AUD/USD continues to push against support at 0.6700. For the past three days, the pair has been testing this key level. However, it rebounded toward 0.6750 several times. Despite strong payroll data, which was released during the Asian session on Thursday, traders remain largely bearish on AUD/USD. However, the data release can give support to the pair when USD bulls begin to lose ground.

AUD/USD has been pressured by a stronger USD, which is propelled upwards by increased expectations of hawkish Fed actions. The US CPI data for June, which was published yesterday, alleviated concerns by USD bulls that inflation is slowing down. Despite the PCE index declining for three consecutive months, inflation increased in June. The Federal Reserve could possibly increase interest rates by an additional 75 basis points in September, after an expected 75 bps hike in July. The University of Michigan's consumer sentiment index dropped sharply in June to 50 points, down from 58.4 in May.

Inflation in the US exceeded 9% for the first time since 1981, with prices of all groups of consumer goods and services, particularly energy, foodstuffs, airline fares, and cars climbing sharply. Price growth continues to hit new highs, despite statements by Jerome Powell about inflation possibly slowing down.

Yesterday's CPI data pushed AUD/USD towards 0.6700. However, the pair failed to break into the 0.6600 area. Despite strong Australian payroll data, AUD/USD continues to test 0.6700 amid continuing pressure from bears.

Nevertheless, the payroll data could help the pair could surge upwards when the US dollar halts its uptrend.

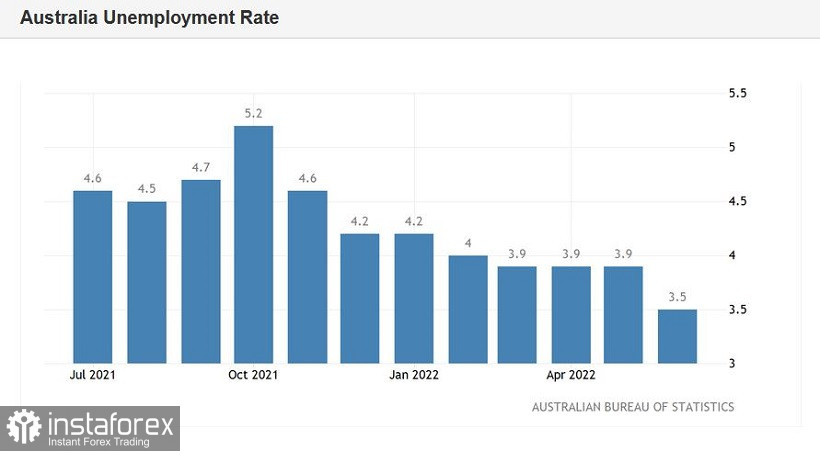

The latest Australian labor market data unexpectedly exceeded expectations. According to the latest data, unemployment in Australia dropped to 3.5% in June from 3.9% in May, reaching the lowest level since 1974.

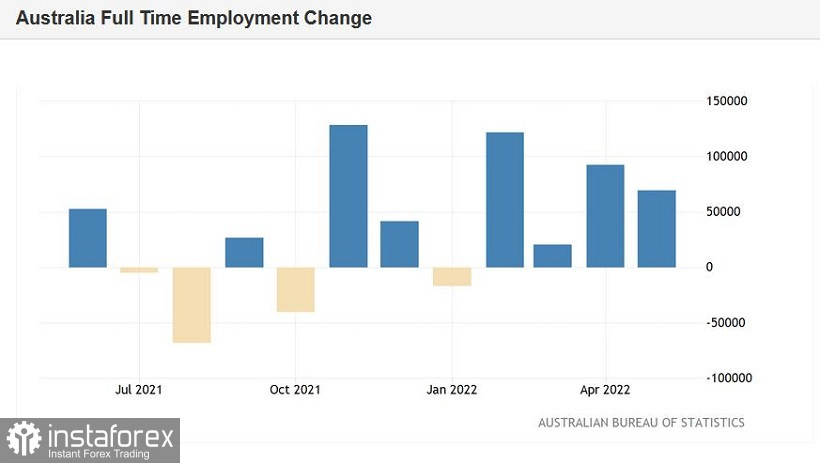

Net employment rose by 88,000 jobs, much higher than the 30,000 jobs that were expected by market players. The majority of new jobs, about 53,000, were full-time positions, while about 35,000 part-time positions were also added. Full-time positions tend to offer higher wages and greater social security compared to part-time jobs. Therefore, the current dynamics in the labor market are extremely positive.

The latest report not only reflected rising employment, but also a sharp drop in unemployment, as the participation rate reached 66.8%.

As a result, several major banks are now pricing in a 50% probability of a 75 bps interest rate increase by the Reserve Bank of Australia in August.

The pair's fundamentals remain mixed. Traders are largely bearish on AUD/USD despite the strong labor market data. Bearish traders need to settle below 0.6700 to extend downward momentum. To continue its upward correction, AUD/USD needs to surpass the Tenkan-sen line at 0.6800 on the daily chart. As the pair continues to move within this range, the best course of action will be to wait for AUD/USD to break through any of these levels and settle either above 0.6800 or below 0.6700.