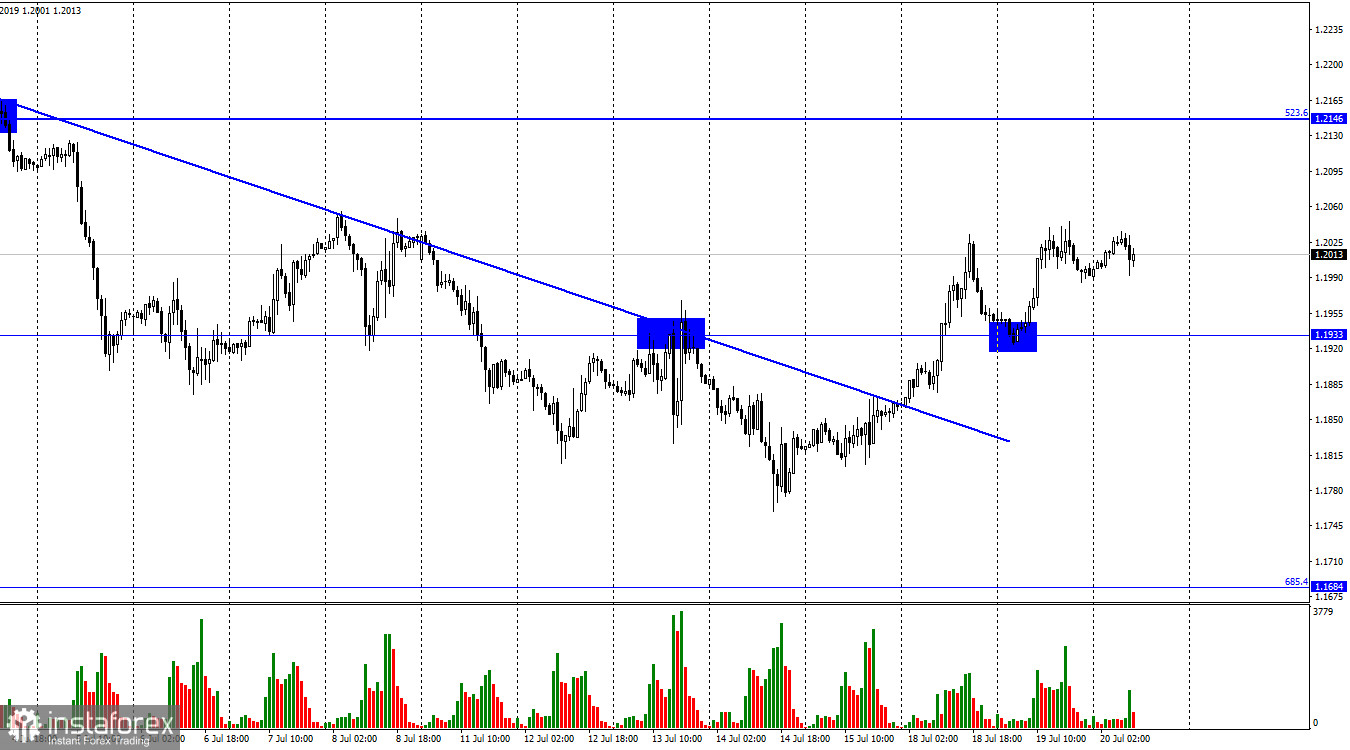

On Monday, the GBP/USD pair continued to rise on the H1 chart. Yet, the next day it was hesitating to go further up to the retracement level of 523.6% at 1.2146. In the morning, UK inflation data for June was published. According to it, consumer prices rose to 9.4% year-on-year. UK core inflation jumped by 5.8%, down from the previous month. So, this data couldn't show exactly whether inflation is still rising. Yet, we can clearly see that it is, especially if we take into account the main indicator. For your reference, core inflation excludes energy and food prices. So, what is the point of it? This data can be good to know but the Bank of England is unlikely to rely on it when making its monetary decisions.

This is what BoE's Governor Andrew Bailey was talking about yesterday. He said that at its next meeting, the Monetary Policy Committee will consider the possibility of a rate hike of 0.50%. I think that the UK regulator will do exactly what is planned. The Bank of England has already raised the rate five times by 0.25%, except for the first time when the rate was increased by 0.15%. However, it failed to slow down the inflation rate in any way. This means that it is time to resort to more serious measures. Against this backdrop, the British pound may continue to rise in the next two weeks ahead of the regulator's policy meeting. At the same time, the Fed will meet next week and may also increase the rate by more than expected. Most analysts are sure that the Fed will not exceed its plan of a 0.75% hike. Still, the US regulator may implement a 1.00% rate hike as inflation is accelerating in the US just like in the UK.

