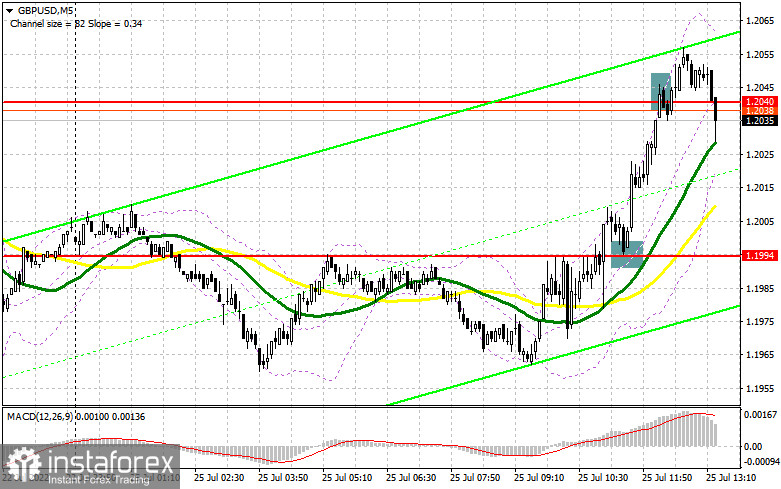

In the morning, the focus was on 1.1994, with entry points considered from this level. Let's turn to the 5-minute chart to get a picture of what happened in the market. A sell signal was formed during the European session after a failed breakout above the level. Yet, it was a fall of just about 20 pips. Bulls managed to break through the barrier after the third try. A top-bottom test of the mark created a buy signal, and the price soared to 1.2040, bringing about 40 pips of profit. A sell signal was made after a false breakout at 1.2040. The pair is now going down, but the signals itself is unlikely to profitable enough.

When to go long on GBP/USD:

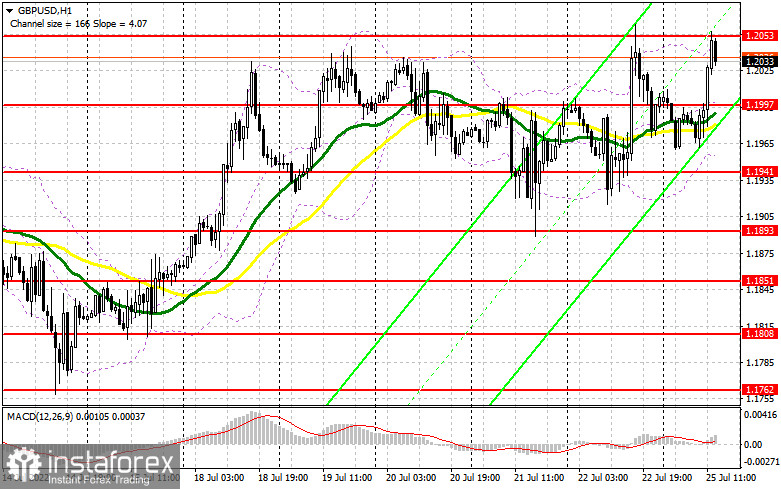

During the North American session, some macro data is scheduled for release in the United States. However, it will hardly affect the forex market. So, bulls will try to retest the mark of 1.2053 and go above it. In the case of a correction, a false breakout at 1.1997, in line with bullish MAs, may occur. The target stands at 1.2053 resistance. A stronger bullish impulse is likely to emerge after a breakout and a top-bottom retest of this level. A buy signal will be made with the target at 1.2119, where profit taking should be considered. A more distant target is seen at 1.2160. Should GBP/USD fall and bullish activity decrease at 1.1997, pressure on GBP will rise. In such a case, it would be wiser to look for long entry points after a false breakout at 1.1941. Long positions could also be opened after a rebound from 1.1893 or 1.1851, allowing a 30-35 pips intraday correction.

