When to go long on GBP/USD:

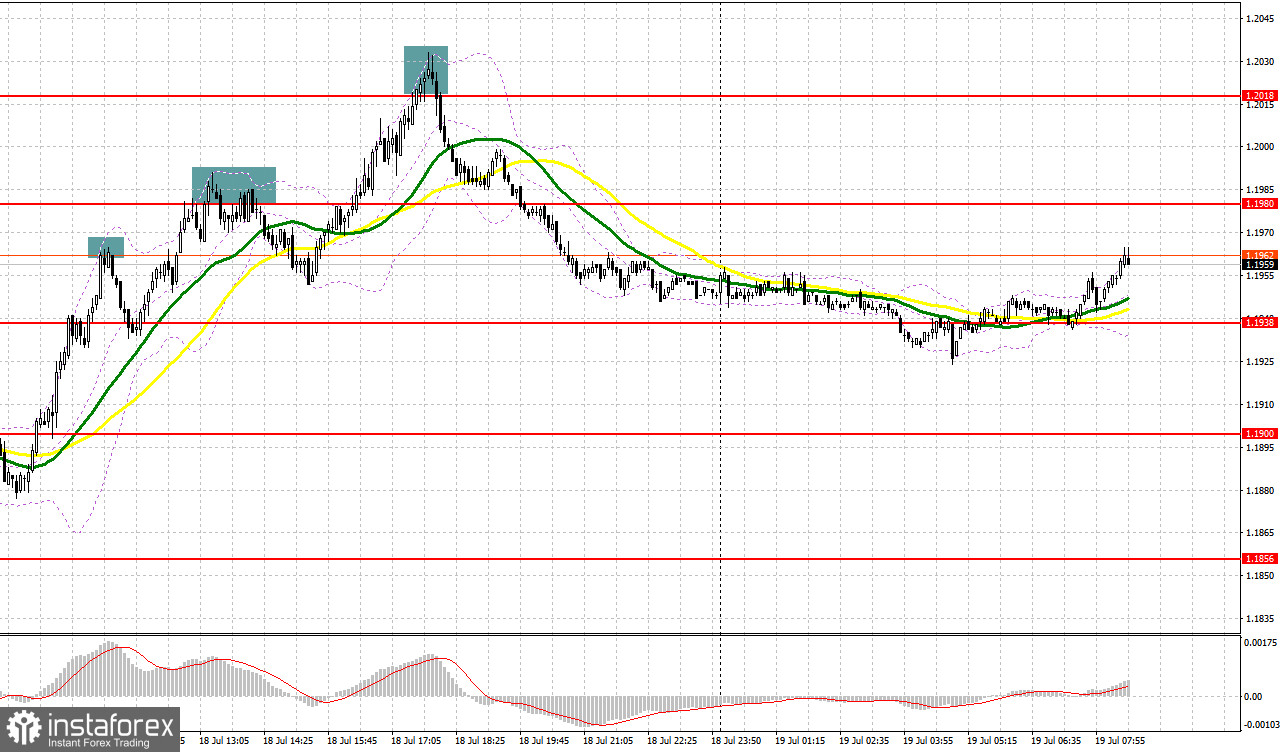

Several fairly profitable market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.1964 level in my morning forecast and advised making decisions from it. Quite a large rise in the pound and a breakthrough of 1.1915 occurred without a reverse test, so it was not possible to get an entry point for longs there. However, I managed to sell perfectly on a rebound at the price of 1.1964, which I paid special attention to in the morning. After that, the downward movement amounted to more than 30 points. The technical picture changed in the afternoon: growth and an unsuccessful attempt to consolidate above 1.1980, as a result - a signal to sell and move down by 30 points. The next wave of growth led to a test of the level of 1.2018, short positions from which made it possible to take about 40 more points from the market.