On the 4-hour chart, the pound/dollar pair continued its uptrend after the MACD indicator had formed a bullish divergence and the price settled above 1.1980. So, the price may continue to grow towards the descending trendline which still indicates a well-pronounced bearish trend. A bounce from this trendline will be in favor of the US dollar, indicating the resumption of the downtrend.

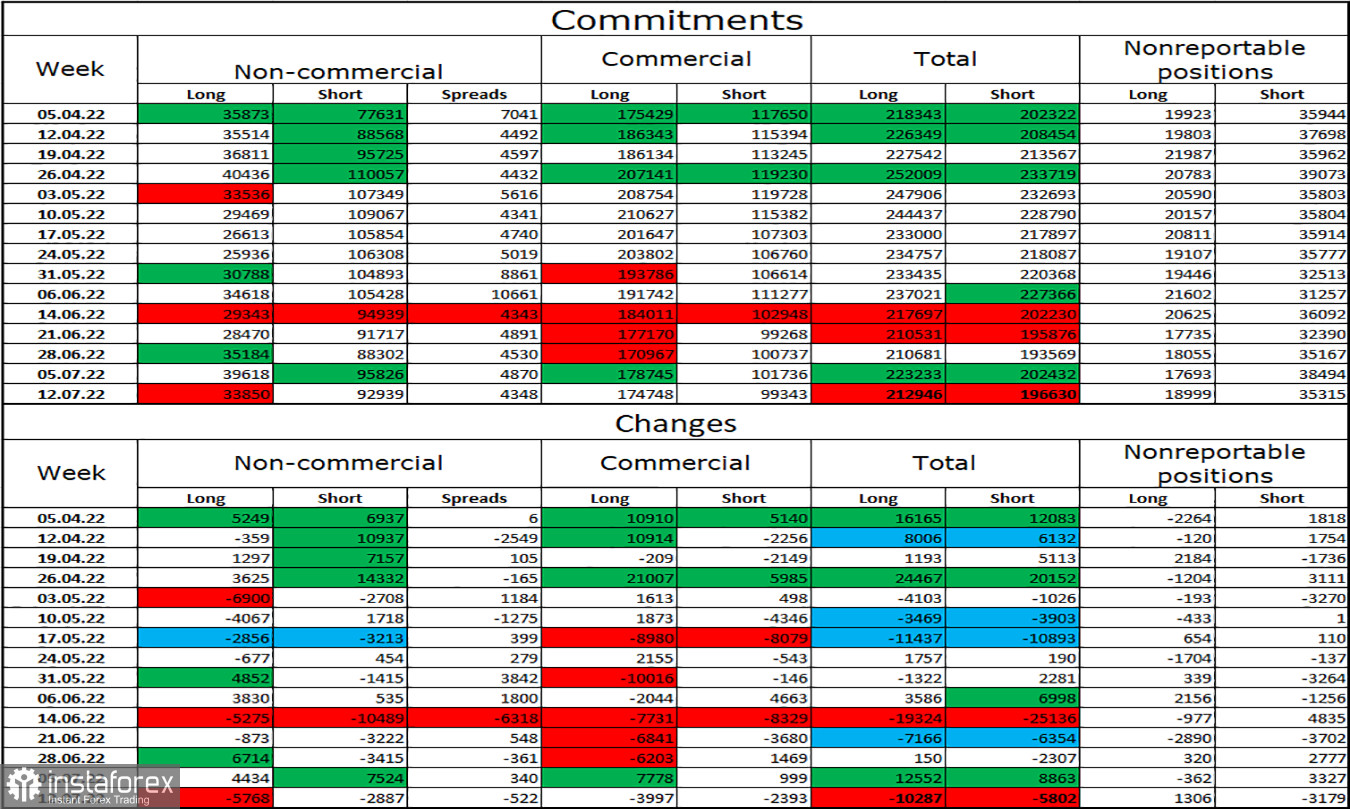

Commitments of Traders (COT) report:

The non-commercial category of traders became more bearish on the pair over the last week. Long positions decreased by 5,768, while short positions fell by 2,887. So, the overall sentiment of major market players remained bearish as the number of short contracts notably outweighs the number of long ones. Large market players prefer to sell the pound, and this sentiment has been the same for quite a long time now. Therefore, the pound may extend its decline in the next few weeks. It has a slight chance of growth which is unlikely to turn into a new trend and will most likely last for 2-3 days.

Economic calendar for US and EU:

UK – Consumer Price Index (06-00 UTC).

All reports in the UK are already out on Wednesday, while nothing important is seen in the US economic calendar in the afternoon. So, there will be no information background until the end of the day.

GBP/USD forecast and trading tips:

I recommend selling the pound after a rebound from the 1.2146 level on the 1-hour time frame or on a rebound from the trendline on the 4-hour chart. It is better to buy the pound when the price consolidated above 1.1980 on H4. The nearest target is the level of 1.2146. Current trades can be left open for now.