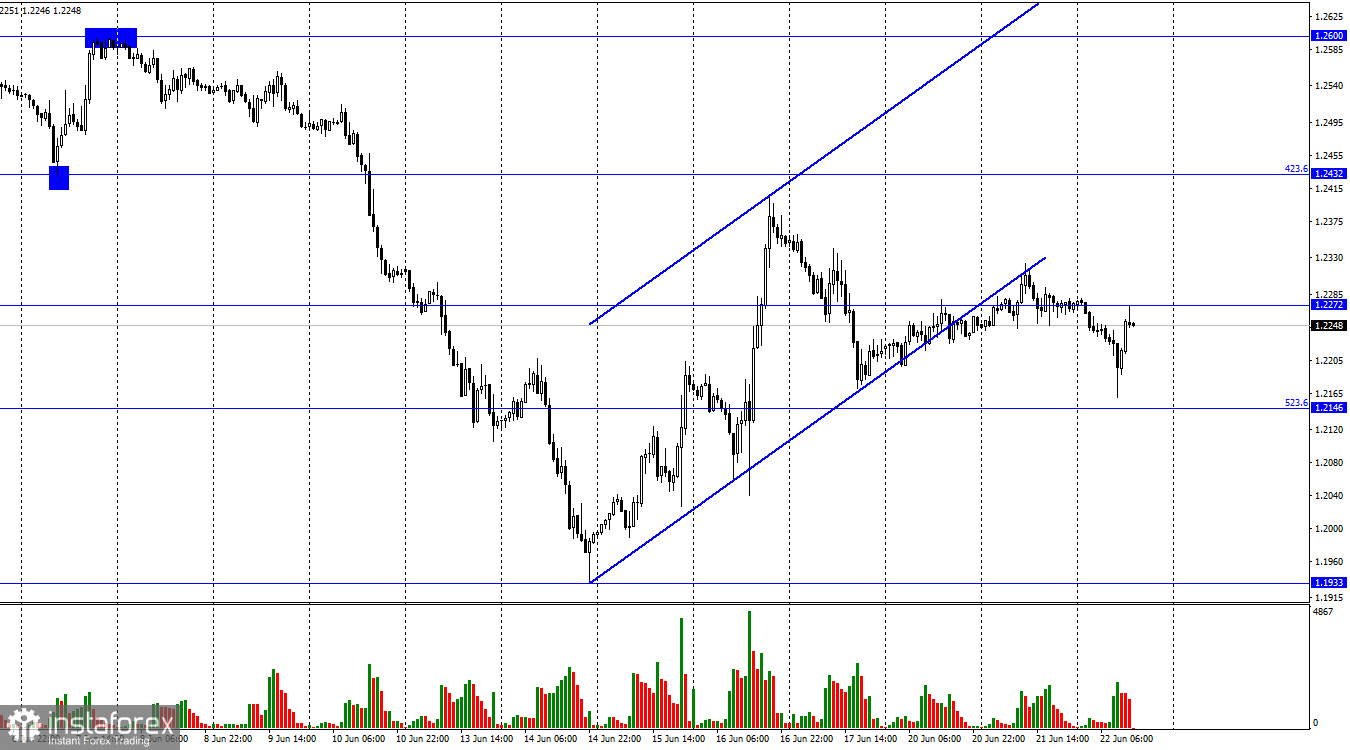

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US dollar on Tuesday and began the process of falling towards the corrective level of 523.6% (1.2146). However, before reaching it by only a few points, a reversal was made in favor of the British currency and a return to the level of 1.2272. The rebound of quotes from this level will again work in favor of the dollar and a new fall in the direction of 1.2146. Fixing the pair's exchange rate above the level of 1.2272 will increase the chances of the British to grow in the direction of the corrective level of 423.6% (1.2432). This morning, a report was released in the UK, which traders were very much waiting for. They were waiting for it because it is the only report in the UK this week. And in addition, it is very important, since it is on inflation that the further actions of the central bank now depend on. The report, we can say, was disappointing, as inflation rose (which is bad), but it grew within the forecast (9.1% y/y), which did not allow traders to draw more global conclusions, did not allow them to be taken by surprise.

