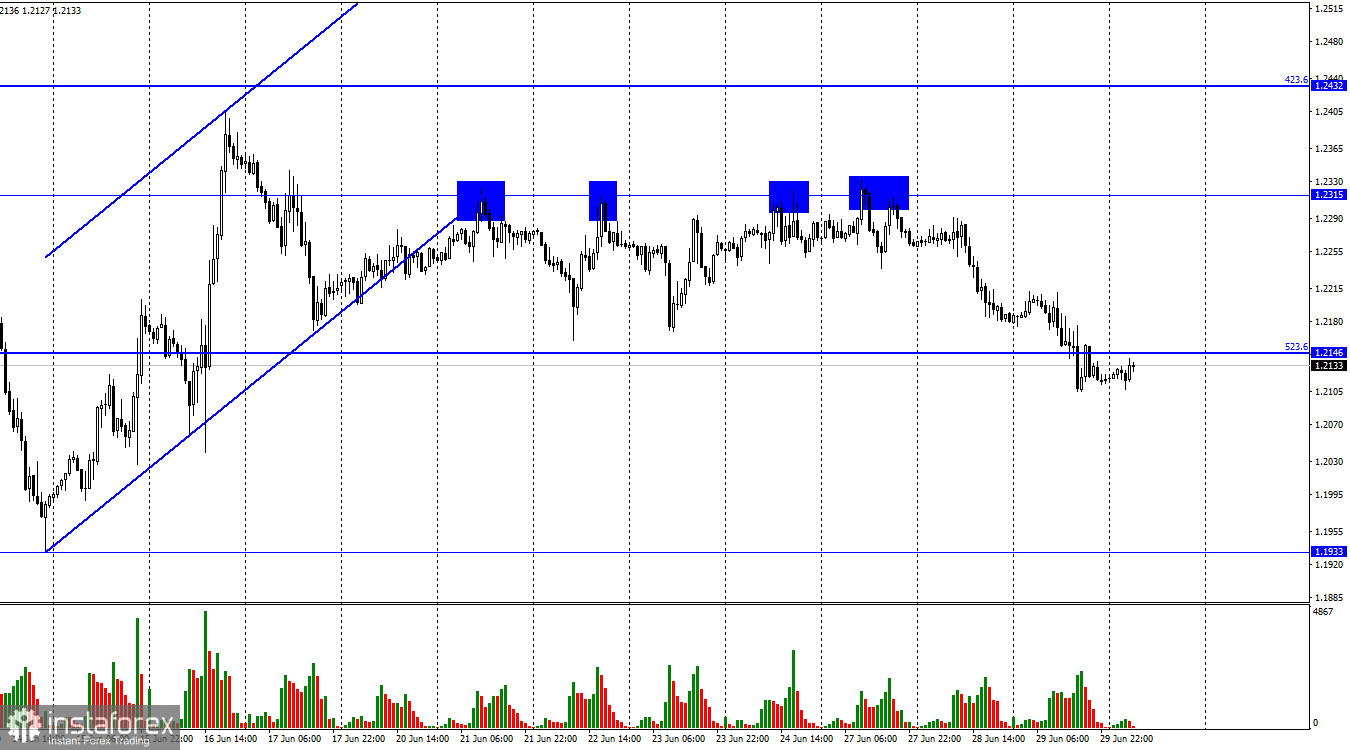

According to the hourly chart, the GBP/USD pair continued the process of falling on Wednesday and secured under the corrective level of 523.6% (1.2146). Thus, the fall of the British dollar can be continued towards the next level of 1.1933. Fixing the pair's rate above the level of 523.6% will work in favor of the British and some growth in the direction of 1.2315. However, bull traders failed to close above this level in four attempts, so I think there is more chance of seeing a new fall in the pound than its growth. Yesterday, the Governor of the Bank of England, Andrew Bailey, delivered a speech at the same economic forum where Christine Lagarde and Jerome Powell spoke. As is customary in modern times, he talked about inflation. In particular, he said that the regulator is ready to move to more drastic measures if it sees "high stability of high inflation." Bailey also said that a return to low inflation is the main goal of the Bank of England, but this has long been known to everyone.

