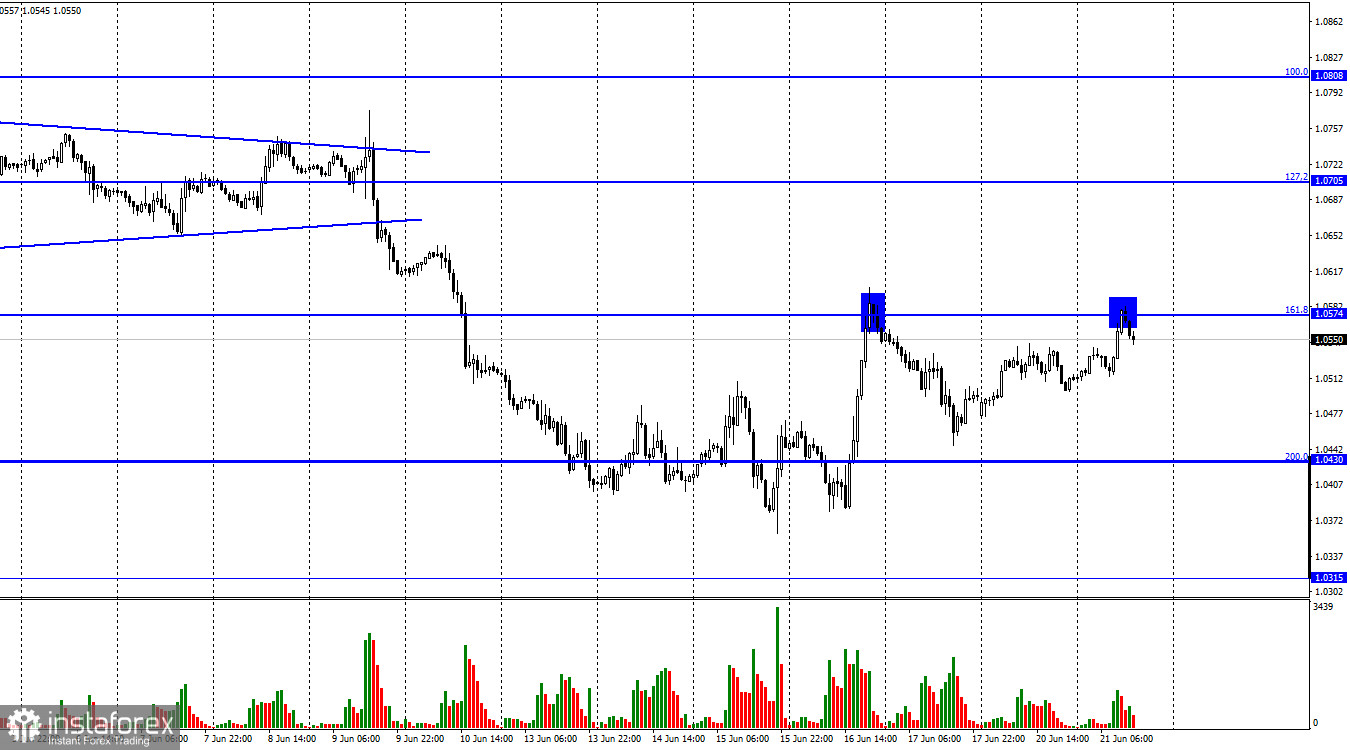

The EUR/USD pair started the growth process on Monday, continued it on Tuesday, and reached the corrective level of 161.8% (1.0574). The second rebound from this level again worked in favor of the US currency and began to fall in the direction of the Fibo level of 200.0% (1.0430). Fixing the pair's rate above 1.0574 will increase the probability of further growth in the direction of the Fibo level of 127.2% (1.0705). Monday turned out to be quite boring this time. The main reason was that in the USA this day was a weekend. Nevertheless, there was no weekend in Europe and even a speech by ECB President Christine Lagarde in the European Parliament took place, which was not included in the calendar this weekend. Christine Lagarde noted that the ECB is very concerned about high inflation, is ready to fight it by all available means, and even conducted an internal investigation to find out who is to blame for underestimating the price increase and why it happened.

