Ether is on the verge of surpassing $1,600, and a rebound to $1,830 is a distinct possibility. By the end of the week, they anticipate bitcoin will be worth $ 28,000. Who could have envisioned such numbers a month ago, when everyone was praying that ether would not fall below $ 800 and bitcoin would remain above $ 19,000? It appears that the bottom of the market has been reached, but much will depend on how the correction will unfold following the observed bull market and whether traders and investors will begin to increase their long holdings.

Before we discuss the technical aspects of bitcoin, I want to say a few things about the recent statements made by the governor of Nigeria's central bank. Godwin Emefiele is a critic of the cryptocurrency market and bitcoin. Recently, he startled everyone when he remarked that the expansion of fintech companies and cryptocurrencies compelled banks and financial institutions to modify their operational procedures. According to Emefiele, the monetary policy council of the central bank must reconsider how it governs the financial system and how it influences it.

Countries with weak economies and financial systems have recently been the most vulnerable to the rise of the crypto business. Inhabitants increasingly hide their savings and income by using cryptocurrency unaffected by hyperinflation and devaluation. In light of this, the authorities are making every effort to obstruct the entry of this industry and its growth. However, the central bank governor of Nigeria's comments were truly shocking.

As said previously, Godwin Emefiele emphasized that the MPC should chart a new course that will alter the course of Nigeria's monetary policy. Moreover, he highlighted that new technologies and innovations play a significant part in Nigeria's development. Therefore, future MPC solutions should be geared toward maximizing the contributions of these technologies. In addition, a former bitcoin detractor has asserted that fintech and cryptocurrencies have altered the functioning of the financial system. However, he did not specify in which direction, adding that everything needed rethinking and examination.

The management explained: "The evolution of financial technology, cryptocurrencies, digital payments, artificial intelligence, and machine learning has altered the global and national financial and banking industries." Although new technologies and innovations are frequently associated with risks and ambiguity, Emefile believes they also have many benefits, such as greater access to financial services, poverty reduction, and job creation. "To ensure the relevance of monetary policy and the function of monetary authorities in the new digital environment, MPC members should submit recommendations addressing the connection between digitalization and the aims, objectives, and instruments of monetary policy," Emefiele stated.

Regarding the technical outlook for bitcoin, the balance of power has shifted slightly. In the case of a collapse in the trading instrument, speculators will defend the nearby support at $ 22,875, which plays an important role. Its collapse and consolidation below this range will cause the trading instrument to retrace to the lows: $ 21,875, $ 21,140, and $ 20,500, which are close to $ 19,880 and $ 19,320. If a subsequent reversal to the upside, bears will show in the vicinity of $ 24,280, representing the nearest area of resistance. Fixing higher will drive the trading instrument to a new limit of $ 25,750, allowing investors to feel even more at ease. The $ 26,780 region will serve as a more distant objective.

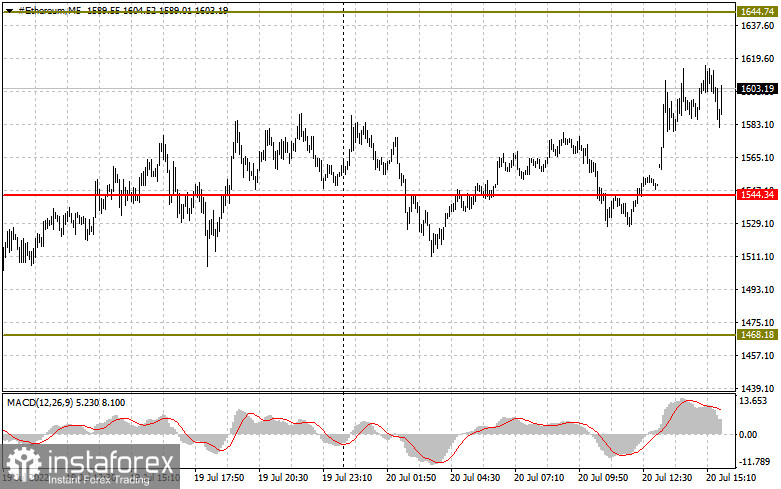

Ether is in the spotlight, as buyers are currently focusing on the $ 1,640 resistance. Only once growth surpasses this level can we anticipate a faster surge with an update to the maximum of $ 1,740 and the potential for a medium-term upward trend. A return to $ 1,740 and consolidation on that level will encourage additional purchases to update the $ 1,830 resistance, for which a fierce battle will re-emerge. The bulls will attempt to defend $1,470 if ETH is under threat. At the breakdown of this range, it is most prudent to anticipate purchases in the region: $ 1,385 to $ 1,320.