The inflation policy of central banks now differs little from each other. The only difference is the rate at which they raise their interest rates. The Bank of England takes a moderate position on this issue. He raises rates every month, but only by 0.25%. Will this be enough to reduce inflation? I think not. Over the past six months, when the Bank of England raised the rate five times in a row, inflation did not begin to decline, although it had enough time to react. I can assume that if the next inflation report shows an increase, then the regulator will have no choice but to raise the rate at a higher rate. Let me remind you that at the last meeting, three members of the Bank of England voted for an increase of 0.5% at once. Bailey also said that the British economy is now in a state of shock due to strong growth in real incomes. An important indicator of GDP for the first quarter will be released in the UK this morning, which may affect the mood of traders.

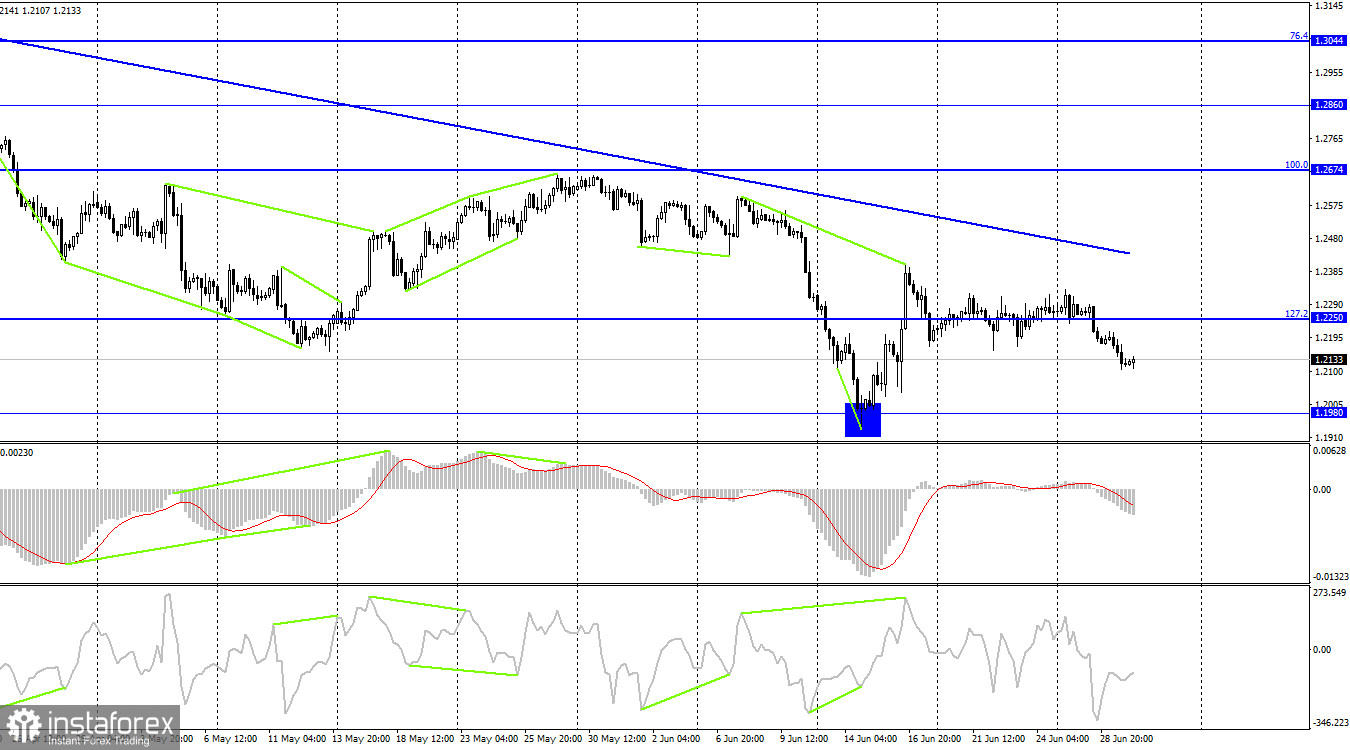

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the CCI indicator and is now continuing the process of falling towards the level of 1.1980, from where the British began its growth a couple of weeks ago. The descending trend line continues to characterize the mood of traders as "bearish". I don't expect strong growth of the British dollar until the quotes close above the trend line.