It turned out that it was all the fault of the energy carriers that had increased in price. ECB economists did not expect such a sharp rise in prices and did not include them in their forecasts. However, from my point of view, such an investigation is an attempt to whitewash itself in the face of the public. It's no secret that Europeans tend to criticize their government or the central bank. In Europe, where democracy is flourishing, public opinion is very important, so the ECB feels that confidence in it is falling every day, and tries to act according to the classic scheme – to find the guilty. On the one hand, it is quite difficult to find them, since energy prices have risen unexpectedly and mainly due to the military conflict between Ukraine and Russia, as well as due to the sanctions imposed by many countries of the world. On the other hand, ECB economists should have changed their forecasts at a time when the conflict had already begun and recommended that the monetary committee raise the rate as soon as possible, as, for example, the British or American regulator did. Instead, it turned out to be a situation where Christine Lagarde was simply misled by incorrect forecasts.

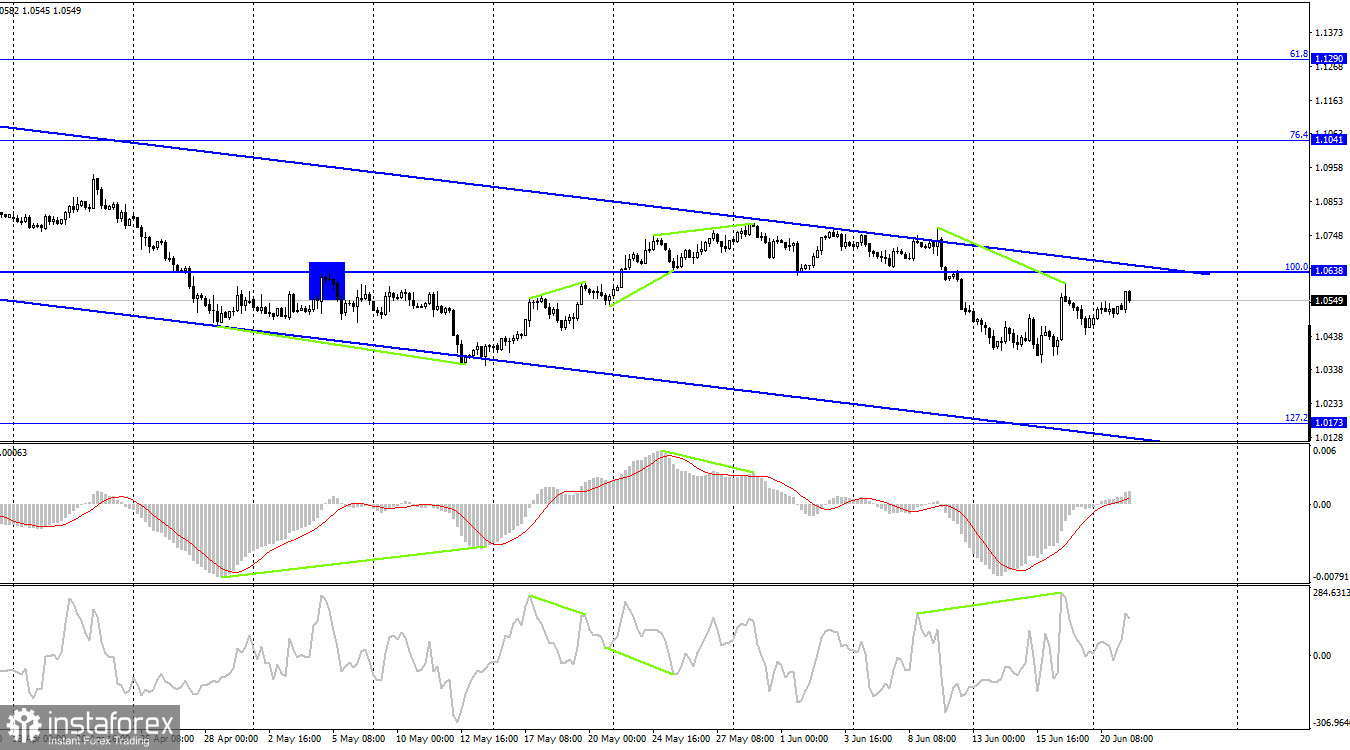

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator. A drop in quotes has begun, which can still be continued in the direction of the Fibo level of 127.2% (1.0173). Fixing the pair's exchange rate above the downward trend corridor will work in favor of the EU currency and only after that I can count on a strong euro growth in the direction of the Fibo level of 76.4% (1.1041).

