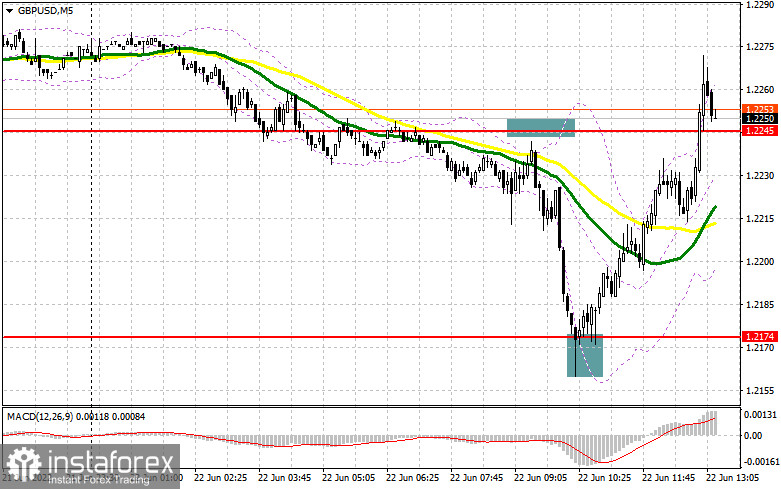

In my morning forecast, I paid attention to the level of 1.2174 and recommended making decisions from it. Let's look at the 5-minute chart and figure out what happened there. After the pound moved down against the background of inflation data in the UK, an unsuccessful attempt to break below 1.2174 led to an excellent entry point into long positions. As a result, the pair not only returned to the 1.2245 area but is now trying to gain a foothold above this range. All this made it possible to take more than 70 points of profit from the market. Sales from the level of 1.2245 did not work out, as there were a couple of points missing before the formation of a false breakdown in the first half of the day. And what were the entry points for the euro?

To open long positions on GBP/USD, you need:

