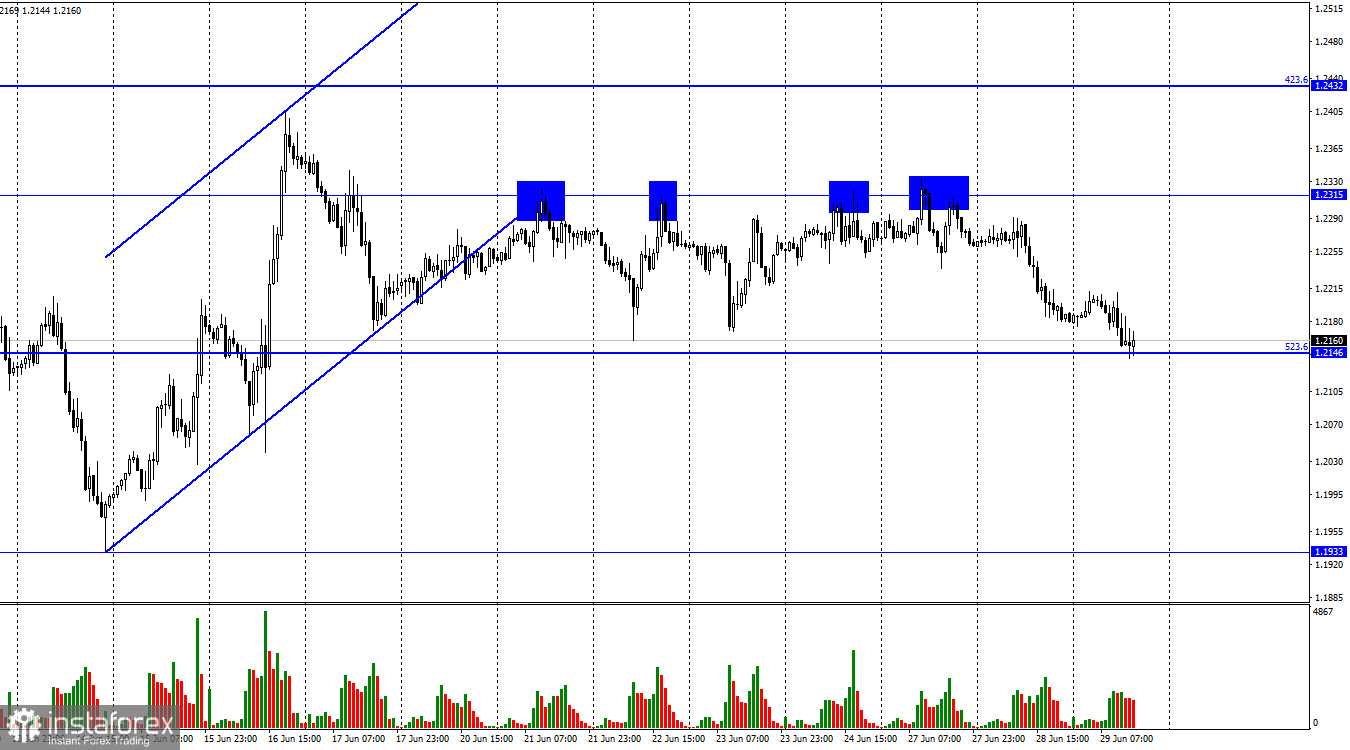

According to the hourly chart, the GBP/USD pair performed a new rebound from the 1.2315 level on Monday, the fourth in a row. However, this time, the pair also performed a fall to the corrective level of 523.6%. The pair's rebound from this level will work in favor of the UK currency and its new growth in the direction of the 1.2315 level. Fixing the pair's exchange rate below the Fibo level of 523.6% will increase the probability of a fall. The fall of the British pound. Let me remind you that in recent reviews I have repeatedly questioned the willingness of bull traders to continue to bend their line. Four times they failed to close over 1.2315, what else can we talk about? Even today's US GDP report, which turned out to be weaker than traders' expectations, led to a rise in the dollar. Thus, I think that the level of 1.2146 will not withstand the onslaught of bears, and the pound will resume a longer-term decline, which is visible on the older charts. What can save the pound from this fate?

