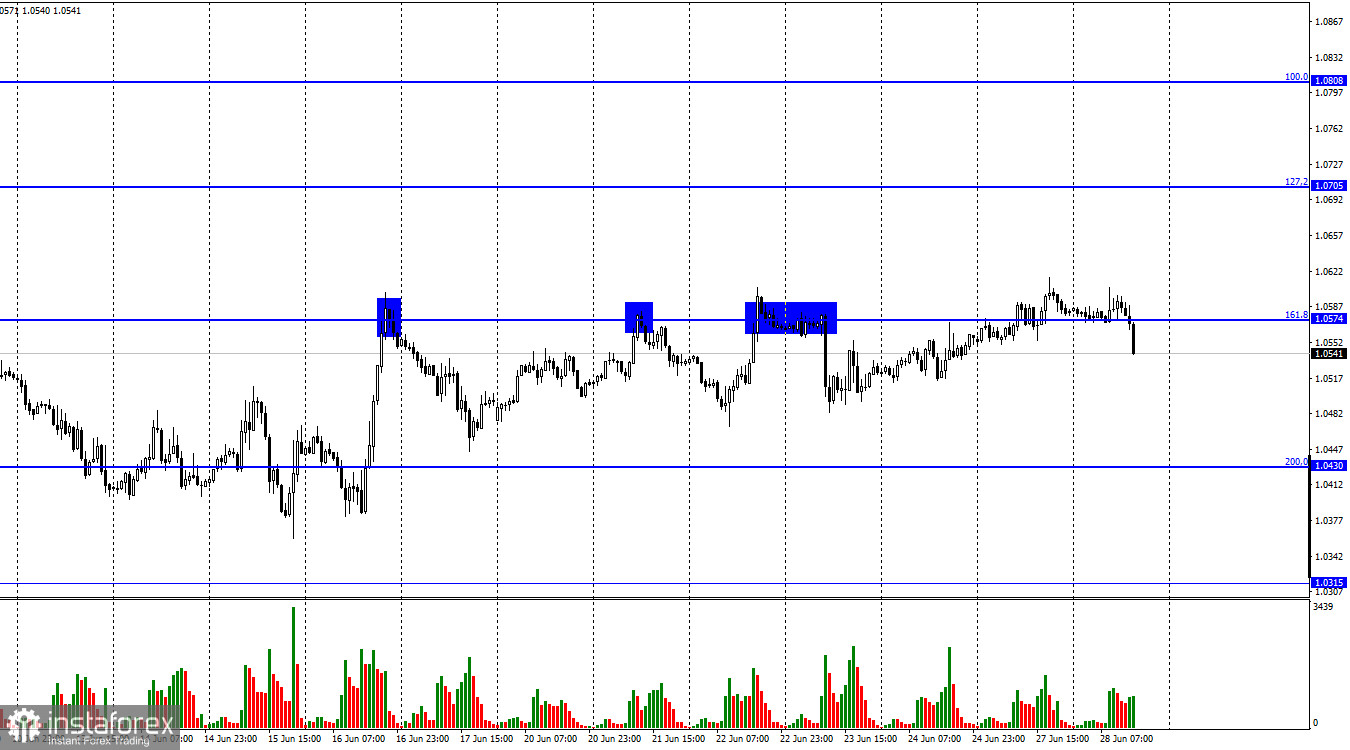

On Monday, EUR/USD continued to rise and managed to gain a foothold above the 161.8% retracement level of 1.0574. However, just as I predicted, this consolidation did not facilitate the further rise of the pair. As a result, the US dollar strengthened, and the price settled below the 161.8% Fibonacci level of 1.0574. This paves the way to the next downward target at the 200.0% Fibonacci level of 1.0430. I think that this decline will not be significant either. Judging by the current chart, neither bears nor bulls have enough strength to move the pair. Traders are currently in a wait-and-see mode. Even the speech by Christine Lagarde at the ECB forum in Sintra, Portugal, could not drive the market.

The ECB President has confirmed the intention of the European regulator to raise the rate in July in response to mounting inflation in the eurozone. Her hawkish rhetoric should have spurred the demand for the euro. Instead, the European currency is sliding. As far as I see it, the new stance of the ECB President and even the first rate hike will not help the euro stay afloat or prompt its significant uptrend. In parallel, the Fed may raise the rate to 2.25-2.5%, thus beating the hawkish policy of the ECB. Christine Lagarde also noted that the pace of monetary tightening might be accelerated if inflation expectations increase. Notably, she spoke about expectations but not about inflation itself. It seems that the ECB relies on its economic forecasts which are quite optimistic given that the regulator is planning to raise the rate only two times this year. Obviously, such a stance of the regulator is not favorable for the euro bulls. So, EUR remains vulnerable.

