Bitcoin reached $17.7k, where the peak of panic was reached. It was during the first and deepest fall below $20k that investors began to capitulate en masse. Subsequently, the price managed to reach the $20k level and stabilize near the $19k–$21k range. The main reason for the stabilization of the situation is considered to be the miners who sold all the BTC earned in May.

As of June 24, the situation is gradually stabilizing. Bitcoin continues to move with minor fluctuations. The main reason for this was the combination of factors that ensured the parity of expectations regarding the future of Bitcoin. There is a large proportion of investors who expect Bitcoin to further decline below $15k, but their short positions will be opened when the current market bottom is broken at around $17.7k.

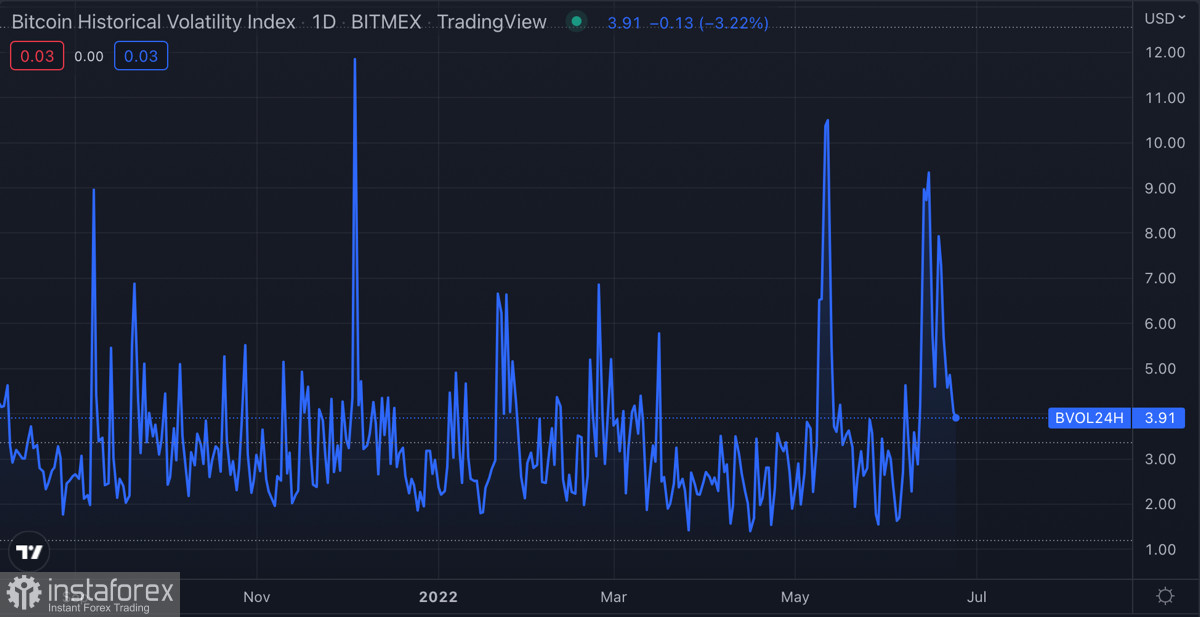

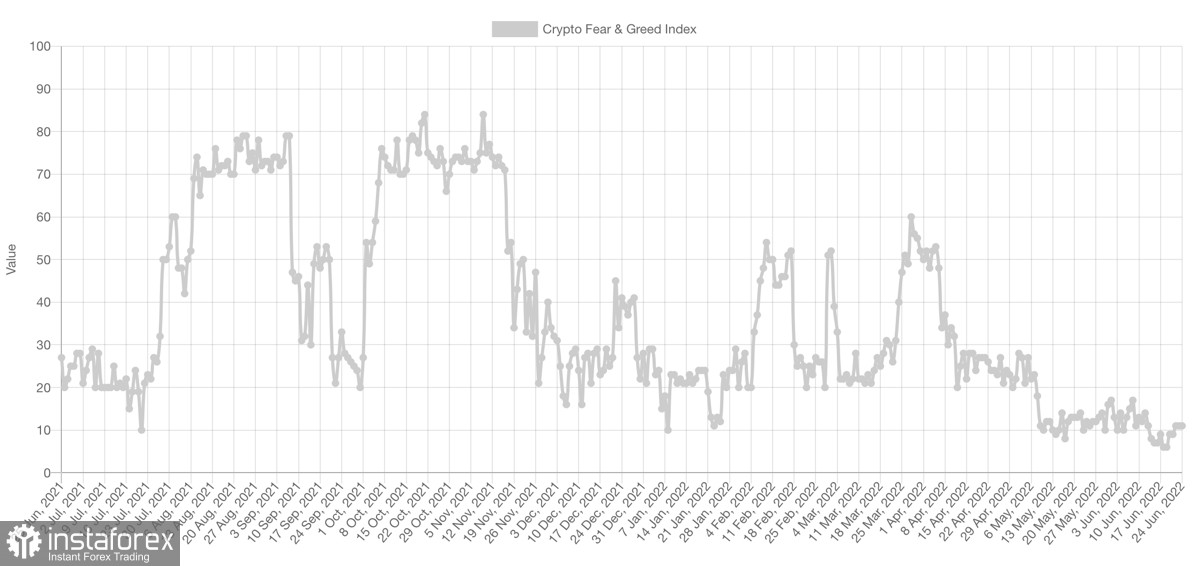

In addition, we can observe a local rebound of the main indicators characterizing the level of fear and the desire to sell. The fear and greed index reached 11 after setting a record high of 6. We also see a decrease in volatility to normal levels, which indicates the stabilization of trading activity and the absence of impulsive decisions. These metrics give a general idea that the market has gone through a period of absolute fear, but will mistakenly believe that the initiative has passed to the buyers.

