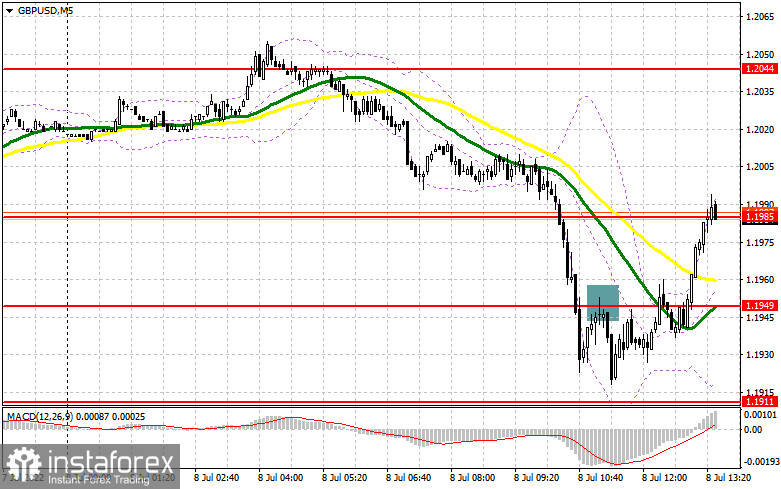

In my morning review, I pointed out the level of 1.1949 and recommended it as an entry point. Let's have a look at the 5-minute chart and see what is going on there. A breakout and a retest of this level created a nice entry point for short positions which come in line with the prevailing bear market. Given that this was the second descending wave of the pound, the pair declined by almost 30 pips and then the pressure eased. In the afternoon, the technical chart of the pair changed completely.

For long positions on GBP/USD:

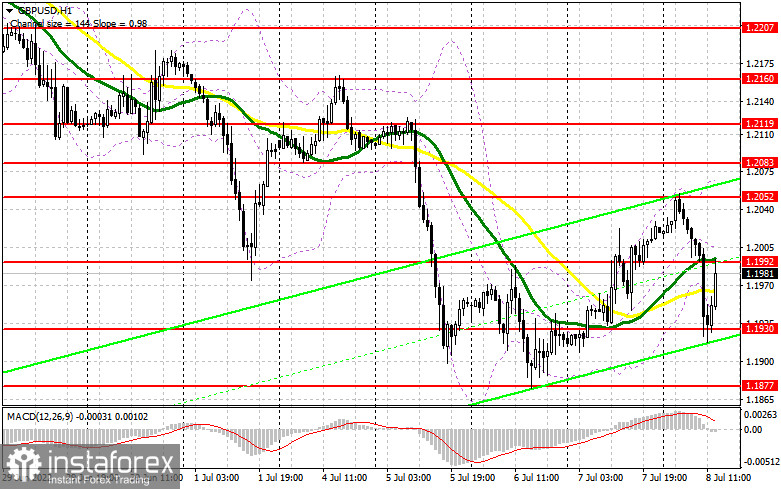

The pound has already won back most of its morning losses. So, the situation has stabilized. The picture is unlikely to change until the jobs data release in the US. The further direction of the pair will largely depend on the published results. Today, markets are waiting for the US Nonfarm Payrolls report and the unemployment rate. A decline in the number of new jobs may negatively affect the pound. The downside correction will be very logical in such a volatile market. However, only a false breakout of the nearest support at 1.1930 will generate a buy signal with the next target found at the level of 1.1992. This is the level at which the market balance may change. A pause in the bear rally will be possible only when the bulls take the level of 1.1992 under their control. A breakout and a retest of this level will create a signal to buy the pair with the target at 1.2052. This is where I recommend taking profit. If the price drops and there are no bulls at 1.1930, it is better not to rush with buying the pair. The recent statement by the Fed officials about interest rates strengthened the US dollar. Today, FOMC member John Williams will speak, and this is something to note as well. I advise you to buy the pair only when the price reaches the support level of 1.1877 that was formed during the European session. It is better to buy the pound only on a false breakout. It is possible to open long positions on GBP/USD right after a rebound from 1.1816, or even lower at 1.1742, keeping in mind a possible correction of 30-35 pips within the day.

