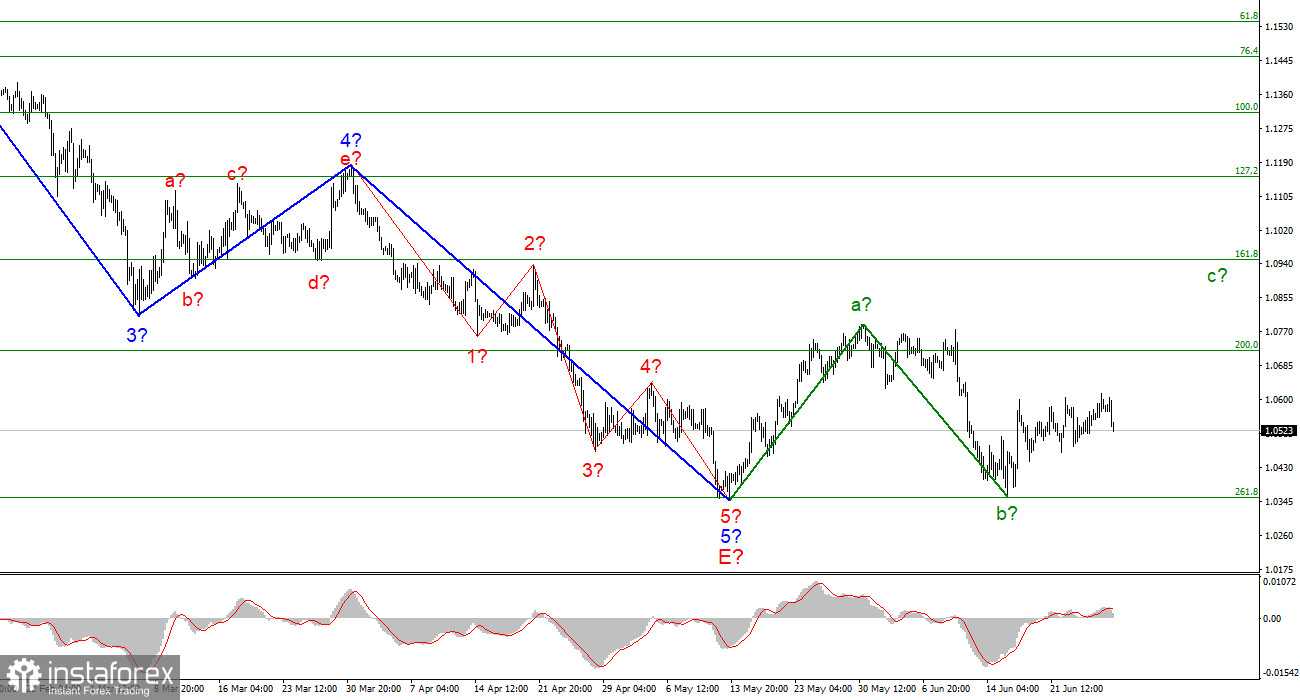

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. In addition, the markup has not changed in recent weeks, as the market is completely calm. The instrument has completed the construction of a downward trend segment. If the current wave marking is correct, then the construction of a new upward trend section has begun at this time. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of an ascending wave c has now begun. The instrument has not decreased under the low of the descending trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background. But at the moment, the chances of building an upward wave c remain. Only the news background can interfere.

Lagarde's speeches and European inflation

The euro/dollar instrument fell by 60 basis points on Tuesday. Market activity remains low, but I note that the news background has been practically absent in the last few days. To put it more precisely, on Monday, there was a report on orders for durable goods in the United States, and on Tuesday there was a speech by ECB President Christine Lagarde. But watching the movements of the instrument these days, I absolutely cannot say that the market has paid at least some attention to these events. What happened on the market on Monday and Tuesday? On Monday we saw a slight increase, and on Tuesday – a slight decrease. Both of these movements do not affect the current wave marking in any way. Both of these movements do not coincide at all with the nature and time of both events.

The internal wave structure of the proposed wave c is already becoming very complicated and everything may end up with the instrument resuming the construction of a downward trend section. As I thought, the news background may interfere with the construction of a corrective wave. It is not currently exerting harmful pressure on the euro currency, but it also does not provide any support to it. And let me remind you, we need an increase in demand for the euro. So far, the market is not able to just slowly bribe the euro, relying on the wave picture. Therefore, a news background is needed. Christine Lagarde assured the market today that the ECB is ready to fight inflation and raise the interest rate in July, but the market clearly shows that a stricter attitude is required from the ECB, and not a promise to increase the rate once. Thus, to my regret, the wave marking is in danger. However, before a successful attempt to break low waves E and b, I still expect the construction of an upward wave.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". Wave b is presumably completed. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for new sales of the instrument.

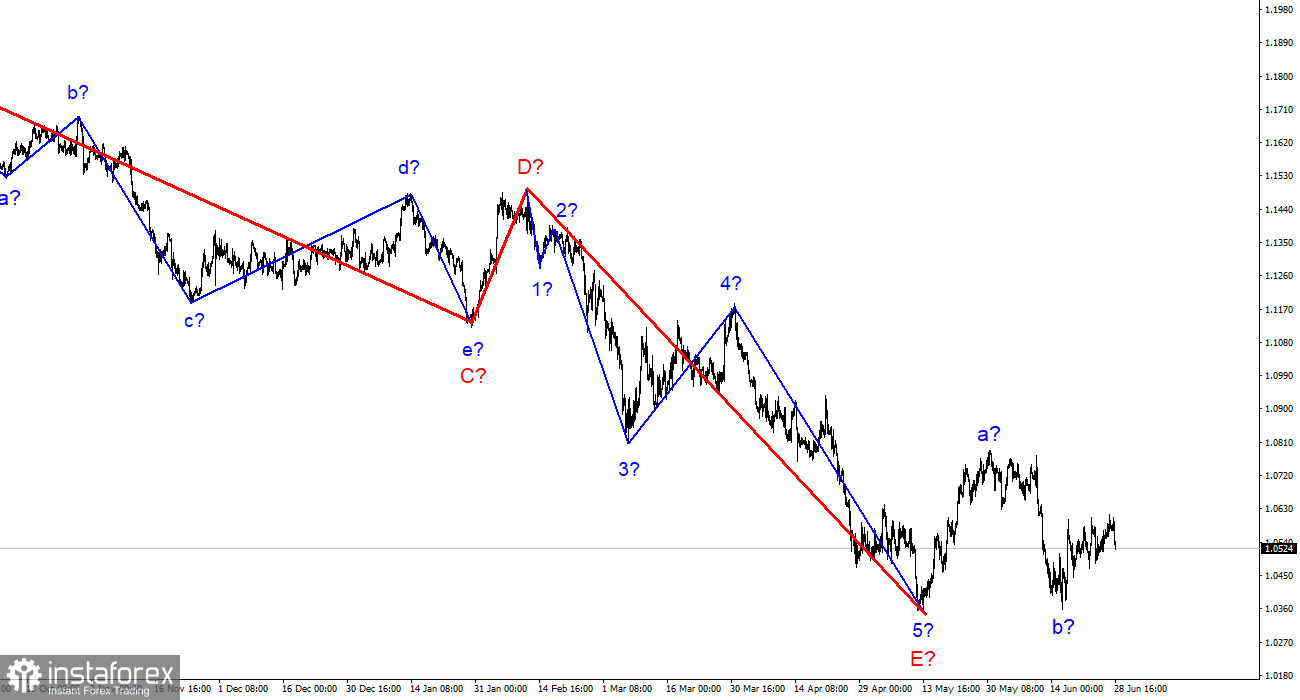

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.