Well, first of all, Andrew Bailey or Jerome Powell. Both will be speaking at the Sintra Economic Forum today. However, what is required of central bank presidents? Andrew Bailey is required to promise to raise the rate as much as it will be necessary to return inflation to 2%. Let me remind you that British inflation has already overtaken both European and America. Thus, this problem is most acute in Britain. This means that the central bank of this country should also put in the greatest amount of effort. The British regulator also applies them but does it less aggressively than the Fed. Thus, inflation is rising, rates are rising and it is generally unclear whether these two indicators are going to pay attention to each other? It's the same with Jerome Powell's performance. He is required to use "dovish" rhetoric if the pound wants to stay afloat. However, how can we expect "dovish" rhetoric from Powell, when he has almost promised a rate hike of at least 0.5% in July? There is not much to count on for a pound.

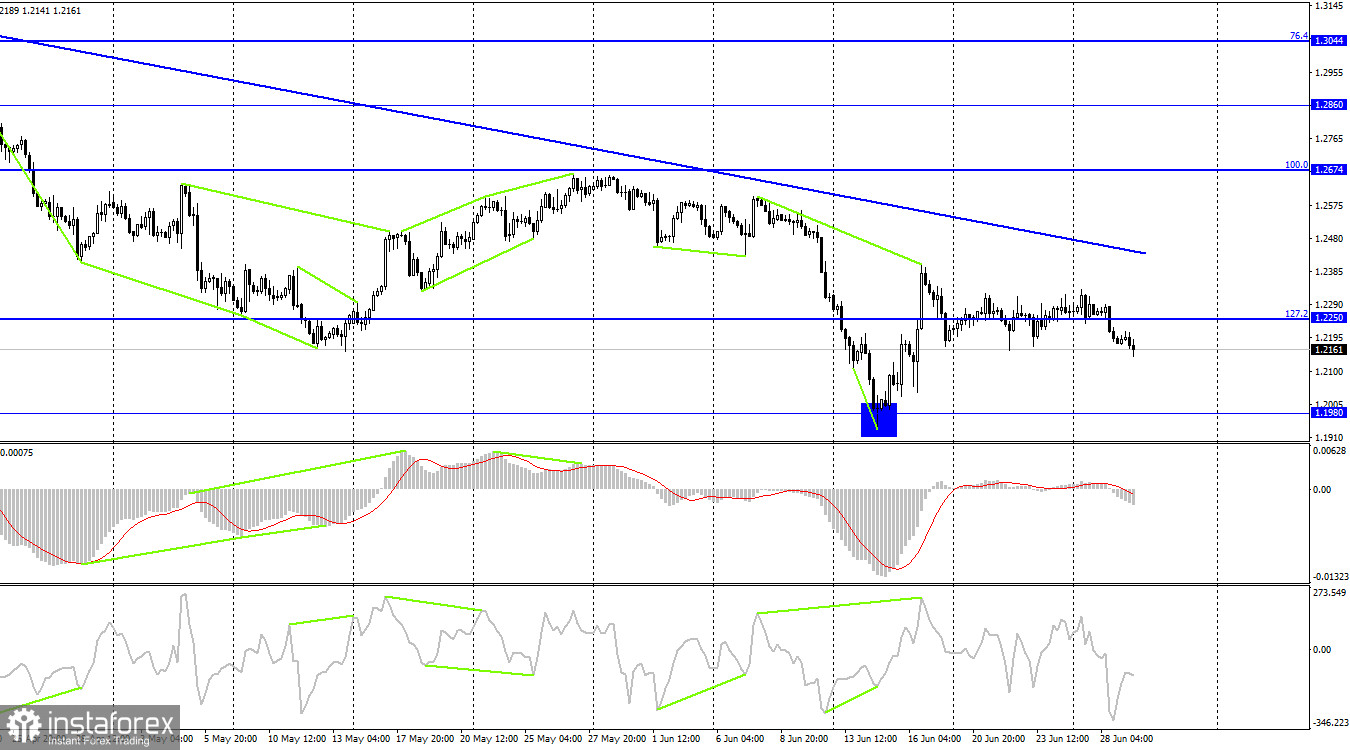

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator and returned to the corrective level of 127.2% (1.2250). Fixing the pair's rate under this level allows us to count on a further fall in the direction of the 1.1980 level, from where the Briton began its growth. The descending trend line continues to characterize the mood of traders as "bearish". Until the quotes close above the trend line, I do not expect strong growth for the British.