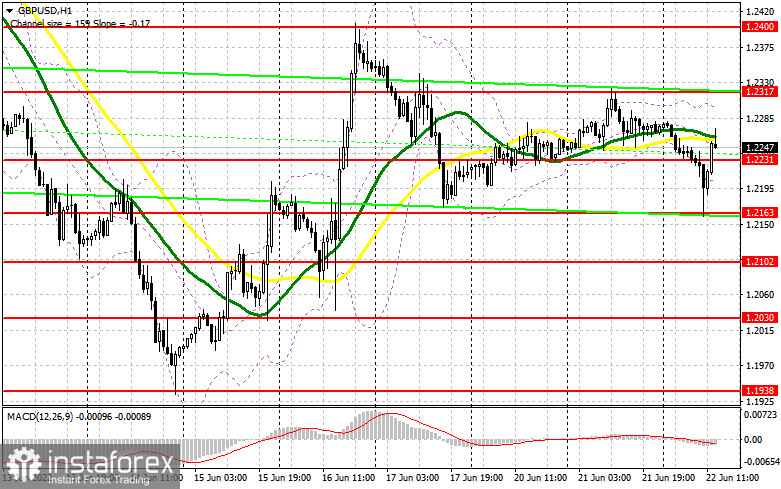

For the American session, the technical picture changed slightly. Everything will depend on the statements of Jerome Powell. If traders do not hear anything new, the pound will have every chance of continuing the upward correction. At least it will be possible to stop the bear market, an attempt to build which was observed today in the first half of the day. The primary task of the bulls will not be a breakthrough of 1.2317 – a new level of resistance formed at the end of the first half of the day, but the protection of the nearest support of 1.2231. In the case of a fall in the pound during North American trading, only the formation of a false breakdown by 1.2231 will give a signal to open new long positions in the expectation of continued growth of the pair and a return to 1.2317. This way it will be possible to build a new lower boundary of a new bullish channel. The 1.2317 level is critically important for bulls. Therefore, a breakout and a top-down test of this range will give a buy signal based on the 1.2400 updates, and then an exit to a new maximum of 1.2452. A similar breakthrough at this level will lead to another entry point into long positions with the prospect of updating 1.2484, where I recommend fixing the profits. A more distant target will be the 1.2516 area. If GBP/USD falls and is absent at 1.2231 after Powell's speech, the pressure on the pair will increase, but you should not panic. I advise you to open new long positions only on a false breakout from 1.2163, which was formed following the results of the European session and which is the lower boundary of the new side channel. You can buy GBP/USD immediately for a rebound from 1.2102, or even lower – around 1.2030 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears did everything possible to return to the market and even took advantage of the inflation data in the UK, carefully following the stop orders of buyers, but this was not enough. Now they again need to think about how to return to the level of 1.2231 formed by the results of the morning session. Only a consolidation below 1.2231 and a reverse test from the bottom up will give an entry point into short positions with the prospect of a decline to 1.2164. However, a test of this level will not lead to the surrender of buyers. To do this, you need to break below and get out to 1.2102, where I recommend fixing the profits. We will be able to reach this area only in case of new interesting surprises that the Fed, together with Jerome Powell, has prepared for the US Congress and the markets. With the GBP/USD growth option, the bears will certainly manifest themselves in the resistance area of 1.2317. A false breakout will be an excellent signal to open short positions. In the absence of sellers' activity there, I advise you to postpone sales, as the situation may change dramatically. Only a false breakout at 1.2400 will give a new entry point to short positions in the expectation of a resumption of the downtrend. Short positions can be viewed immediately for a rebound from 1.2452, or even higher – from 1.2484, counting on the pair's rebound down by 30-35 points inside the day.

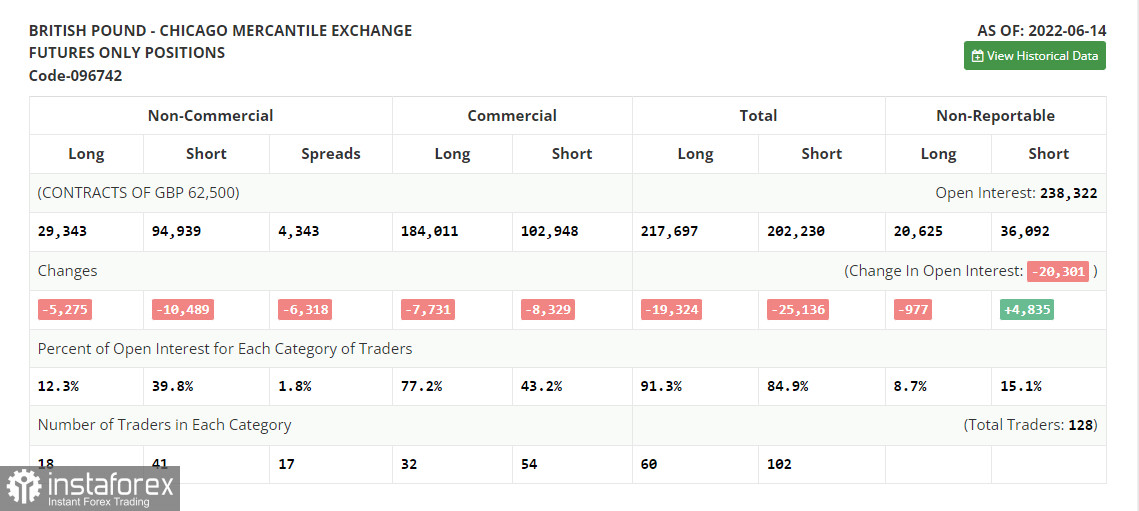

The COT report (Commitment of Traders) for June 14 recorded a reduction in both long and short positions, which led to a slight decrease in the negative delta. After the meeting of the Bank of England, at which it was announced that it would adhere to the previous plan to raise interest rates and combat high inflation, the pound strengthened its position, which will affect future COT reports. For sure, the big players are taking advantage of the moment and buying back the much cheaper pound, despite all the negative things that are happening with the UK economy right now. However, one should not rely too much on the pair's recovery in the near future, since the policy of the Federal Reserve System will seriously help the US dollar in the fight against risky assets. The COT report indicates that long non-commercial positions decreased by 5,275, to the level of 29,343, while short non-commercial positions decreased by 10,489, to the level of 94,939. This led to a decrease in the negative value of the non-commercial net position from the level of -70,810 to the level of -65,596. The weekly closing price decreased to 1.1991 against 1.2587.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.