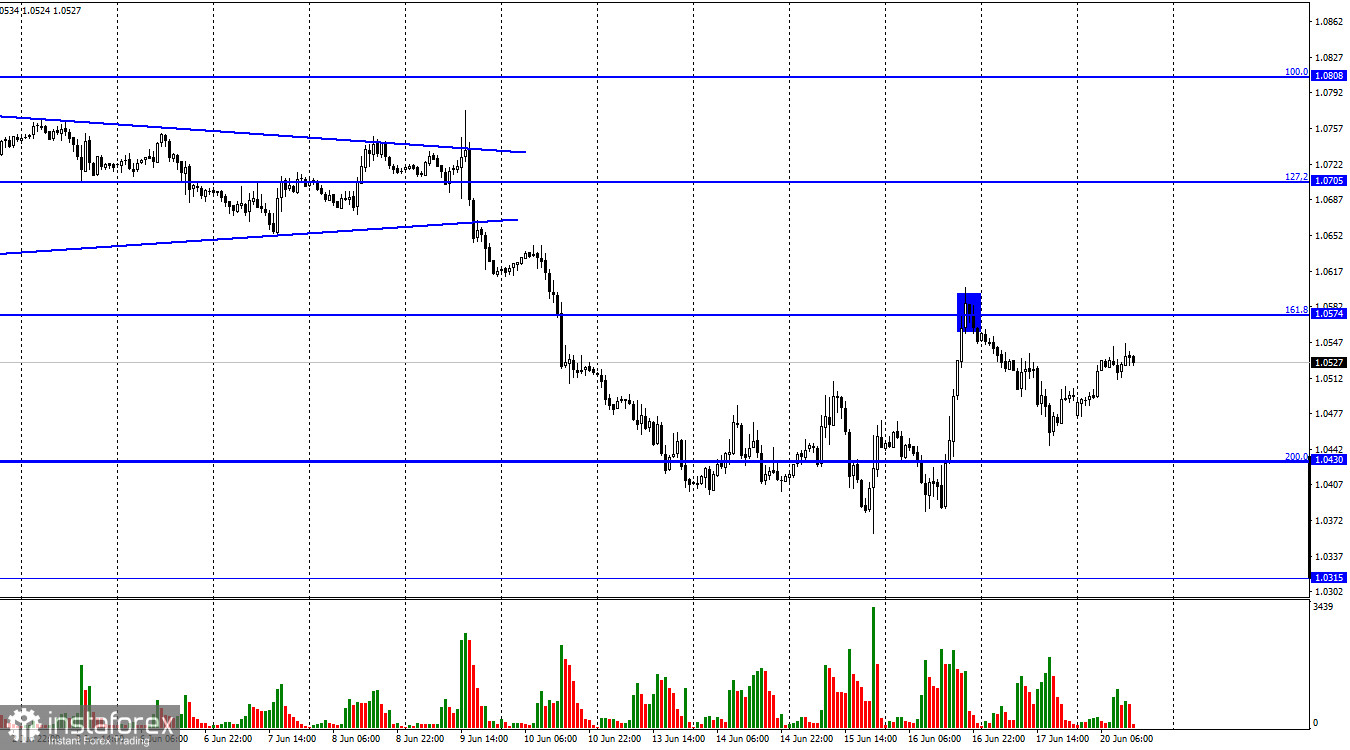

The EUR/USD pair on Friday performed a drop almost to the corrective level of 200.0% (1.0430). However, later a reversal was made in favor of the European currency and a new growth process began in the direction of the Fibo level of 161.8% (1.0574). The rebound of quotes from this level will work again in favor of the US dollar and a new fall in the direction of 1.0430. Fixing the pair's rate above the level of 161.8% will increase the probability of further growth towards the next corrective level of 127.2% (1.0705). Last week turned out to be very active. However, it is not every week that central banks meet and important economic reports are not released every week. For example, there will be very few important events this week. I can only single out the speeches of Fed President Jerome Powell in the US Congress. First, Powell will make a report to the Financial Services Committee, and then to the banking committee. As a rule, these reports are completely identical and, as a rule, they contain all those theses that have been known for a long time.