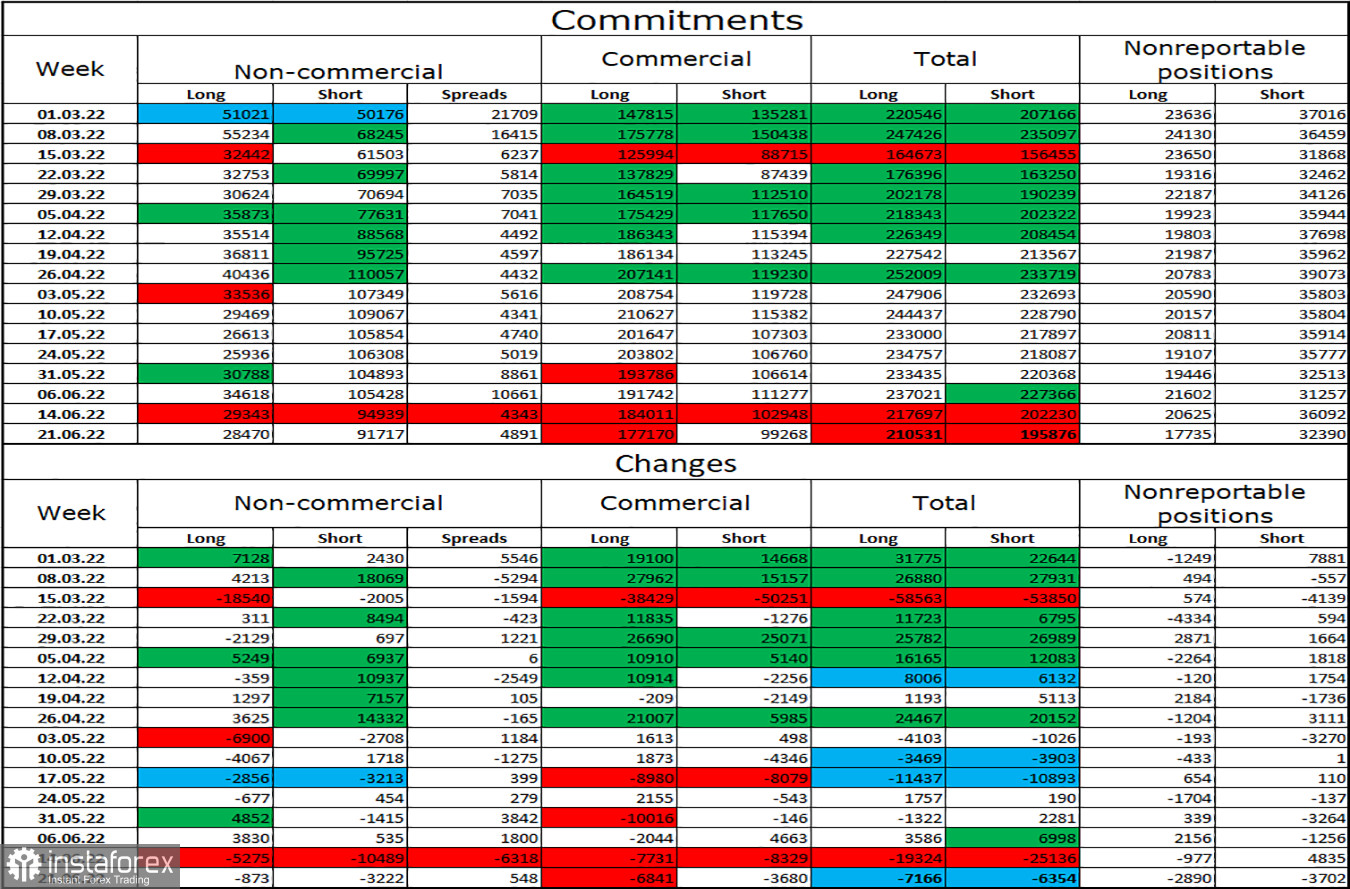

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators decreased by 873 units, and the number of short - by 3,222. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts still exceeds the number of short contracts by several times. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could resume its decline over the next few weeks. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. And the news background remains not in favor of the Briton. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the US and the UK:

US – GDP report (15:30 UTC).

UK - Bank of England Governor Bailey will deliver a speech (16:30 UTC).

US – Fed Chairman Jerome Powell will deliver a speech (16:30 UTC).

On Wednesday in the UK and the US, the calendars of economic events also contain one interesting entry. I say "one at a time" because the GDP report did not interest traders. But they may also not be interested in the speeches of Powell and Bailey, since they, in turn, may not try to surprise traders.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when rebounding from the 1.2315 level on the hourly chart with a target of 1.2146. This goal has been achieved. New sales – when anchored at 1.2146 with a target of 1.1933. I recommend buying the British when fixing above the trend line on the 4-hour chart with a target of 1.2674.