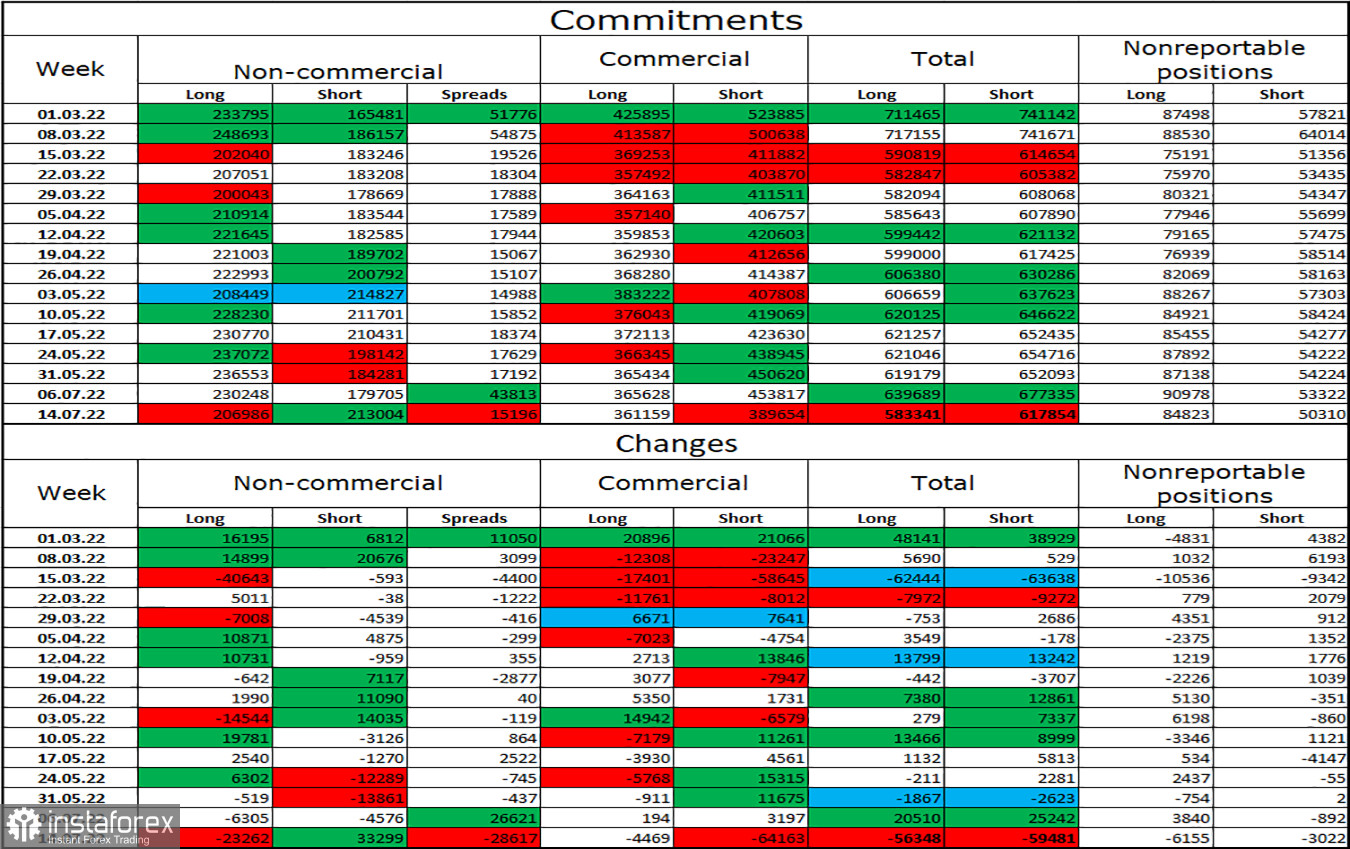

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 23,262 long contracts and opened 33,299 short contracts. This means that the bullish mood of the major players has weakened and ceased to be bullish. The total number of long contracts concentrated in the hands of speculators now amounts to 207 thousand, and short contracts – 213 thousand. The difference between these figures is not very big, but it is no longer in favor of the bulls. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, which did not help the euro currency itself in any way. In the last few weeks, the chances of a rise in the euro currency have been gradually growing, but the latest COT report showed that new sales of the EU currency may now follow. The euro did not get any good news from the Fed or the ECB. There were some good signs, but they were crossed out by negative messages for the euro.

News calendar for the USA and the European Union:

On June 21, the calendars of economic events of the European Union and the United States are empty. Thus, the influence of the information background on the mood of traders will be absent today.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when rebounding from the level of 161.8% (1.0574) on the hourly chart with a target of 1.0430. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.