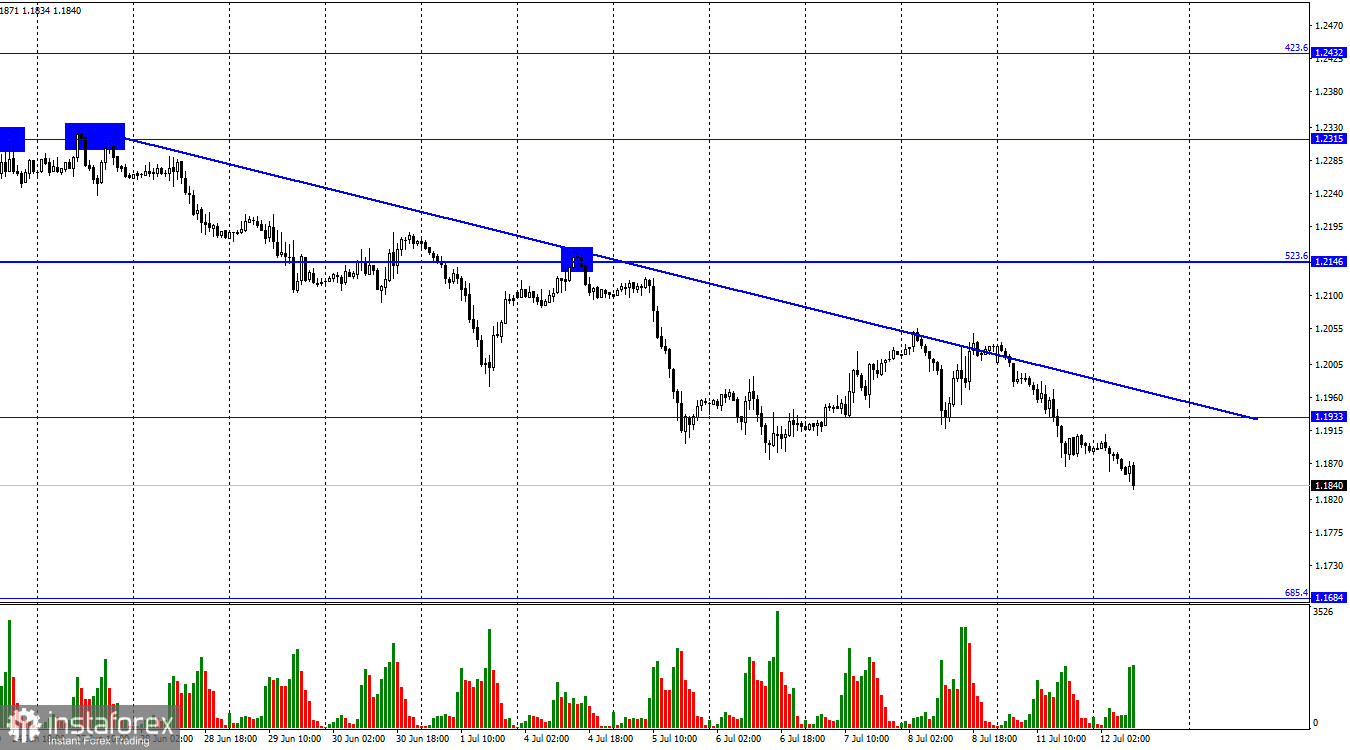

Hi, dear traders! According to the H1 chart, GBP/USD has slumped alongside EUR/USD. There were no important events in the UK on Monday and Tuesday, but the pair slid down nonetheless under bearish pressure. The euro has already fallen to the lowest level in more than 20 years, while the pound sterling is set to hit an all-time low against the US dollar. GBP/USD dived to 1.1411 in March 2020. Currently, the pair is trading at 1.1800 – only 400 pips separates it from a historical low, and it has already dropped by 200 pips over the past 2 days.