When to go short on GBP/USD:

So far, bears have been strong enough to withstand bullish attacks. Short positions could be opened after a false breakout at 1.2053 resistance. If the price goes beyond the range, bulls will be able to open new long positions, and the uptrend will extend. Strong macro data in the US will exert pressure on the pair. The target will stand at 1.1997 support. Should GBP/USD consolidate below 1.1997 and bearish activity decrease at 1.1997, an additional sell entry point with the target at 1.1941 will be made after a bottom-top retest. This is where partial profit taking should be considered. A more distant target is seen at 1.1893. If GBP/USD shows growth and there is no bearish activity at 1.2053, short positions could be opened after a false breakout at the 1.2084 high, with the possibility of a pullback. Should there be no bearish activity at this level, a rebound may occur. In such a case, short positions could be considered at 1.2119, allowing a 30-35 pips downward correction intraday.

Commitments of Traders:

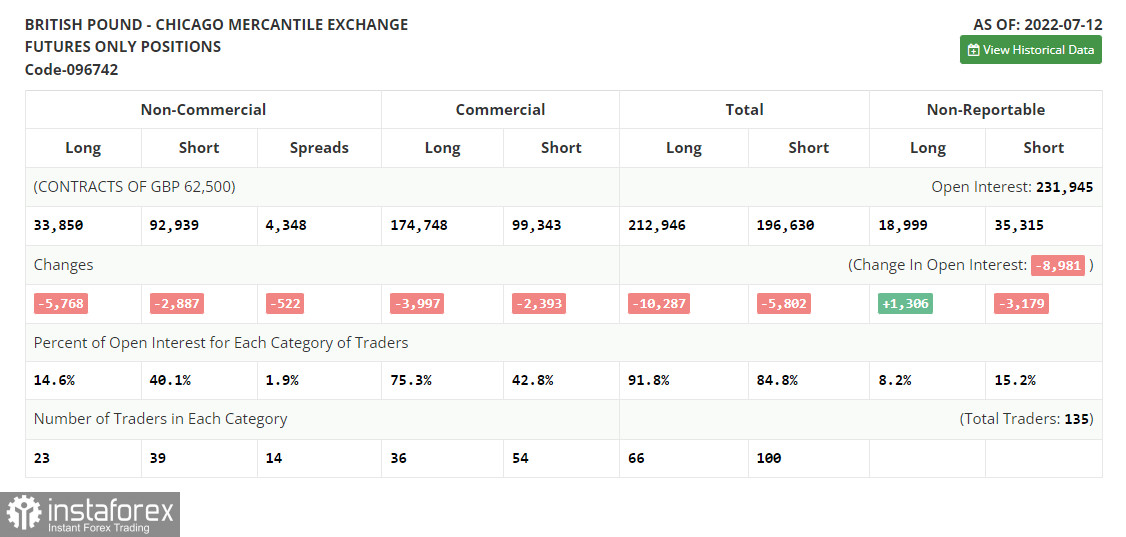

The COT report for July 12 logged a decrease in both long and short positions. The negative delta increased. Another attempt to buy the pair at yearly lows failed although traders started to take profit at the end of the week, encouraged by the strong macroeconomic data from the US. As a result, a small correction occurred. The cost of living crisis in the UK is getting more acute every day, and the government is struggling to cope with it. At the same time, the Fed's policy and the pace of monetary tightening in the US provide significant support to the US dollar and put more pressure on the pound. The US regulator is expected to raise the rate by 1.0% at the next meeting. According to the COT report, the long positions of the non-commercial traders decreased by 5,768 to 33,850, while short positions declined by 2,887 to 92,939.The negative non-commercial net position increased to -59,089 from -56,208. The weekly closing price dropped to 1.1915 from 1.1965.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, showing bulls' attempts to push GBP higher.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance and support are seen at 1.2053 and 1.1955 in line with the upper band and lower band respectively.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.