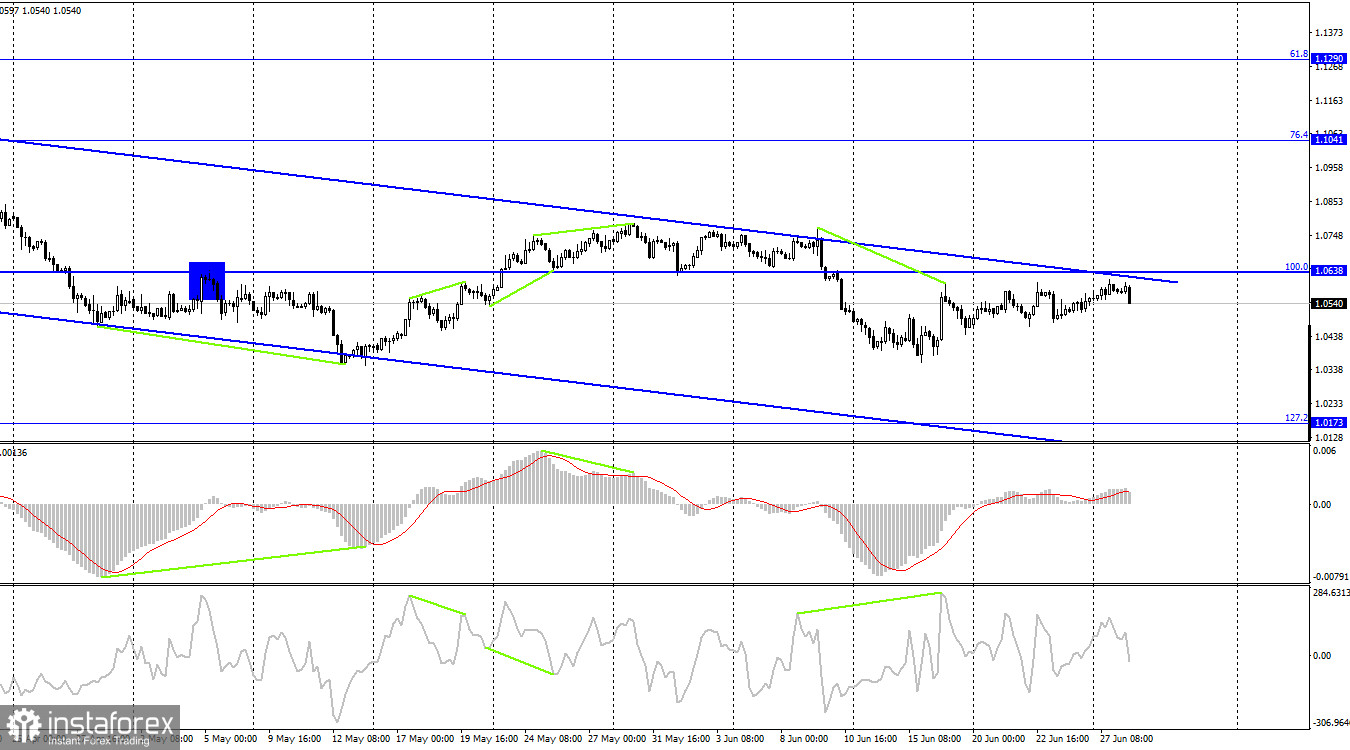

On the 4-hour time frame, the euro/dollar pair resumed its movement towards the upper line of the descending trend channel, which characterizes the market sentiment as bearish. I call this trajectory "a movement" rather than "growth" since it is too weak to be called otherwise. Consolidation of the price above the trend channel will significantly increase the chances for growth to the 76.4% fibo level located at 1.1041.

