Gold prices appear to have created a short-term bottom, with many analysts expecting a rebound to at least $1,750 as market sentiment has improved significantly.

At the same time, many are questioning the current strength of the US dollar as it fell for the first time in four weeks.

The US dollar is losing strength as the Federal Reserve's aggressive price action is now fully priced in. The looming global recession and a potential sovereign debt crisis in Europe could lead to a rally in the US dollar and gold in tandem.

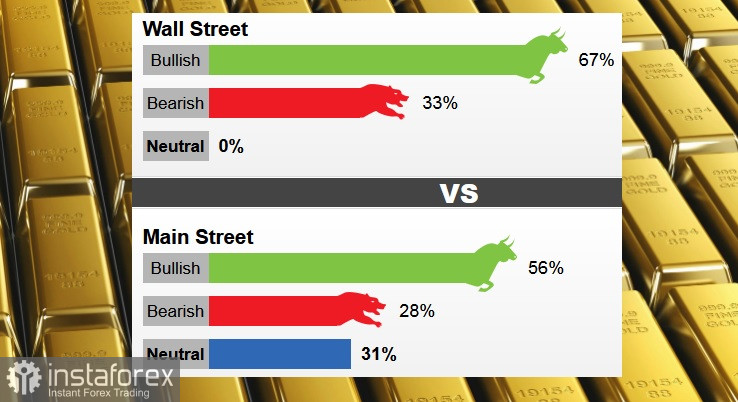

Last week, 18 Wall Street analysts took part in the gold survey. Among the participants, 12 analysts, or 67%, are optimistic. At the same time, six analysts, or 33%, were bearish. There were no neutral votes.

In Main Street online polls, only 187 votes were cast. Of these, 105 respondents, or 56%, expected gold prices to rise this week. Another 52 voters, or 28%, announced a reduction, while 16 voters, or 31%, were neutral.

The resumption of bullish sentiment is due to the fact that gold prices seem to break a five-week losing streak.

For many analysts, the biggest factor influencing the price of gold remains the US dollar, driven by the aggressive actions of the Federal Reserve in monetary policy. However, some analysts note that a slowdown in the US economy may prompt the Federal Reserve to ease its tightening policy.

Adrian Day, president of Adrian Day Asset Management, said that despite the extraordinary rate hikes by the US central bank, inflation will remain persistently high, leaving real yields under pressure.

Senior Technical Analyst Jim Wyckoff said despite the rebound in gold, the technical picture remains bearish.