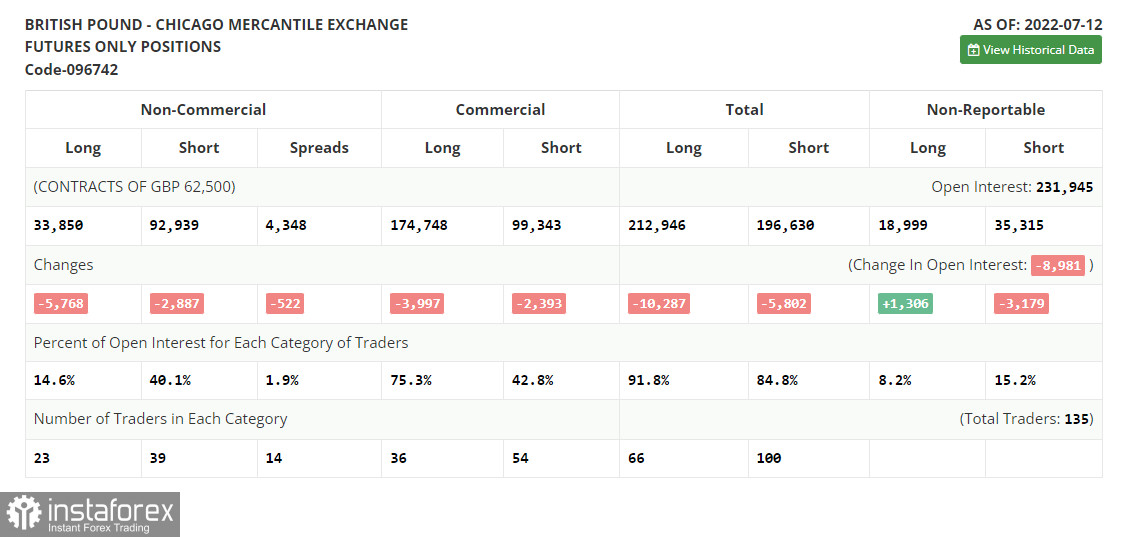

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for July 12 logged a decrease in both short and long positions, but the former turned out to be much more, which led to an increase in the negative delta. Another attempt to buy back the annual low again failed, although by the end of the week, traders began to take profits, taking advantage of strong US statistics, which led to a slight correction in the pound, which has been implied for quite some time. The crisis in the cost of living in the UK continues to flare up, and so far the government can do nothing about it. At the same time, the Federal Reserve's policy and its pace of raising interest rates in the US, and the next increase is expected at once by almost 1.0%, provides the dollar with much more support, pushing the pound lower and lower. The COT report indicated that long non-commercial positions decreased by 5,768 to 33,850, while short non-commercial positions decreased by 2,887 to 92,939, which led to an increase in the negative value of the non-commercial net position to -59,089 from level -56 208. The weekly closing price decreased and amounted to 1.1915 against 1.1965.

Today's data on the labor market and wage growth can do a disservice to the pound: on the one hand, the growth of the labor market and wages is a sign of a strong economy, but in these conditions, all this will lead to another inflationary pressure and a weakening of the pound against the US dollar. A sharp slowdown in indicators will avoid another inflationary surge, but also indicate the economy is sliding into a recession, which is now increasingly being talked about. So how to proceed? If the pair goes down, I advise you to count on a false breakout in the area of the nearest support at 1.1938, where the moving averages play on the bulls' side are. This will provide a new buy signal, which can continue the bullish correction of the pound. The primary target in this case will be the immediate resistance at 1.1988, formed on the basis of yesterday's results. Consolidation above this range and reverse downward test will provide a buy signal in hopes of a larger recovery to the area of 1.2029, where the bears acted especially aggressively yesterday, not making it possible to close the day higher. I think the bulls will take a break there. A more distant target will be the area of 1.2081, where I recommend taking profits.

In case the pound falls during the European session and the lack of activity at 1.1938, I advise you to postpone long positions until the next support at 1.1900. Forming a false breakout there, by analogy with what I analyzed above, will provide an entry point into long positions, counting on the formation of the lower border of a new ascending channel. You can buy GBP/USD immediately on a rebound from 1.1856, or even lower - around 1.1810, counting on correcting 30-35 points within the day.

When to go short on GBP/USD:

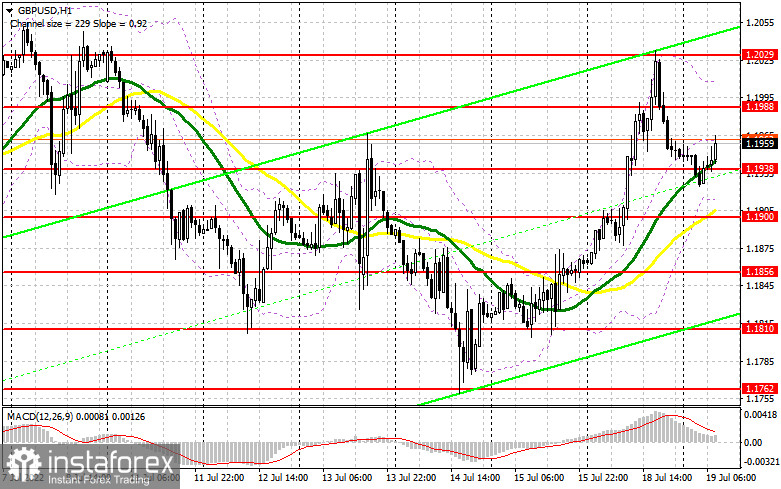

The bears made themselves known around 1.2029, which led to a fairly significant correction of the pound in the afternoon. Of course, the best option for opening short positions today would be forming a false breakout in the new resistance area of 1.1988. This will provide an entry point for the pair to fall and then break through support at 1.1938, on which a lot depends on these conditions. A breakthrough and reverse test from the bottom up of this range will bring the GBP/USD to a low of 1.1900, leaving a good opportunity for a return to 1.1856. A more distant target will be the area of 1.1810, the test of which will testify to the resumption of the medium-term bearish trend.

If the pair rises during the European session after the data and the absence of bears at 1.1988, then their grip could loosen. In this case, I advise you to postpone short positions until 1.2029. I advise you to sell the pound there only after a false breakout. You can open short positions immediately for a rebound from the high of 1.2081, or even higher - from 1.2119, based on the correction of the pair down by 30-35 points within the day.

I recommend to read:

Indicator signals:

Moving averages

Trading is conducted above 30 and 50 moving averages, which indicates an attempt to continue the growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.1920 will increase pressure on the pair. If the pair grows, the upper border of the indicator around 1.2010 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.