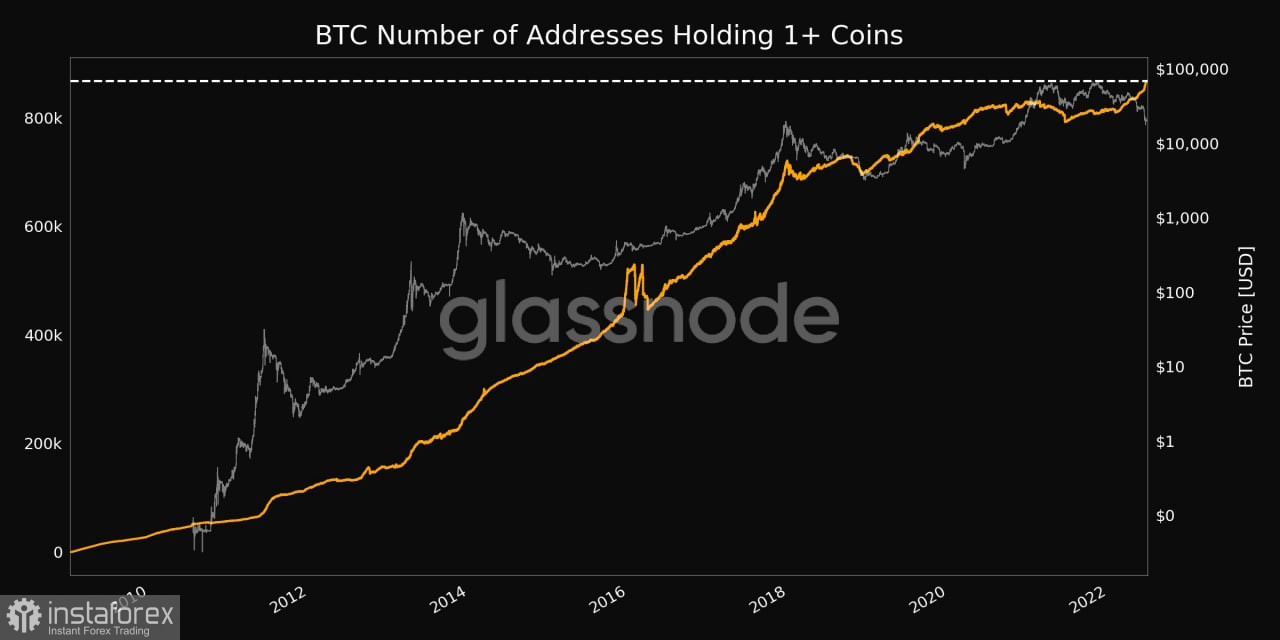

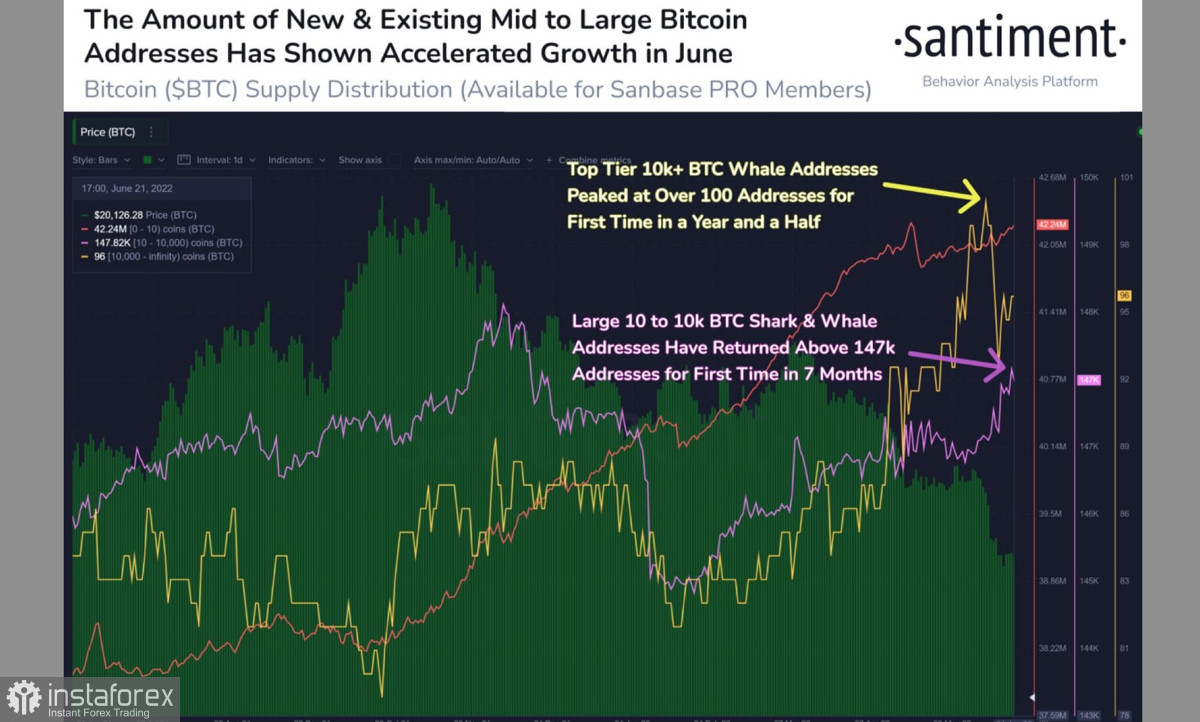

This only indicates that the market has recovered from the shock and moved to the stage of consolidation and accumulation. The main on-chain metrics indicate an increase in buying sentiment, as well as network activity. The number of Bitcoin addresses containing more than 1 BTC has reached an all-time high of 867,478. This is a positive signal, typical of an accumulation period at the bottom of the price. In addition, the number of large addresses has increased significantly. Wallets with balances between 10 and 10k BTC have seen an upward trend over the past two weeks, while addresses from $10k coins have shown an increase since February 2022.