For short positions on GBP/USD:

Bears made an attempt to return the pair to the weekly low but faced strong resistance there. At the moment, the sellers need to protect the resistance level of 1.1992 as the price has already tested it in the morning. However, only strong data from the US will confirm the continuation of the downtrend. The best moment to go short on the pair is to wait for a false breakout at 1.1992 after the jobs report is out in the US. This will initiate a new deciding cycle in the pound towards the level of 1.1930. A breakout and a retest of this level will generate a sell signal and will push the pair to the low of 1.1877 which serves as the last strong level for the buyers. The next downward target is found at 1.1816 where I recommend taking profit. In case the pair rises during the US session, and the bearish activity is low at 1.1992, sellers may lose control over the pair. In this case, I would recommend opening short positions only when the price reaches the mark of 1.2052. It is better to sell the pound only after a false breakout. It is possible to open short positions right after a rebound from the high of 1.2083, or even higher from 1.2119, keeping in mind a possible correction of 30-35 pips within the day.

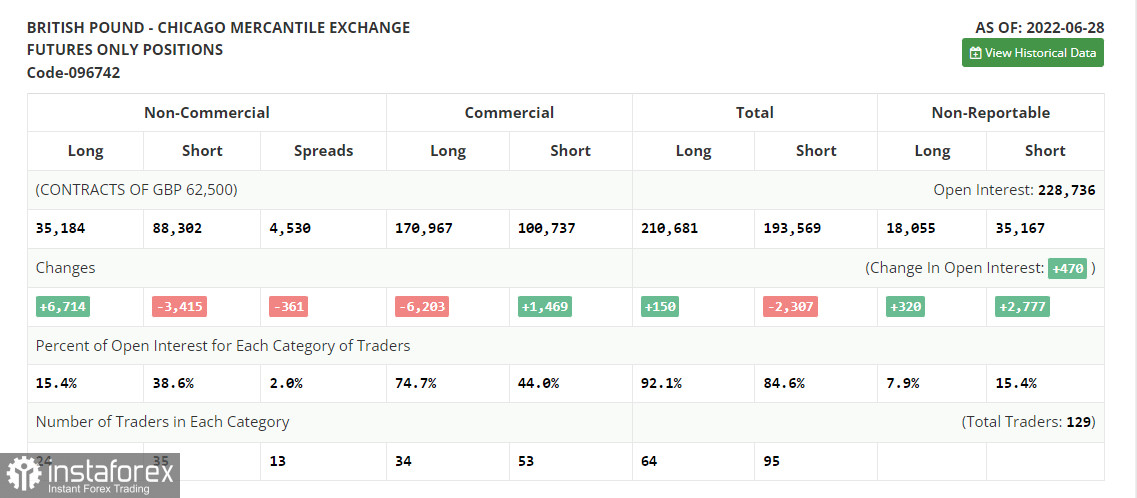

COT report

The Commitment of Traders report for June 28 showed that short positions have decreased while long positions have rapidly increased. This indicates the attempts of traders to buy the pound while it is still holding at its yearly lows due to the BoE's decision to raise the rates and stick to aggressive monetary policy. A sharp rise in consumer prices in May does not allow the UK regulator to change its stance on monetary tightening. The rising cost of living in the UK makes the country's economy more vulnerable, especially now when the regulator has to lift the rates to tackle inflation. Naturally, the British pound is losing its shine among investors. GBP is confidently moving towards the lows of 2020. The US Federal Reserve and its aggressive rate hikes provide much better support to the US dollar. According to the COT report, long positions of the non-commercial group of trades went up by 6,714 to 35,184, while the short ones fell by 3,415 to 88,302. Yet, this did not change the bearish sentiment of the market. It only resulted in the total non-commercial net position decreasing from -63,247 to -53,118. The weekly closing price declined to 1.2201 from 1.2295.

Indicator signals:

Moving Averages

Trading near the 30 and 50-day moving averages indicates market uncertainty ahead of important publications.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of an uptrend, the upper band of the indicator at 1.2060 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.