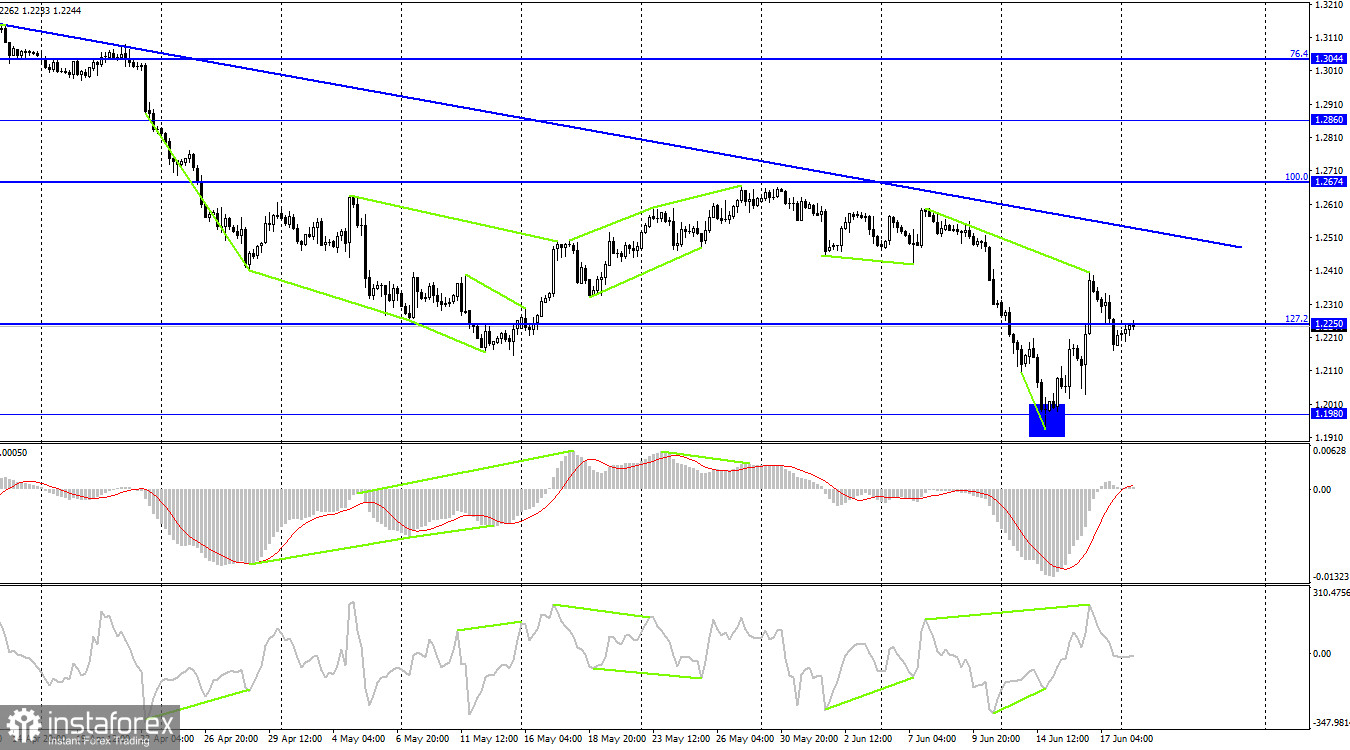

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator and a return to the corrective level of 127.2% (1.2250). Fixing the pair's rate under this level allows us to count on a further fall in the direction of the 1.1980 level, from where the pound began its growth. The descending trend line continues to characterize the mood of traders as "bearish".

