A significant increase in volatility in USD, CAD, and, accordingly, in the USD/CAD pair is expected today from 12:30 to 15:00 (GMT).

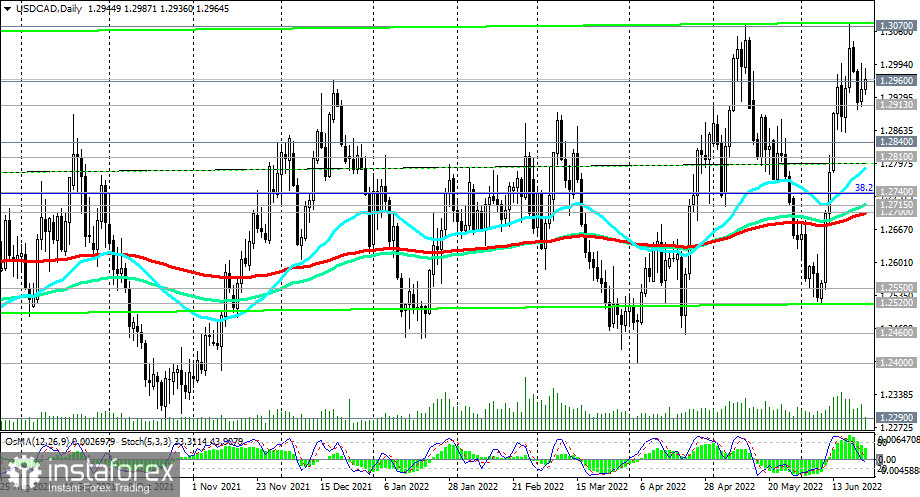

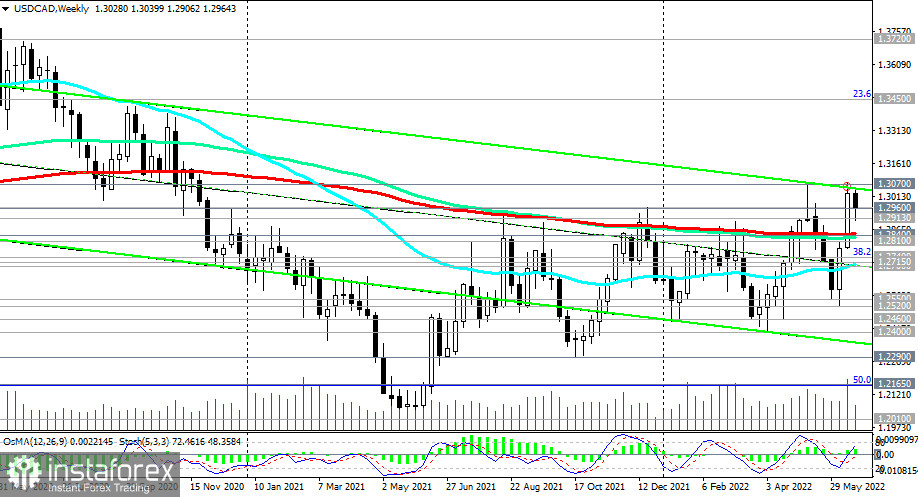

The pair remains in the bull market zone, above the key support levels 1.2840 (200 EMA on the weekly chart) and 1.2700 (200 EMA on the daily chart).

