Even though the market opened in a big loss after yesterday's recovery, US stock index futures managed to compensate for all the losses. Now, they are trading in the green territory. Futures on the S&P 500 index rose by 0.4%, while futures on the Dow Jones Industrial Average added 42 points or 0.1%. Futures on the Nasdaq 100 increased by 0.7%. Yesterday, the markets showed the strongest weekly gains. The S&P 500 and Nasdaq Composite gained more than 2% and the Dow Jones jumped by 1.9%.

The speech of Federal Reserve Chairman Jerome Powell and his direct hints about the possibility of recession raised concerns in the market, but it did not affect it much yesterday. Small profit-taking at the end of the day led to a correction. Yesterday, the Fed Chairman gave a speech to the Senate Banking Committee. In his opening remarks, Powell said that officials foresaw a further rate hike that would be appropriate in the current situation, which would help reduce the strongest price pressure in 40 years. "Inflation has surprised to the upside over the past year, and further surprises could be in store. We therefore will need to be nimble in responding to incoming data and the evolving outlook," Powell said.

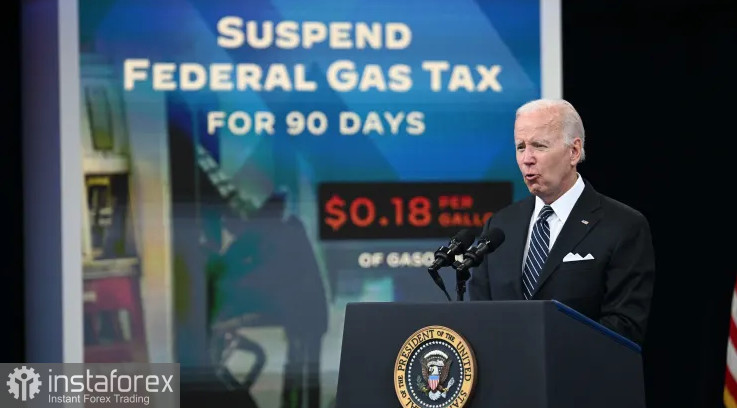

However, Powell is not the only one fighting against high inflation. Yesterday, US President Joe Biden urged Congress to suspend the federal gas tax for 90 days. This came after gas station prices once again skyrocketed to record highs. The federal tax is currently $0.18 per gallon of regular gasoline and $0.24 per gallon of diesel.

The president said such a move would not hit the Highway Trust Fund hard, saying the shortfall could be covered by other sources of revenue. Biden also urged states to suspend their fuel taxes and, if not, to find other ways to ease the situation. Several experts have already assessed the situation and concluded that suspending the fuel tax would keep demand stable and would not solve the structural problems in the market.

Today, investors will look forward to the fresh jobless claims data. Powell will also address the House of Representatives, but his speech is likely to be identical to yesterday's one. The data on production and services index activity in June this year should be perceived by the markets rather calmly.

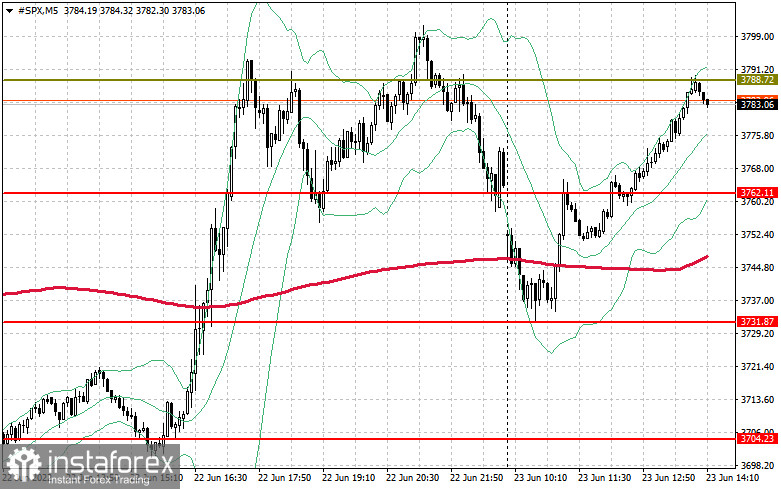

The technical picture of the S&P 500

Yesterday, investors could remain calm during the trading session. Today, buyers of risky assets will seek to regain control over the resistance of $3,788. A breakthrough of this level may push the asset to the area of $3,826 and $3,866, where large sellers may return to the market again. At least, there will be those, who wish to lock in profits on long positions. The next target is located at the level of $ 3,900, but the asset is unlikely to reach it. In the case of pessimism and another talk about high inflation and the need to curb it amid speeches of representatives of the Fed about more aggressive steps, the trading instrument may update the nearest support at $3,762, but it will not hurt the market much. The other thing is if the bulls test the level of $3,731. A breakthrough of that level is highly likely to trigger a new sell-off at $3,704 and $3,677.