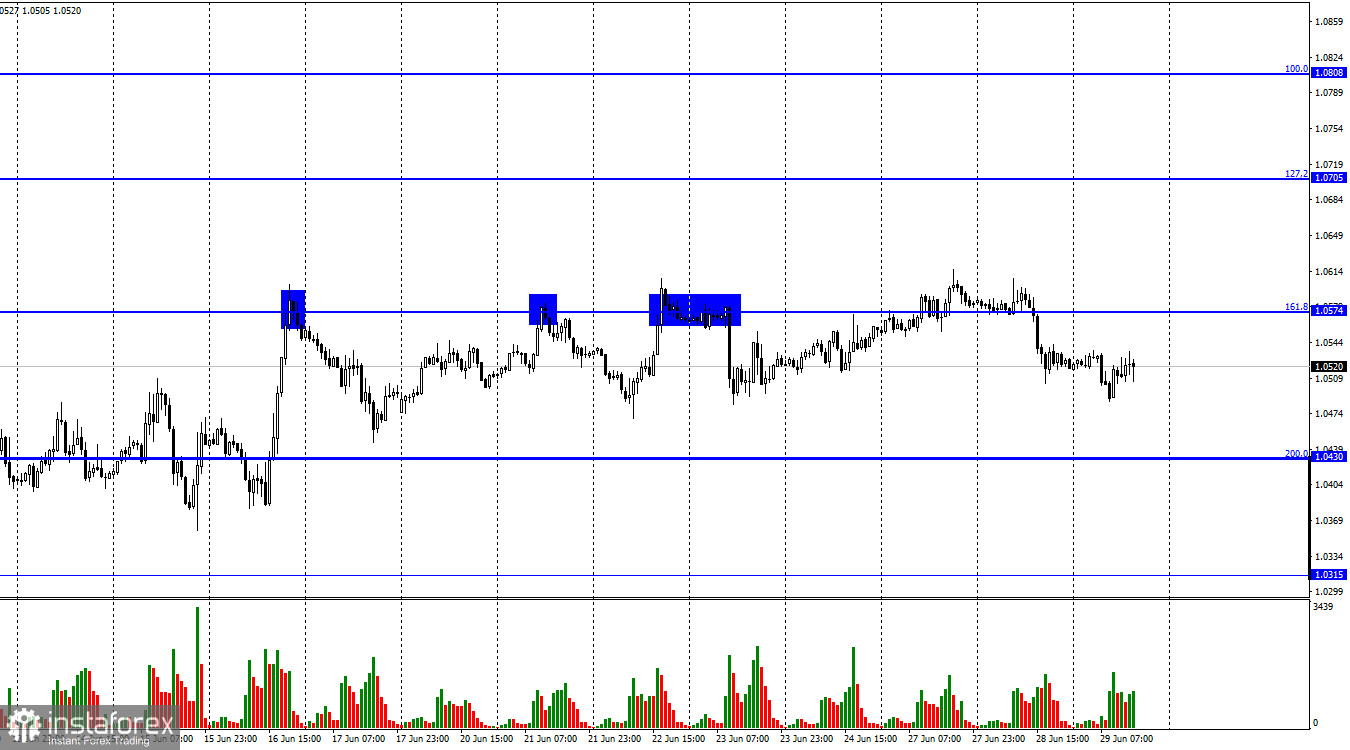

The EUR/USD pair continued Monday's movement on Tuesday. Yesterday, the pair's quotes performed a consolidation above the corrective level of 161.8%, but, as I expected, it turned out to be false. The fall in quotes began, which continued today, but somehow too weak and uncertain. Although I suppose that all the most interesting things are still ahead. Just an hour ago, the US released a report on GDP in the first quarter. Its final value. Let me remind you that initially it was expected that GDP would fall by 1.2%, then by 1.5%, and in the end, it turned out to fall by 1.6%. Of course, this is bad news for the US currency, but look at the chart – a loss of 20-30 points is not a movement that can be called a fall. By and large, the euro/dollar pair has not moved all day. This fits perfectly into the current graphical picture, as traders have been moving the pair mostly sideways for more than a week.

Neither bulls nor bears have advantages. In such conditions, it is difficult to expect any movement. And we see exactly such a "no" movement on the charts. I believe that the GDP report did not have a proper impact on the mood of traders. Therefore, it remains to wait for the speeches of Christine Lagarde and Jerome Powell. However, everything is completely ambiguous here. Christine Lagarde has already spoken twice this week. She assured that the rate would be raised in July, but traders were not impressed with this promise. After all, at the same time, the Fed intends to raise the interest rate by 0.75% for the second time in a row. Thus, the European currency could not continue to grow, and cannot find support from traders. I believe that sooner or later the bears will take up and we will see a new drop in the quotes of the European currency. Although maybe today everything will not be so sad for the euro. In the evening it will be possible to draw the first conclusions.

