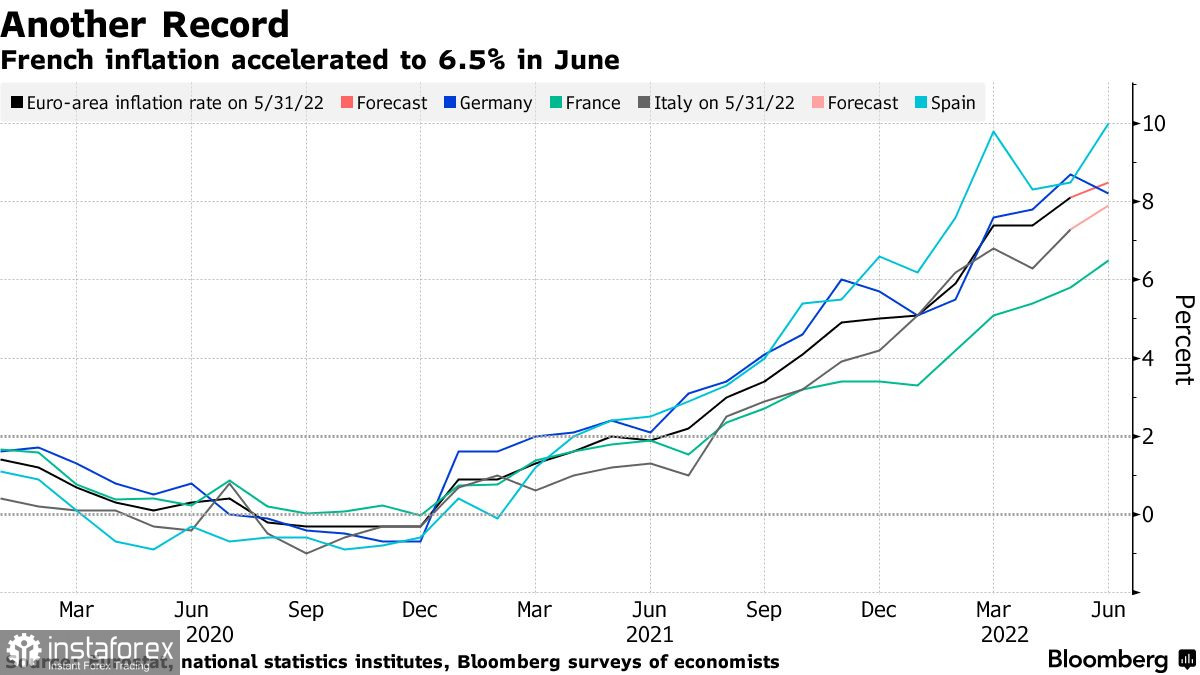

Germany seems to be the only country to cope with its problems independently. Soaring inflation is a major problem for some developed countries. Today's report shows that inflation in France has accelerated to its highest level since the introduction of the euro. This has increased pressure on President Emmanuel Macron and the European Central Bank, forcing them to do more to contain the economic shock.

According to Insee, a sharp increase in food and energy prices pushed consumer prices to 6.5% in June from 5.8% in May. The data fully matched economists' forecasts. The indicator of the eurozone's second-largest economy thus increases the pressure on the European Central Bank and its plans to raise interest rates, which have remained at their lows for more than a decade. By the way, it is not just France that is suffering. In Spain, inflation has already jumped to 10%, which is likely to add even more politicians to the ranks of those who believe that more aggressive measures to influence inflation are necessary. So far we are only talking about a 25 basis point rate hike, but that may change any minute.

Although the French government has already spent €25 billion to curb rising fuel prices, Macron continues to come under pressure - especially after losing his parliamentary majority in the elections. Next week, his government is expected to present a revised budget for 2022, which will include another €25 billion to extend existing economic support measures.

Today's data also showed that consumer spending rose by 0.7% in May compared to April. That's after five consecutive months of declines.

As it was mentioned above, only Germany has managed to cope with the problems and slow down inflation. However, European Central Bank President Christine Lagarde said in a recent interview that the focus would be on the value for the entire 19-member eurozone. The key report will be released tomorrow. Economists estimate that a record 8.5% price increase is expected.

As for Germany, data released on Wednesday showed that lower fuel taxes and rebates on public transportation helped slow consumer price growth to 8.2% in June from 8.7% in May. Analysts had forecast a rise of 8.8%. According to Bundesbank economists, the decline in inflation in Germany may continue next month when the renewable energy charge is lifted from electricity prices, but underlying price pressures are likely to remain elevated.

As for the euro, the currency's perspectives are uncertain. There is no talk about serious purchases and bulls' attempts to correct the situation. Only a return to 1.0480 may help somehow cope with the developing bearish scenario. If we see a consolidation at 1.0480, the pair may recover to 1.0530 and 1.0570. However, even that will not let bulls gain control of the market. The only thing bulls can count on is sideways trading. If the euro continues to decrease, bulls need to show some activity near 1.0435. Otherwise, the pressure on the trading instrument is likely to increase. Once dropping below 1.0435, the pair's recovery will be canceled. It means that it can nosedive to 1.0380. A breakthrough of this support level will surely increase the pressure on the trading instrument, opening the possibility to test 1.0320 and 1.0260.

Against this background, the British pound is losing ground against the US dollar and is already aiming for hitting new swing lows. It is possible to speak about an upward correction only after bulls push the price above 1.2150, which will lead to a breakthrough of 1.2210 and 1.2270, where buyers will face much more difficulties. If the pound shows a more considerable rally, it may retest 1.2330. If bears drag the price below 1.2100, it may touch 1.2030. Going beyond this range will lead to the next move down to the low of 1.1990, opening the way to 1.1940.