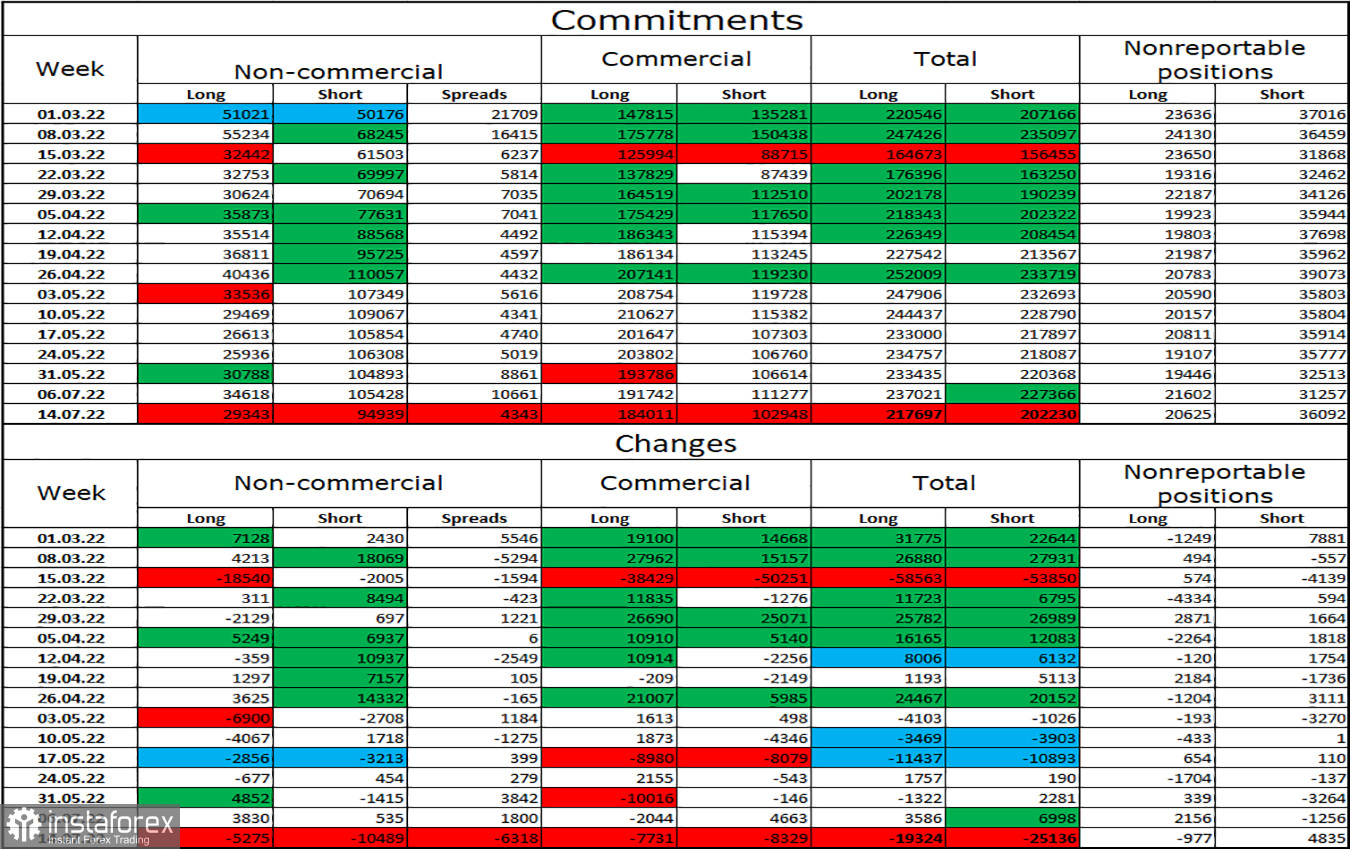

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators decreased by 5,275 units, and the number of shorts - by 10,489. Thus, the general mood of the major players remained the same – "bearish", and the number of long contracts exceeds the number of short contracts several times. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could continue its decline over the next few weeks and months. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. The influence of the information background on the mood of traders will be absent. There will be several important events later this week, but the market may take a short break this week.

GBP/USD forecast and recommendations to traders:

I recommend selling the British when closing under the ascending corridor on the hourly chart with targets of 1.2146 and 1.1933. I recommend buying the British when fixing above the level of 1.2272 on the hourly chart with a target of 1.2432.