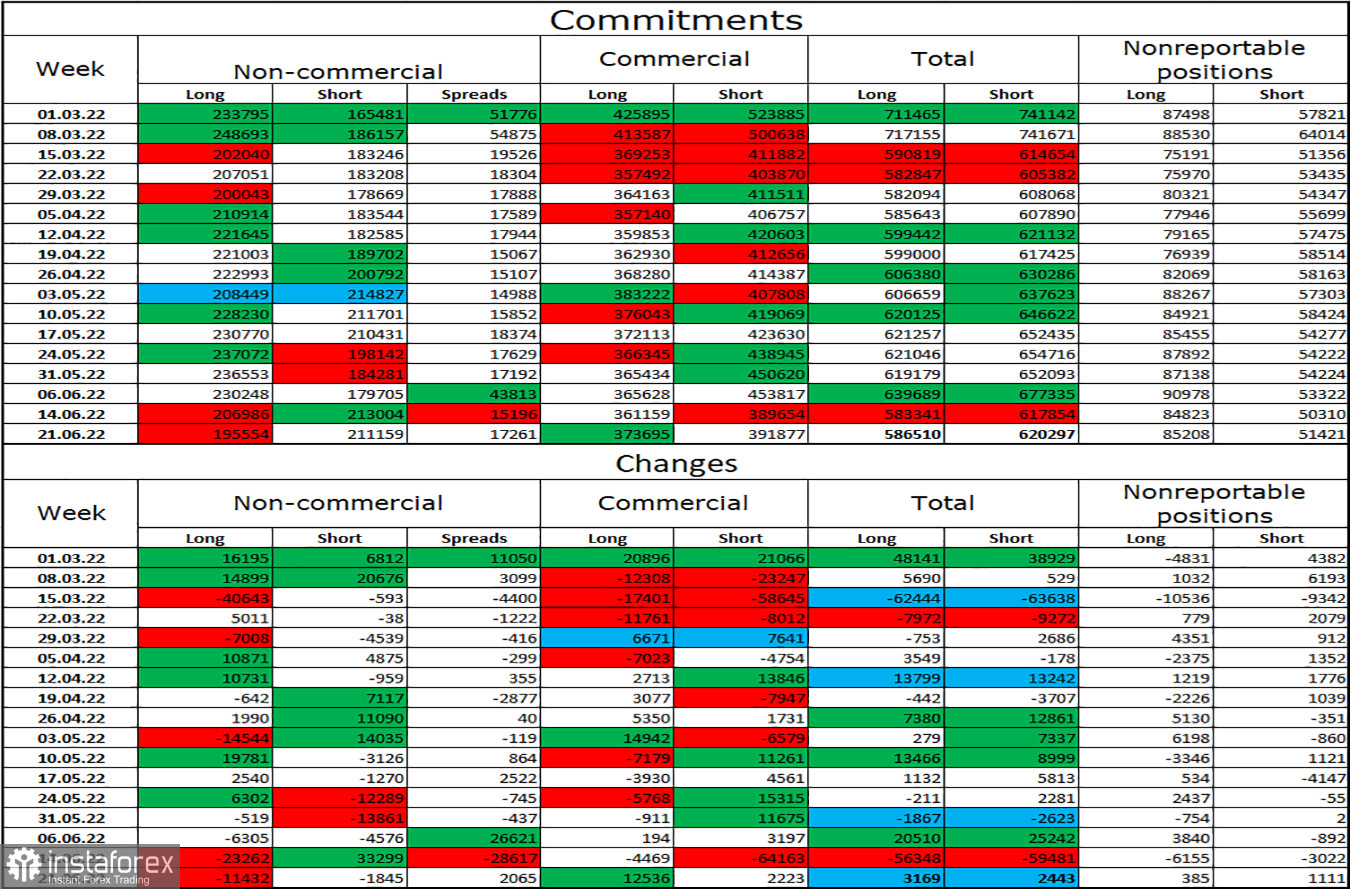

Commitments of Traders (COT)

Last week, traders closed 11,432 Long contracts and 1,845 Short contracts. This indicates that the bearish sentiment has intensified among large market players. The total number of opened Long contracts stands at 195,000, while the number of Short contracts is 211,000. Although the difference is minor, it still shows that bulls are losing ground. In recent months, the non-commercial category of traders was mostly bullish on the pair, which did not support the euro in any way. The possibility of a rise in the euro was getting higher in recent weeks. However, the latest COT reports showed that the European currency may soon face a new sell-off. Neither the Fed nor the ECB has anything to support the euro.

Economic calendar for US and EU:

EU - ECB President Christine Lagarde speaks (11:00 UTC).

On June 28, the economic calendar features only one important event in the EU. Christine Lagarde has already made a statement at the ECB forum today. Therefore, the influence of the information background will remain weak for the rest of the day.

EUR/USD forecast and trading tips:

I would recommend selling the pair on H1 after it rebounds from the level of 161.8% at 1.0574 with the next target found at 1.0430. You can consider selling the euro when the price settles firmly below the level of 1.0574. It is also possible to open long positions as soon as the price consolidates above the trend channel on H4 with the target at 1.1041.