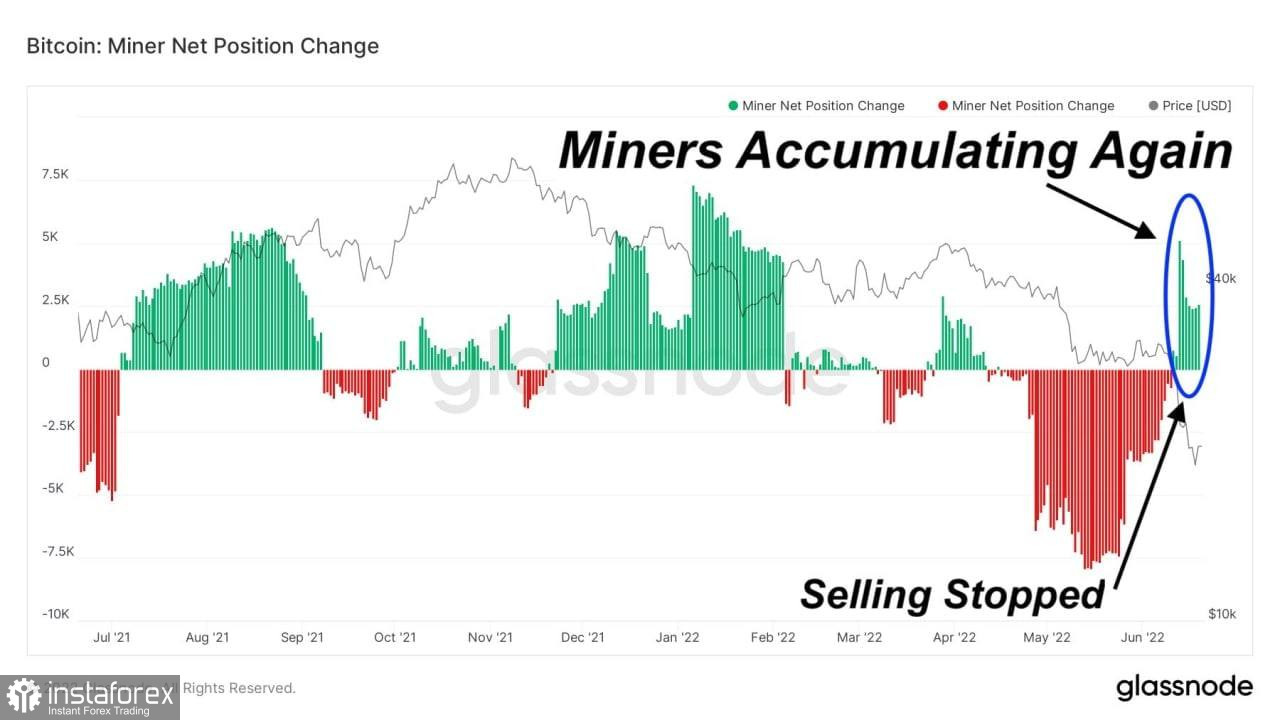

In addition, the period of sales from the miners has ended. Cryptocurrency mining companies have sold over 18,000 BTC since June 14, putting significant pressure on the price of Bitcoin. As of June 24, BTC/USD quotes have stabilized, and the need for a serious sale of Bitcoin to cover expenses has disappeared. However, even despite the local positive, any negative movement of Bitcoin will force the miners to resume the sale of coins.

Bitcoin has undoubtedly managed to stabilize, as a result of which the accumulation period has begun. After a powerful downward trend, the market needs a break and a correction. With this in mind, it can be assumed that after a short period of accumulation, the price will try to storm several resistance levels in the range of $22k–$30k.

The first serious resistance level is in the $22.8k–$23.2k area. In fact, this range is the upper limit of the current consolidation framework, and therefore the price will try to consolidate above it. This is necessary to start trading the $23k–$28k price free fall range. In this area, the first target for BTC/USD will be the $24.5k–$25.3k area, where the middle of the largest bearish candlestick is located, as well as the buyout zone of the previous local bottom.

The probability of a breakout of the first level is getting higher due to the gradual activation of buyers and the presence of bullish signals on the daily MACD. The metric has made a bullish crossover and is acquiring an upward direction. At the same time, the indicator is below the zero mark, and therefore it is too early to judge the potential of the upward impulse. Bitcoin has just begun the consolidation stage, and as of June 24, the bulls do not have the strength and desire to storm the $22.8k–$23.4k range.