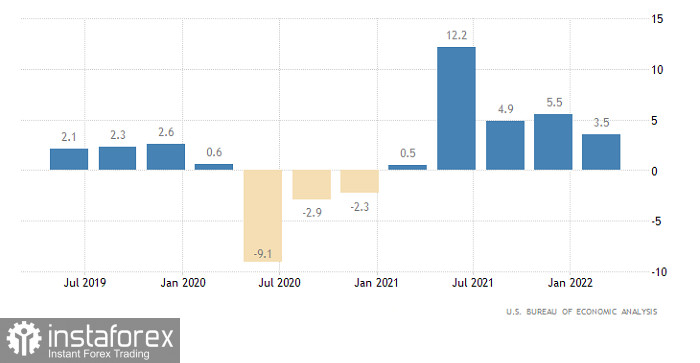

The euro and the pound have been trading in a sideways mode for almost two weeks, having failed to leave a relatively wide range. The euro was stuck between 1.05 and 1.06, while the pound was holding between 1.22 and 1.23. In theory, after reaching the lower boundary of the channel, the price should move back towards the upper one. However, both European currencies broke below the lower line of the range. Interestingly, this drop happened amid the publication of the US GDP data which came in line with preliminary estimates that were priced in by the market a long time ago. Moreover, the report showed that the US economy contracted to 3.5% from 5.5% which couldn't serve as a driver for the US dollar.

GDP (United States):

Of course, the market cannot stay flat forever, and both pairs will leave the sideways channel sooner or later. Yet, it needs any kind of a driver, be it the macroeconomic data or political factors. Yesterday, though, the information background was very quiet. Nothing that was said at the NATO summit could influence the market sentiment. In other words, the strengthening of the US dollar was based either on speculative activity or on a purely technical factor, or maybe both. The greenback continued to rise which makes sense given the ongoing bullish trend in the USD market. The fact is that the US dollar keeps moving higher regardless of the news or any other factors.

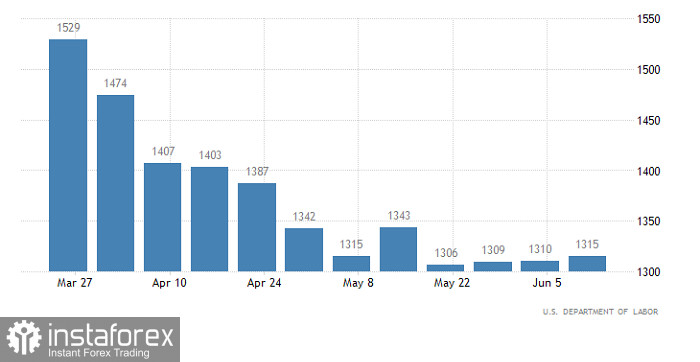

Today, the US currency will have a strong basis for growth as the US will publish the initial jobless claims data. The number of new claims is expected to decline by 11,000, while the continuing claims should drop by 5,000.

Continuing jobless claims (United States):

Although the changes are minor, they show that the number of new claims is decreasing. Besides, the unemployment rate in the US is running at record low levels. So, the labor market has nowhere to move. Against this backdrop, even such a small change in the number of claims looks quite impressive.

EUR/USD broke through the lower boundary of the sideways channel of 1.0500/1.0600 as the bearish pressure increased. This created downward momentum and pushed the euro lower by almost 90 pips. The level of 1.0430 serves as a pivot point for bears as this is where the price was moving flat. Consolidation of the price below this mark will extend the fall further to the 1.0380 target.

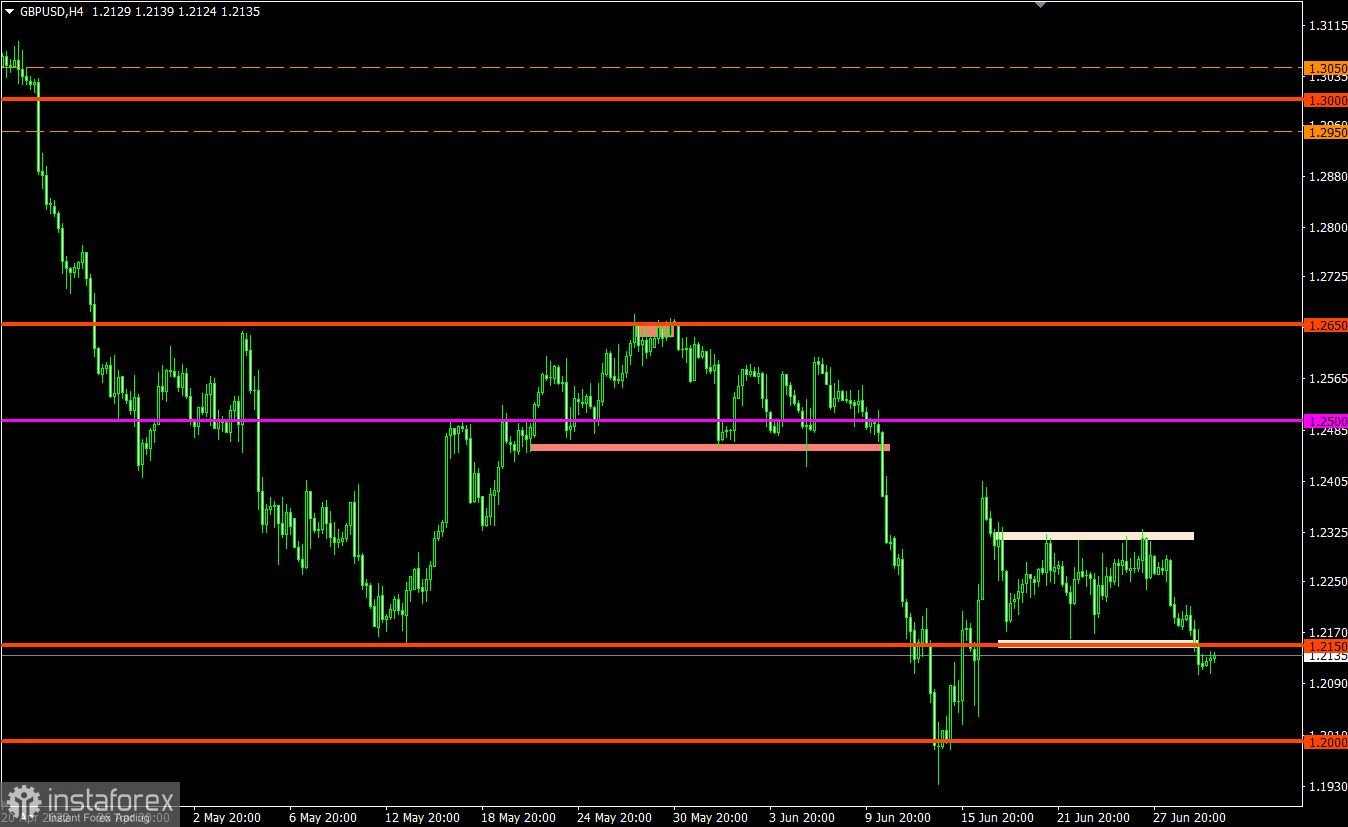

GBP/USD exited the flat channel of 1.2150/1.2320 by breaking through its lower boundary. This indicated the resumption of the initial downtrend after the recent correction. If this is true, then the pound sterling may gradually decline in the near term.