Thus, the Briton first fell, then rose, and with it, the euro currency repeated these movements. From my point of view, this is a very strange behavior of the euro, since the inflation report in Britain has nothing to do with the European economy. Why, then, did the euro also fall first, then grow? The answer suggests itself. Since the real value of inflation coincided with the expectations of traders, there was no reaction to it at all. If you look closely at the hourly chart, it is obvious that in the last few days the pair has been trading in the range between the levels of 1.2146 and 1.2272. Thus, today's movements are movements within the same range. I can characterize them as ordinary market noise. If there was no inflation report today, it is unlikely that both pairs would have stood still, not moving. That's exactly the kind of movement we saw in the end. And the report on British inflation has nothing to do with it. Now we are waiting for Jerome Powell's speech.

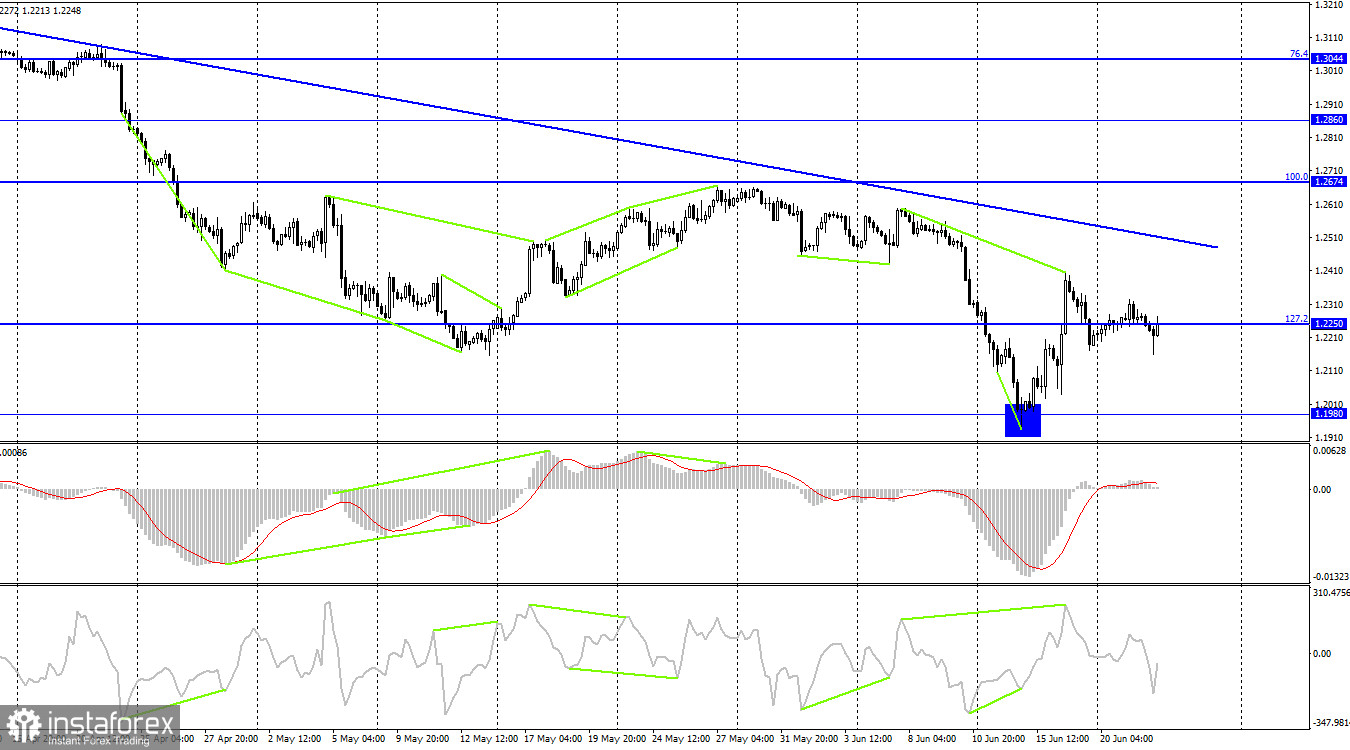

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator and a return to the corrective level of 127.2% (1.2250). Fixing the pair's rate under this level will again allow us to count on a further fall in the direction of the 1.1980 level, from where the Briton began its growth. The descending trend line continues to characterize the mood of traders as "bearish".