In other words, I don't expect any unexpected statements. Just last week, Jerome Powell clearly described the current state of things in the economy and the Fed's plans and goals for the coming months. According to him, the Fed will continue to raise the rate until inflation returns to the target level of 2%. At the moment, inflation in the US is almost 9%, and you don't need to be an expert to understand that it will take a lot of time to complete this task. It will also take far more than one rate increase, even taking into account the fact that it has already risen to 1.75%. And the tightening of the monetary policy usually has a favorable effect on the exchange rate of the monetary unit. Therefore, I assume that in 2022 the US currency will continue its growth. From time to time, we will also observe the growth of the European currency, which may be simple corrections. One of them is currently taking place.

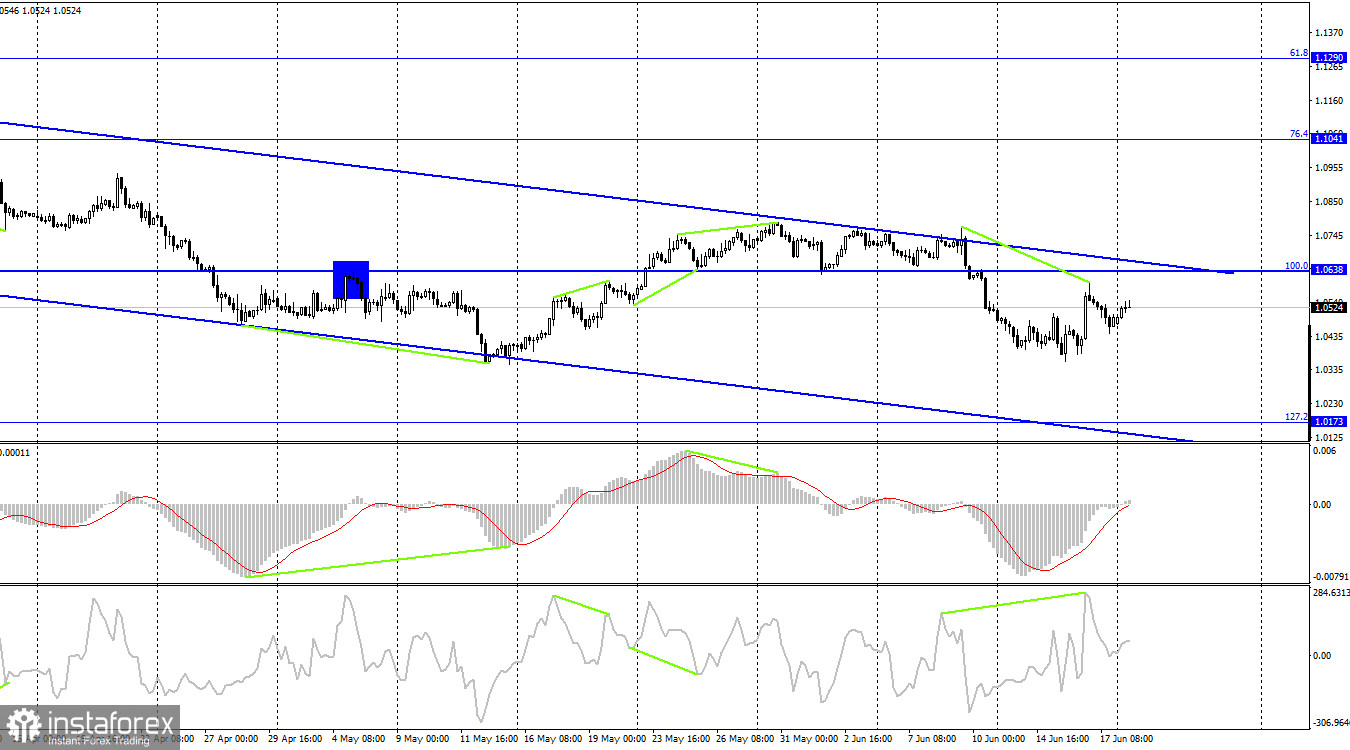

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator. A drop in quotations has begun, which can be continued in the direction of the Fibo level of 127.2% (1.0173). Fixing the pair's exchange rate above the downward trend corridor will work in favor of the EU currency and only after that I can count on a strong euro growth in the direction of the Fibo level of 76.4% (1.1041).