The Governor of the Bank of England, Andrew Bailey, is set to speak today. The UK regulator is currently following a hawkish policy – so far it has increased the interest rate at every past policy meeting. Earlier, the size of the BoE's rate hikes matched the Fed's moves, but it failed to influence the sentiment of traders. Next month, the British central bank could increase the interest rate by 0.50% due to rising inflation. However, traders are unlikely to go long on GBP after ignoring five previous rate hikes. Furthermore, any move by the Bank of England will likely be outmatched by the Federal Reserve, which is expected to hike interest rates by 0.75%. Europe continues to be rattled by the conflict in Ukraine, which remains a key factor for traders.

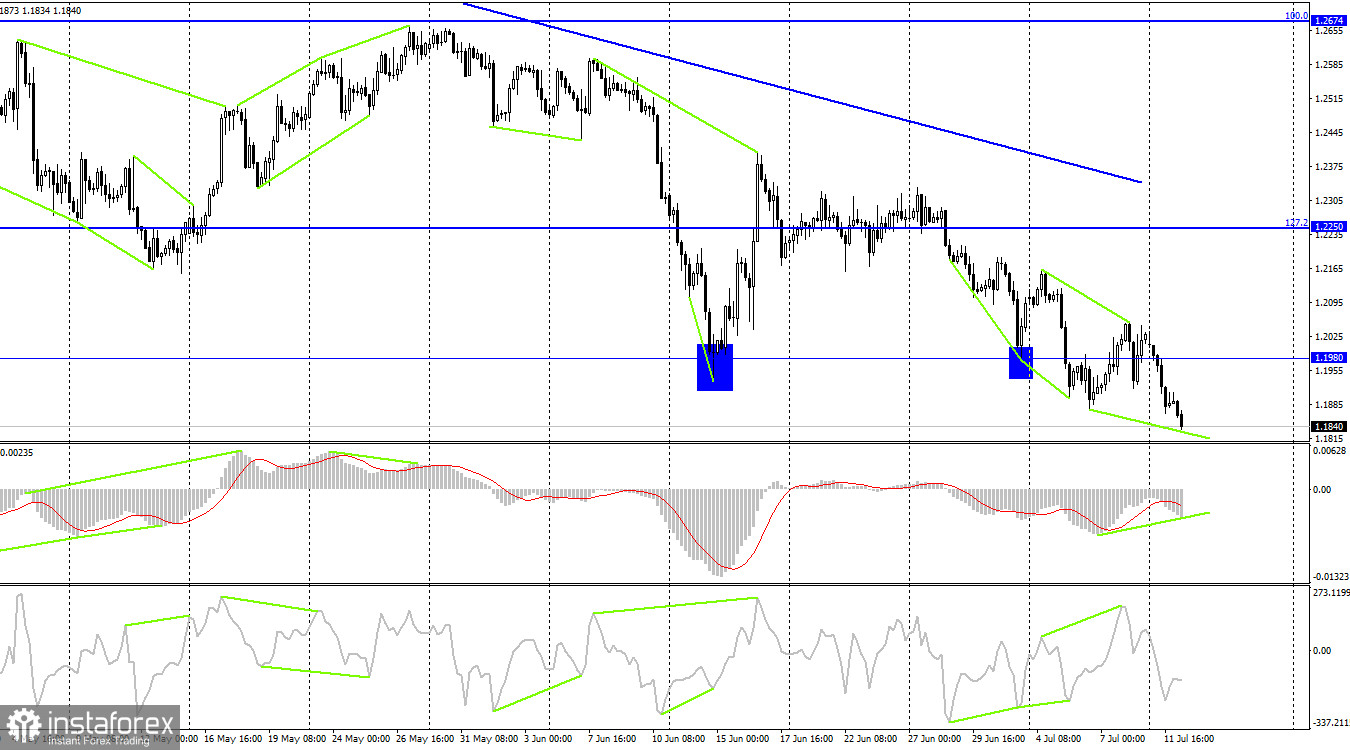

According to the H4 chart, the pair has reversed downwards and settled below 1.1980. GBP/USD could continue to slide towards the next retracement level of 161.8% (1.1709). A bullish MACD divergence is emerging, but if the pair continues to drop in the next couple of days, it will prevent the divergence from forming. GBP/USD is unlikely to advance significantly.

