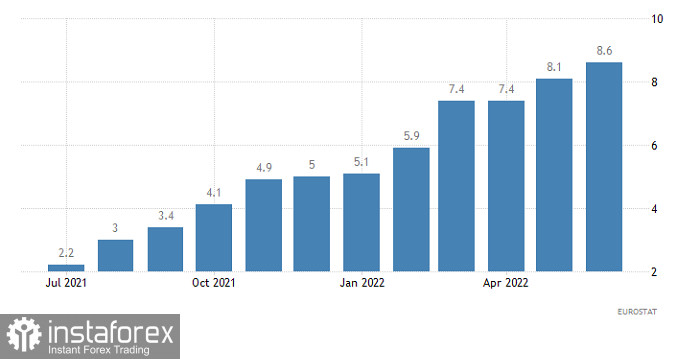

The long-awaited correction has finally come true. Although we are not talking about a full-fledged correction, but only about a local one. But even this is quite enough for the market to somewhat correct the resulting imbalances. So the market has prepared for the upcoming meeting of the board of the European Central Bank. But today the single European currency will have to decline somewhat, under pressure from inflation data. The growth rate of consumer prices may accelerate from 8.1% to 8.6%. Given that the issue of raising the refinancing rate has already been closed in principle, inflation data only plays the role of a parameter characterizing the general state of the economy. And judging by the fact that inflation continues to rise, nothing good is happening. Moreover, taking into account the experience of Great Britain, where the Bank of England began to raise the refinancing rate at the end of last year, that the increase in interest rates, all the more so modest, and the ECB plans to raise it from 0.00% to 0.25%, is not much more than will help. Another thing is that today we are talking about the final data, in general, already taken into account by the market at the time of the release of preliminary estimates. So the decline in the single currency will be limited.

Inflation (Europe):

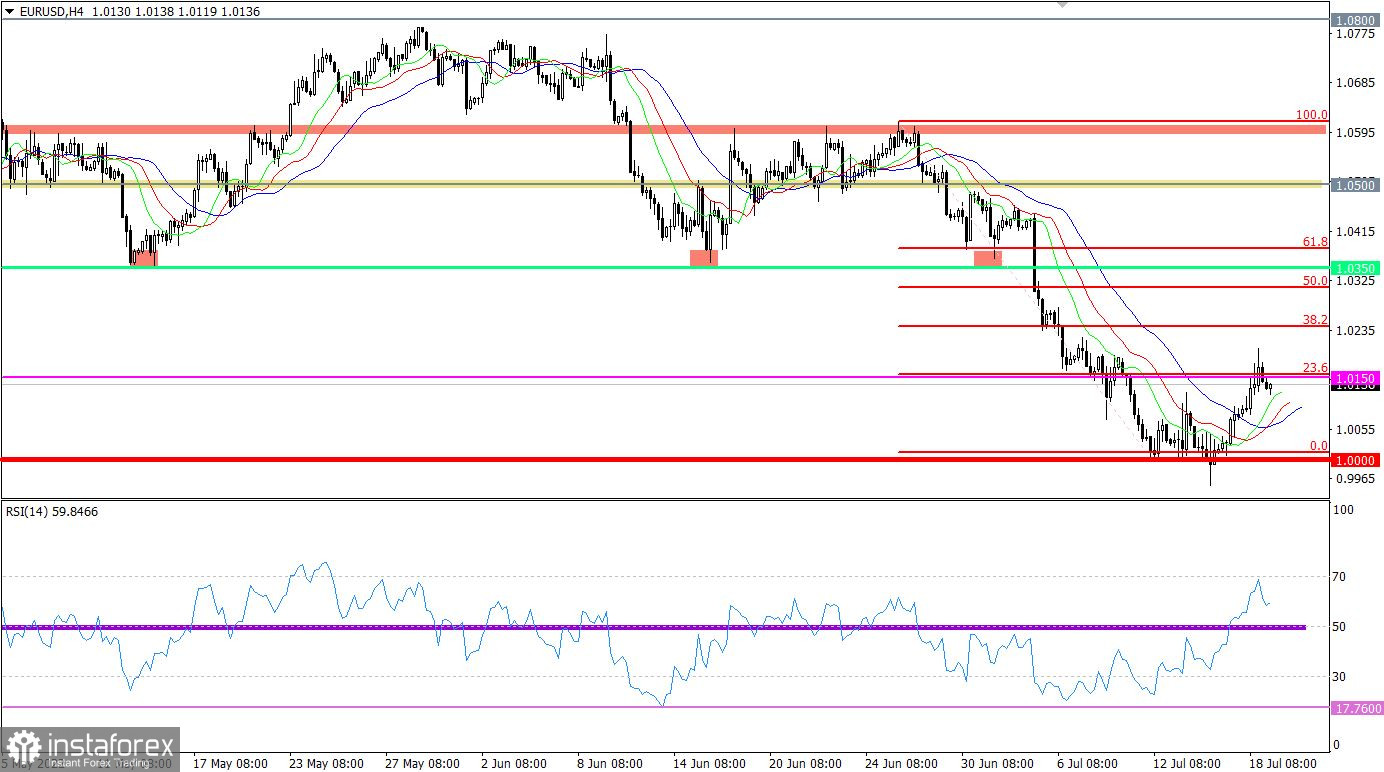

The euro strengthened by more than 200 points against the US dollar from the local low of the downward trend. Despite the scale of price changes, the euro is still oversold in the medium term, this is indicated by a number of historical values in which the quote is currently located.

The oversold status was removed in the short-term and intraday periods, this is indicated by the RSI H1 and H4 indicator, which is moving within the 70 line.

The moving MA lines on the Alligator H4 indicators locally changed direction from downward to upward, which corresponds to a rollback-correction in the market.

On the trading chart of the daily period, there is a subtle rebound of the price from the area of the parity level. Downward interest in the structure of the medium-term trend is still considered the main direction.

Expectations and prospects

The volume of long positions decreased at the moment when the price hit 1.0150, as indicated by the stagnation. For the subsequent growth of the euro's value, it is necessary to return above the level of 1.0150. Otherwise, there may be a gradual recovery of dollar positions, with the price returning to the parity level.

Complex indicator analysis has a buy signal in the short-term and intraday periods due to a rollback. Technical instruments in the medium term signal a sale due to price movement within the parity level.