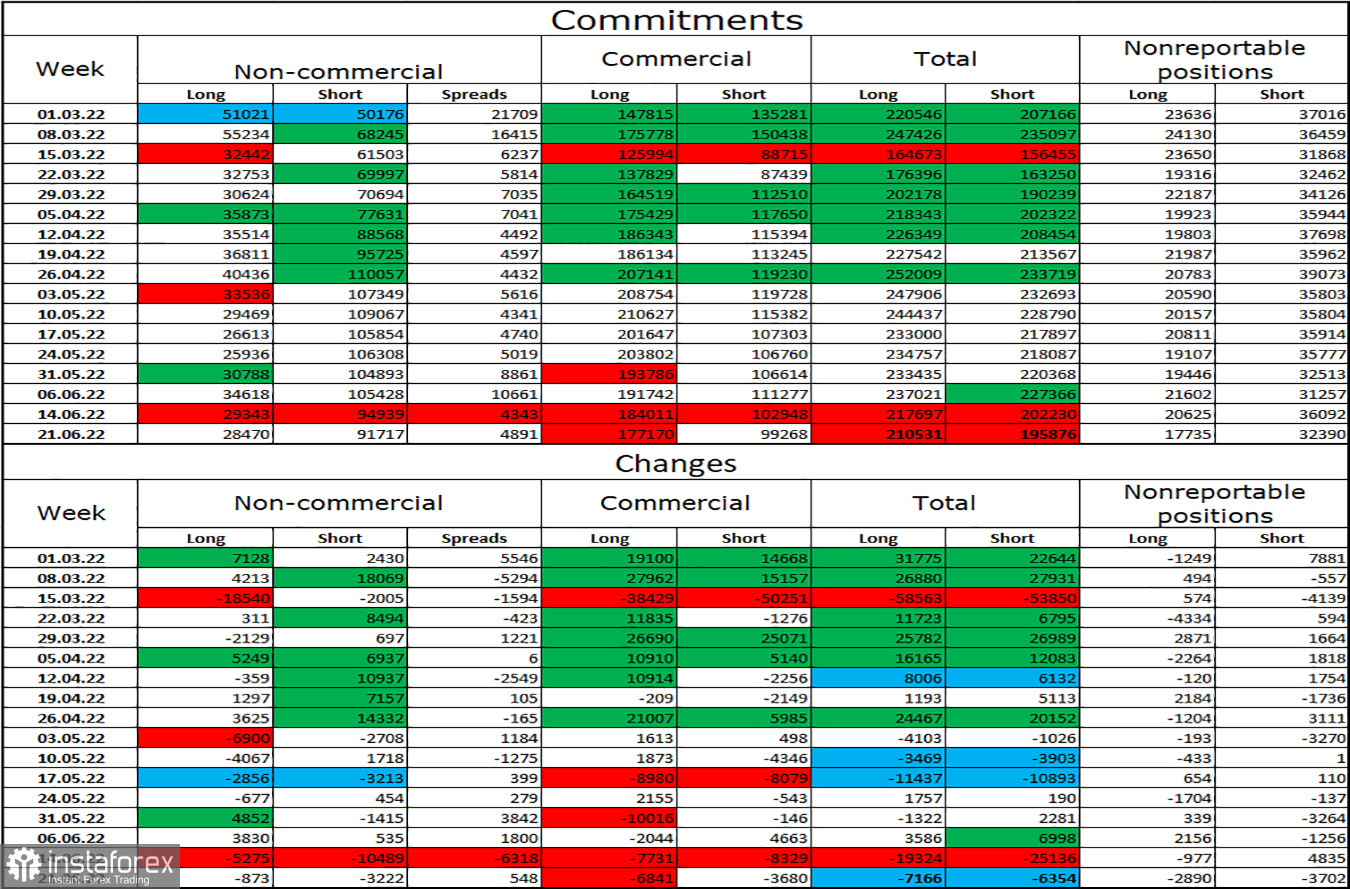

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators decreased by 873 units, and the number of short - by 3,222. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts still exceeded the number of short contracts by several times. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could resume its decline over the next few weeks. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. And the news background remains not in favor of the Briton. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the USA and the UK:

UK - GDP report for the first quarter (09:00 UTC).

US - number of initial applications for unemployment benefits (15:30 UTC).

On Thursday, the most interesting report will be released early in the morning. In Britain, the final value of GDP in the first quarter will be known. Previous reports showed an increase of 0.8%. For the Briton, it is important that today's figure was not lower. I estimate the influence of the information background on the mood of traders today as low.GBP/USD forecast and recommendations to traders:

I recommended selling the British when rebounding from the 1.2315 level on the hourly chart with a target of 1.2146. This goal has been achieved. New sales – when anchored at 1.2146 with a target of 1.1933. I recommend buying the British when fixing above the trend line on the 4-hour chart with a target of 1.2674.