The pound updated its two-week price low against the dollar today, having been designated at the level of 1.2106. And although the bears of GBP/USD do not dare to storm the 20th figure yet, the mood for the pair remains bearish. Hawkish signals from Bank of England Governor Andrew Bailey, voiced yesterday at the economic forum in Sintra, did not help the pound: the British currency still plays the role of a follower when paired with the greenback. In addition, recent events related to Brexit are putting additional pressure on the pound. As a result, the GBP/USD bears were able to push through the support level of 1.2150, falling to the base of the 21st figure.

However, for the development of the downward trend, traders need to settle below the 1.2100 mark. In this case, two marks will appear on the horizon, the achievement of which will be only a matter of time. The first price milestone is the 1.2050 mark, which corresponds to the lower line of the Bollinger Bands indicator on the four-hour chart. This is an intermediate level of support, overcoming which will open the way to the main goal – 1.1990 (the lower line of the Bollinger Bands on the daily chart).

The overall negative fundamental background for the pound is due to Brexit. It is noteworthy that yesterday the pound actually ignored Bailey's words that the central bank is ready to continue to fight high inflation, despite the attendant risks of an economic slowdown. Moreover, he voiced a rather interesting phrase: "If high inflation demonstrates stability, we will act more decisively."

The British currency, as a rule, reacts sharply to such statements by Bailey, since there is still no consensus in the expert community on the further pace of rate hikes by the British central bank. But yesterday, the pound ignored the hawkish signals, allowing the GBP/USD bears to be designated at the level of 1.2105. This suggests that market participants are focused on other fundamental factors. Among which Brexit should be singled out.

Let me remind you that the controversial bill on Northern Ireland was recently approved by members of the House of Commons (i.e. the lower house of the UK Parliament). 295 deputies voted "for", 221 "against". The document itself is so controversial and contradictory (including from the point of view of international law) that it divided even the Conservative Party. Many prominent Tory representatives, including former Prime Minister Theresa May, criticized Boris Johnson's initiative. According to the opponents of the current prime minister, the bill violates the norms of international law, is politically destabilizing and "undermines the authority of the United Kingdom in the eyes of the whole world."

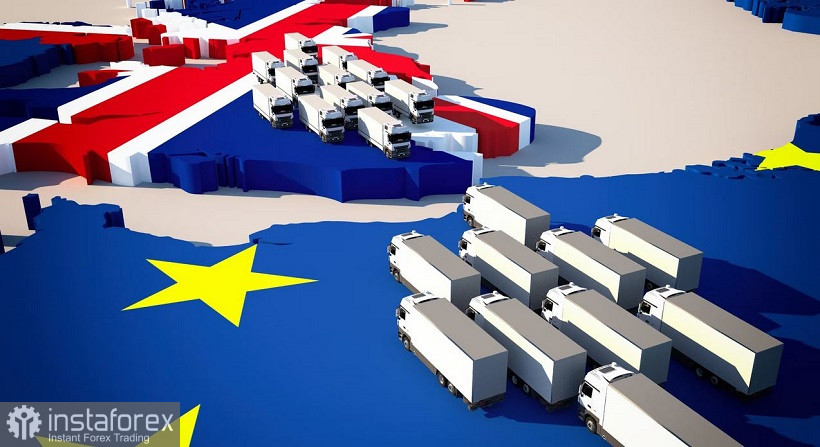

Such criticism is quite justified, since the bill proposed by Johnson allows changing the provisions of the Protocol on Northern Ireland, which in turn is an integral part of the agreement on Britain's withdrawal from the European Union. Therefore, the proposed unilateral adjustments by and large violate the agreements reached earlier. As you know, the Protocol regulates the inspection of goods that arrive in Northern Ireland from the rest of the UK to track goods heading to the European Union through the Republic of Ireland. The bureaucratic difficulties that have arisen have provoked a political crisis, which London is trying to resolve at the legislative level, essentially changing the established rules of the game.

Naturally, the scandalous bill was criticized in Brussels, threatening litigation. This story stretches back to last year, when the document was submitted to the lower house of Parliament and voted on at the first reading. After the scandal, the parties decided to sit down at the negotiating table, but these negotiations did not lead to anything.

Despite the barrage of criticism, Prime Minister Boris Johnson was able to "push through" a resonant bill in the House of Commons. Now the document has been sent to the House of Lords, whose members can approve it, or they can send their comments back to the lower house of the British Parliament for revision.

Meanwhile, the European Union has already invited London to return to negotiations. Brussels' chief Brexit negotiator, Maros Sefcovic, has proposed bringing UK standards in line with EU standards to eliminate the need for additional checks when moving products from Britain to Northern Ireland. Earlier, representatives of the British side rejected such scenarios, so it can be assumed that this time London will reject the proposed conditions. Apparently, the situation will continue to worsen, given the unwillingness of the parties to make any significant compromises. The Northern Ireland issue was one of the most difficult in the Brexit negotiations, and in fact it was taken out of the brackets, accepting the general agreement. Now London and Brussels have clashed again in a political battle, the outcome of which is difficult to predict.

According to Sefcovic, unsettled relations between the European Union and the UK are causing "tremendous economic damage." For example, exports of British goods to the EU have decreased by 25% since 2019, and services by 7%. Obviously, the development of a political conflict will only aggravate the situation. According to some experts, if the case goes to trial, the British may receive significant fines, and a trade war may begin between the UK and the EU, in which the EU will impose sanctions on British exports. Amid a slowdown in the UK economy, such prospects put pressure on the pound.

Thus, in my opinion, the GBP/USD pair in the medium term will try to break through the support level of 1.2100 in order to settle within the 20th figure. Therefore, it is advisable to consider the upward surges in the pair as a reason for opening short positions. The first and so far the main price target is 1.2050 (the lower line of the Bollinger Bands indicator on the H4 timeframe).