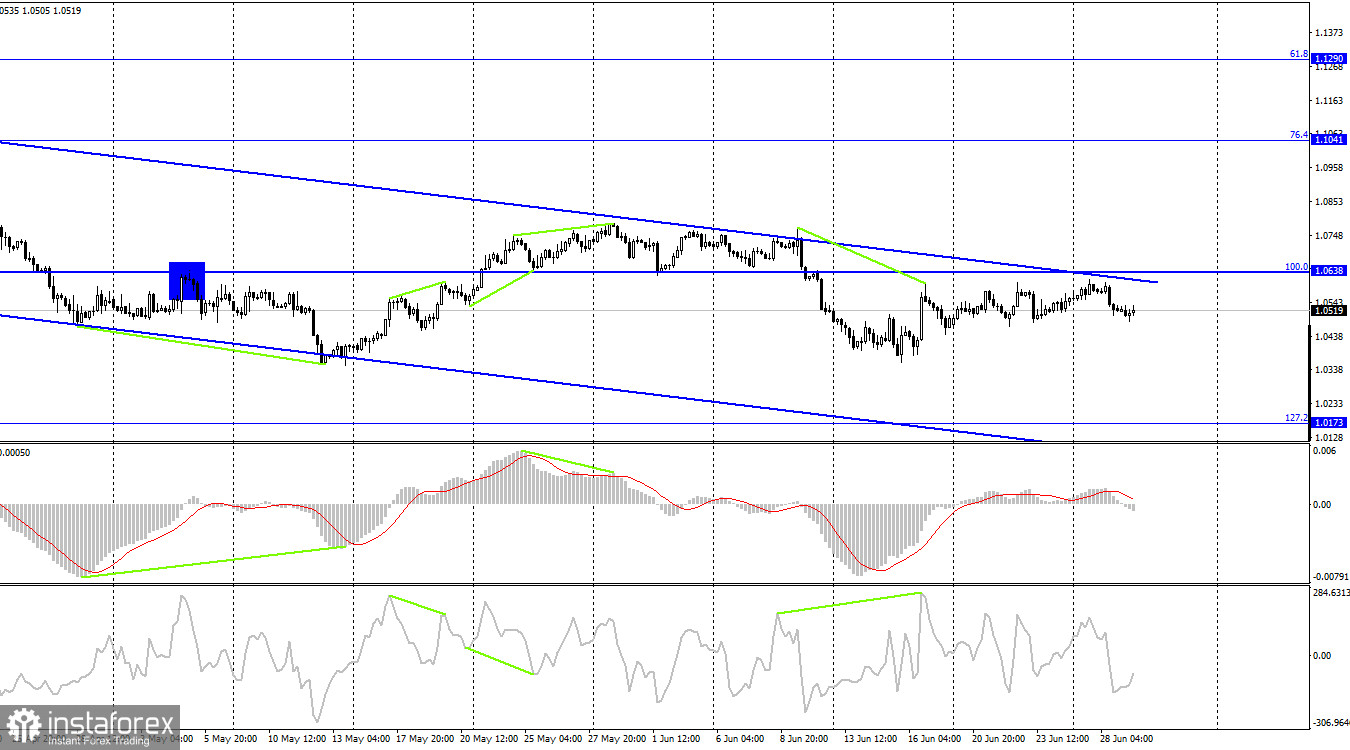

On the 4-hour chart, the pair continues the process of moving towards the upper line of the descending trend corridor, which still characterizes the mood of traders as "bearish". I deliberately call this movement "movement" and not "growth", since it looks very little like growth. Fixing the pair's exchange rate above the corridor will significantly increase the probability of further growth of the European currency in the direction of the Fibo level of 76.4% (1.1041).

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 11,432 long contracts and 1,845 short contracts. This means that the "bearish" mood of the major players has intensified. The total number of long contracts concentrated in the hands of speculators is now 195 thousand, and short contracts - 211 thousand. The difference between these figures is not very big, but it is no longer in favor of the bulls. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, which did not help the euro currency itself in any way. In the last few weeks, the chances of a rise in the euro currency have been gradually growing, but recent COT reports have shown that new sales of the EU currency may now follow. The euro currency has not received good news from the Fed or the ECB.

News calendar for the USA and the European Union:

US - GDP report (15:30 UTC).

EU - ECB President Lagarde will deliver a speech (16:00 UTC).

US – Fed Chairman Jerome Powell will deliver a speech (16:30 UTC).

On June 29, the calendars of economic events of the European Union and the United States contain several important entries, but I am not at all sure that traders will find them interesting. We have already witnessed the lack of reaction to the important US GDP report. I believe that the influence of the information background on the mood of traders may not be present at all today.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the level of 161.8% (1.0574) on the hourly chart with a target of 1.0430. Fixing under 1.0574 can also be used to open sales. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.