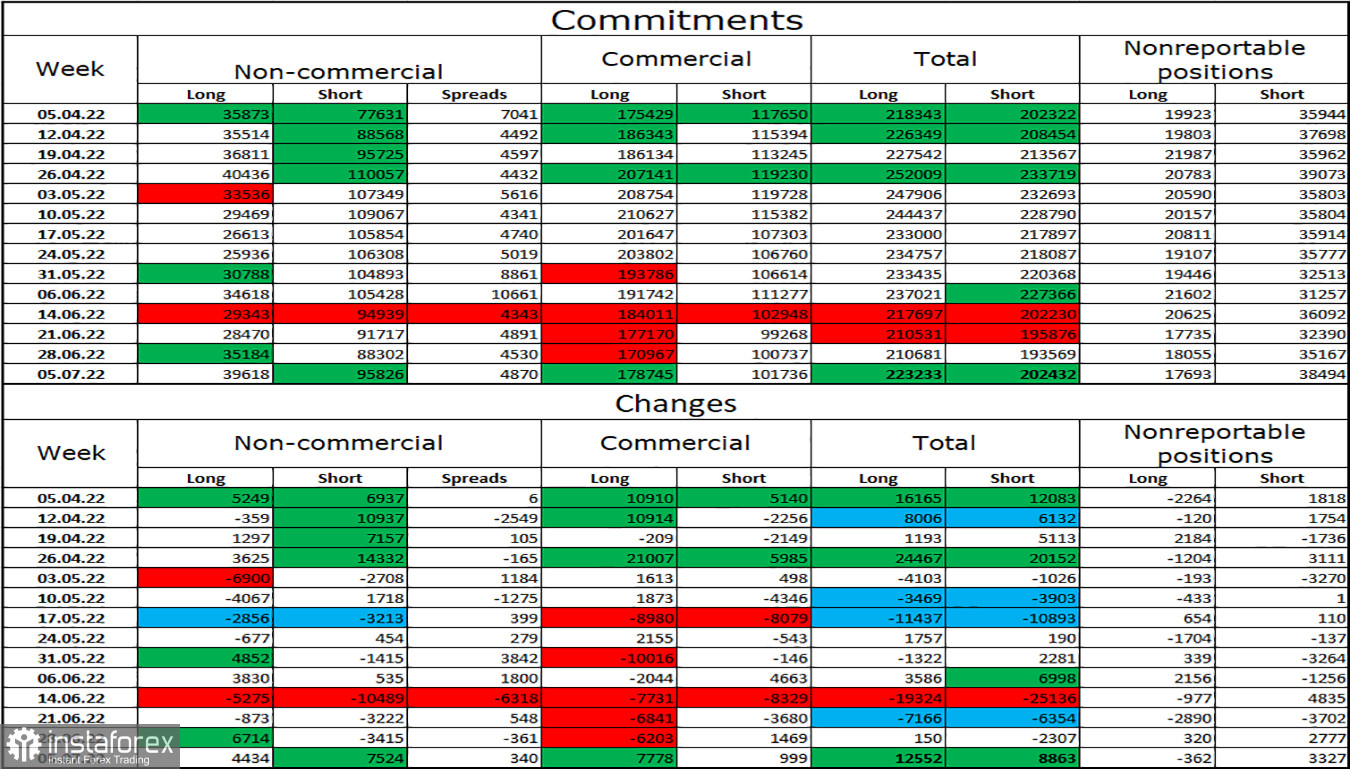

Commitments of Traders (COT) report:

Non-commercial traders became slightly more bearish last week. Traders opened 4,434 Long and 7,524 Short positions. Market players remain bearish on GBP/USD, and Long positions continue to outnumber Short ones greatly. Major players continue to decrease their exposure to GBP, and their sentiment has remained unchanged recently. GBP/USD could continue to fall in the next several weeks and months, despite the gap between Long and Short positions signalling a potential trend reversal. At this point, the news and data releases are more important for market players.

UK and US economic calendar:

UK – Speech by Andrew Bailey, Governor of the Bank of England (17-00 UTC).

Bailey's speech is unlikely to have a significant impact on traders.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if GBP/USD bounced off the trend line on the H1 chart, with 1,1933 and 1.1709 being targets. These positions can be kept open. Long positions can be opened if the pair settles above the trend line on the H4 chart, with 1.2674 being the target.