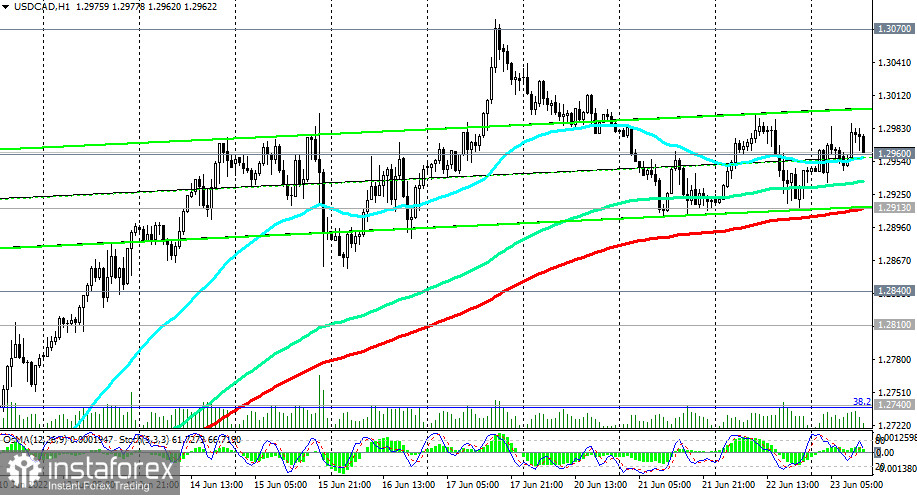

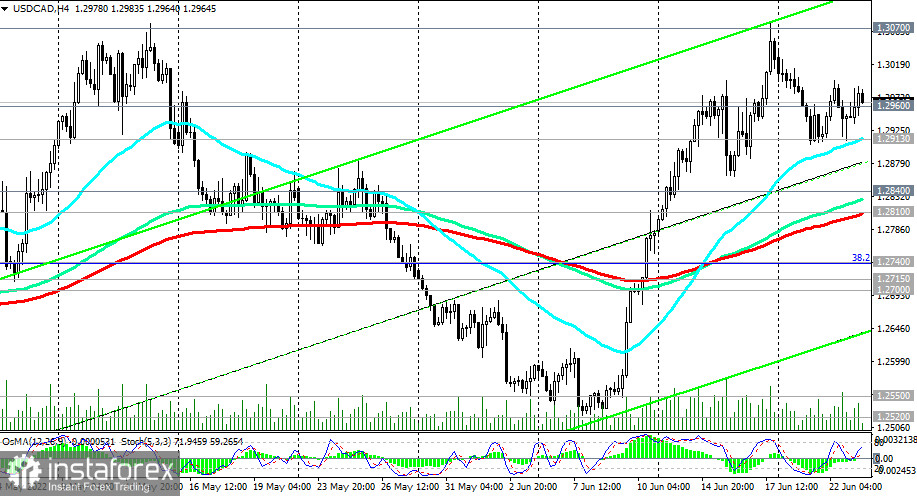

Above the important short-term support at 1.2913 (200 EMA on the 1-hour chart), USD/CAD long positions are not in danger. A breakdown of the local resistance level at 1.2996 or a rebound from the support level at 1.2913 will become a signal to increase long positions with long-term targets at resistance levels of 1.3450 (23.6% Fibonacci retracement of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600) and 1.3720 (local resistance level).

In an alternative scenario, USD/CAD will break through the support level 1.2913 and fall to the support levels 1.2840 and 1.2810 (200 EMA on the 4-hour chart). A corrective decline is possible up to the support level of 1.2700. The breakdown of the long-term support level 1.2550 (200 EMA on the monthly chart) will finally return USD/CAD to the zone of the long-term bear market.

Support levels: 1.2913 1.2900 1.2840 1.2810 1.2800 1.2740 1.2700 1.2600 1.2550 1.2520 1.2460 1.2400 1.2290 1.2165 1.2010

Resistance levels: 1.2960, 1.3000, 1.3070, 1.3100, 1.3450, 1.3720

Trading Tips

Sell Stop 1.2890. Stop-Loss 1.3010. Take-Profit 1.2840, 1.2810, 1.2800, 1.2740, 1.2700, 1.2600, 1.2550, 1.2520, 1.2460, 1.2400, 1.2290, 1.2165, 1.2010, 1.2000

Buy Stop 1.3010. Stop-Loss 1.2890. Take-Profit 1.3070, 1.3100, 1.3450, 1.3720