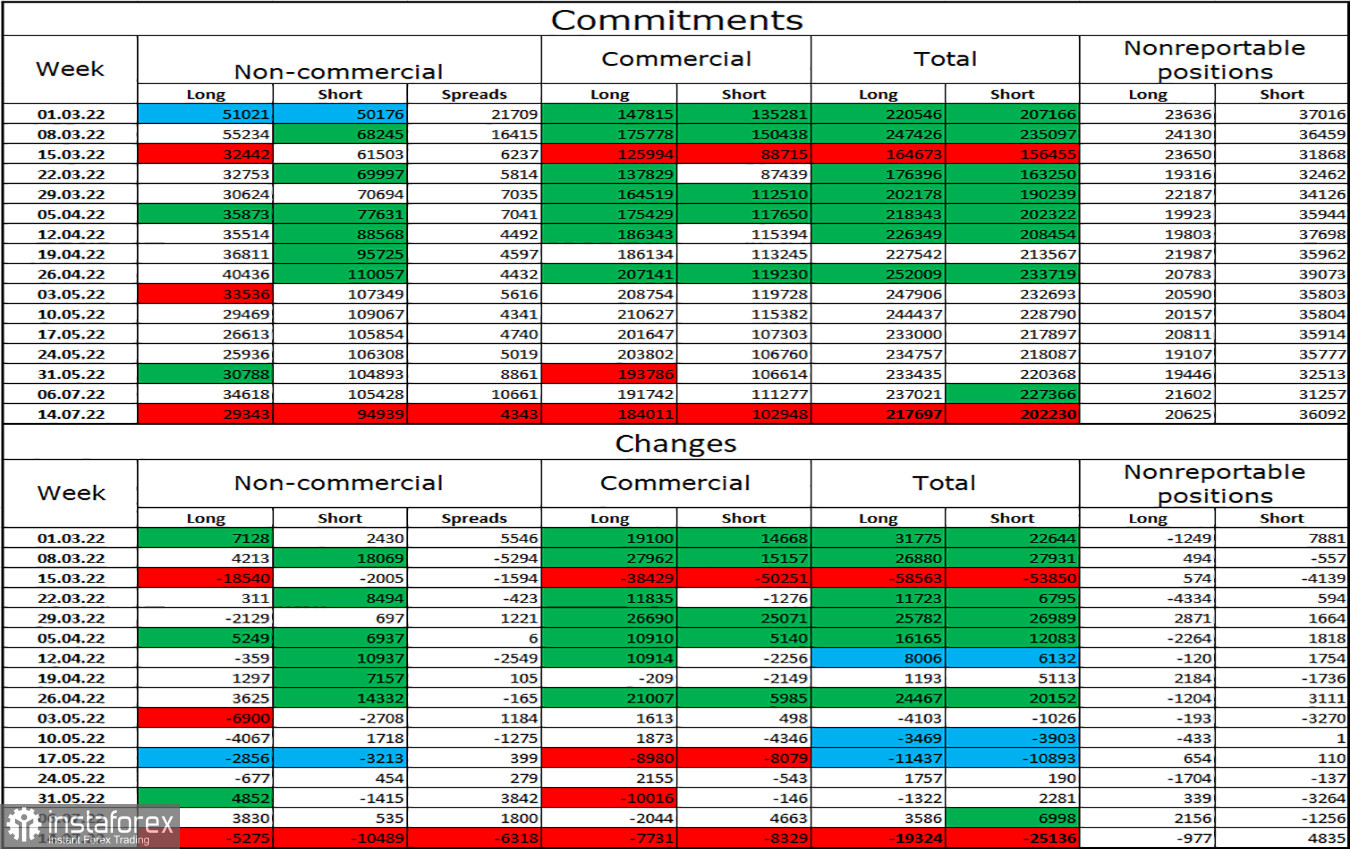

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators decreased by 5,275 units, and the number of short – by 10489. Thus, the general mood of the major players remained the same – "bearish", and the number of long contracts exceeds the number of short contracts several times. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could continue its decline over the next few weeks and months. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the USA and the UK:

UK - inflation report (06:00 UTC).

US - speech by Fed Chairman Jerome Powell (13:30 UTC).

On Wednesday, the calendars of economic events in the UK and the US contain one interesting entry each. And we already know for sure that the British record is not interesting. There remains only Jerome Powell's speech before the Senate Banking Committee. His speech can affect the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when closing under the ascending corridor on the hourly chart with targets of 1.2146 and 1.1933. New sales – when rebounding from the level of 1.2272 with the same goals. I recommend buying the British when fixing above the level of 1.2272 on the hourly chart with a target of 1.2432.