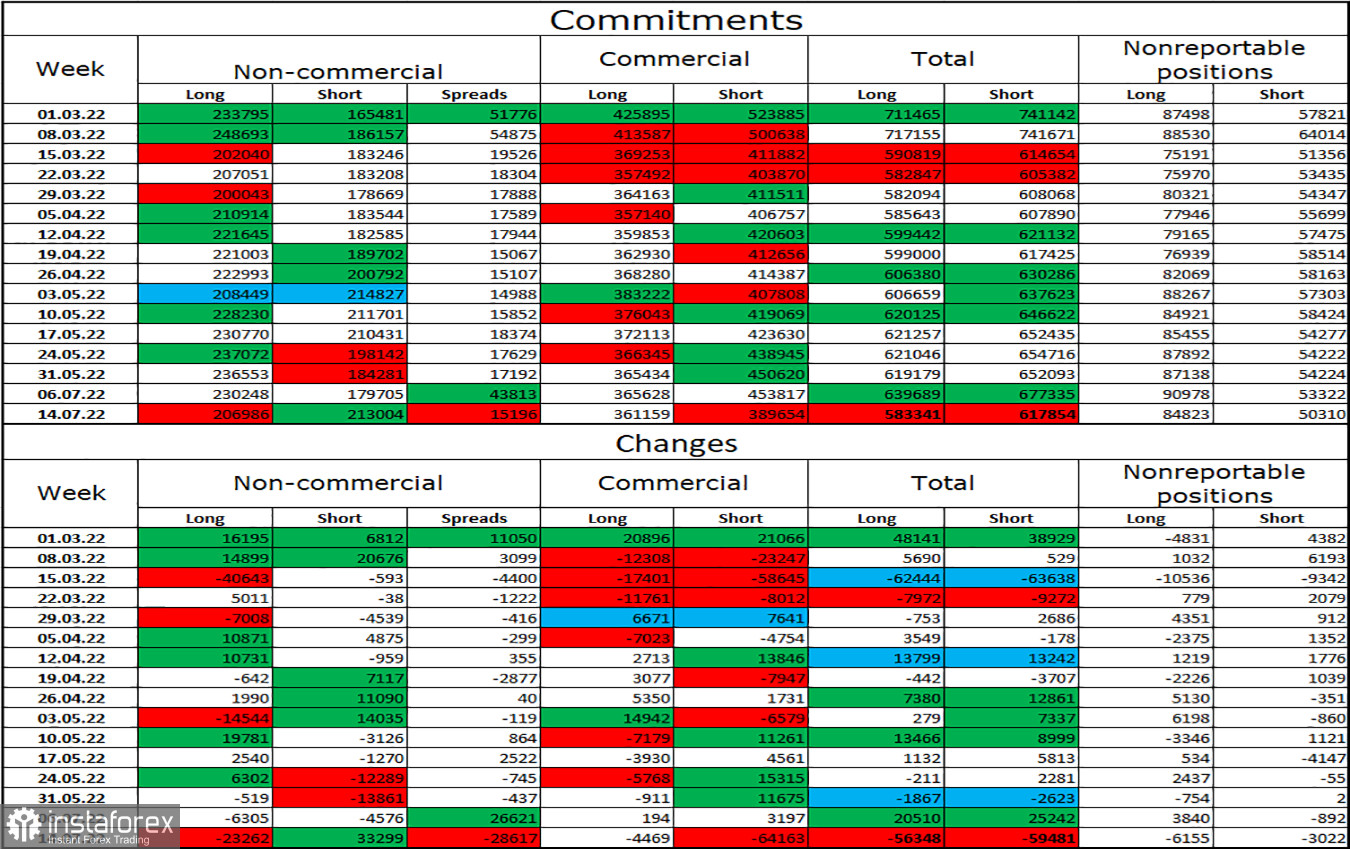

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 23,262 long contracts and opened 33,299 short contracts. This means that the bullish mood of the major players has weakened and ceased to be bullish. The total number of long contracts concentrated in the hands of speculators now amounts to 207 thousand, and short contracts – 213 thousand. The difference between these figures is not very big, but it is no longer in favor of the bulls. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, which did not help the euro currency itself in any way. In the last few weeks, the chances of a rise in the euro currency have been gradually growing, but the latest COT report showed that new sales of the EU currency may now follow. The euro did not get any good news from the Fed or the ECB. There were some good signs, but they were crossed out by negative messages for the euro.

News calendar for the USA and the European Union:

On June 20, the calendars of economic events of the European Union and the United States are empty. Thus, the influence of the information background on the mood of traders will be absent today. There will be some interesting events this week, but not of the scale to expect a change in the general mood of the players.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when rebounding from the level of 161.8% (1.0574) on the hourly chart with a target of 1.0430. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.