The pound is strengthening its position against the dollar amid a general weakening of the US currency and increased hawkish expectations regarding the succeeding actions of the British central bank. This combination of fundamental factors allowed GBP/USD bulls to settle in the area of the 20th figure. The bulls are now aiming for the main resistance level at 1.2180 (the upper line of the Bollinger Bands indicator on the daily chart). However, it is too early to talk about this price height. Prior to the announcement of the results of the July meeting of the Federal Reserve, traders of the pair are unlikely to decide on such a large-scale upward breakthrough. Therefore, long positions should now be treated with extreme caution, especially near the borders of the 21st figure.

Looking at the weekly chart of GBP/USD, we can see that the pair has been consistently declining for seven weeks, while a corrective pullback has been observed over the past two weeks. As part of the downward trend, the price fell by almost a thousand points, from the 26th figure to 1.1760 (in early July). Pushing off this target, bulls were able to win back 300 points, taking advantage of the weakening dollar and the simultaneous strengthening of the pound.

The British currency was supported by BoE Governor Andrew Bailey, who said last week that the English central bank would consider raising the base interest rate by 50 basis points at the next meeting (ie, in early August). He stressed that the return of British inflation to the target of two percent is an "absolute priority" for the central bank. "Therefore, a 50-point increase in the rate will be one of the options that we will discuss at the next meeting," Bailey said.

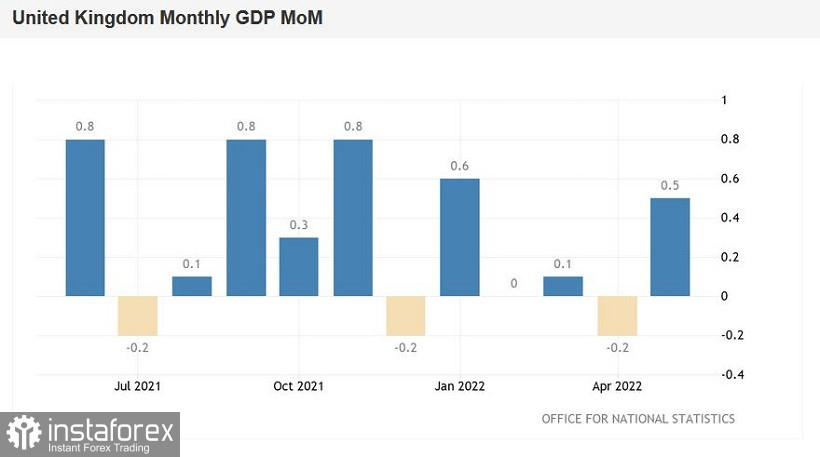

Here it should be noted that such a hawkish signal from the head of the BoE sounded after the release of the latest data on the growth of the British economy. The most important macroeconomic report unexpectedly ended up in the green zone, contrary to the pessimistic forecasts of most experts. Thus, the gross domestic product rose by 0.5% in May after falling by 0.2% in April. At the same time, most analysts predicted a decline in this indicator into the negative area, to the level of -0.2%. In quarterly terms, growth to 0.4% was also recorded, while experts expected to see this component in May at a zero level. On an annualized basis, the volume of GDP increased by 3.5% (against the forecast of growth up to 2.7%).

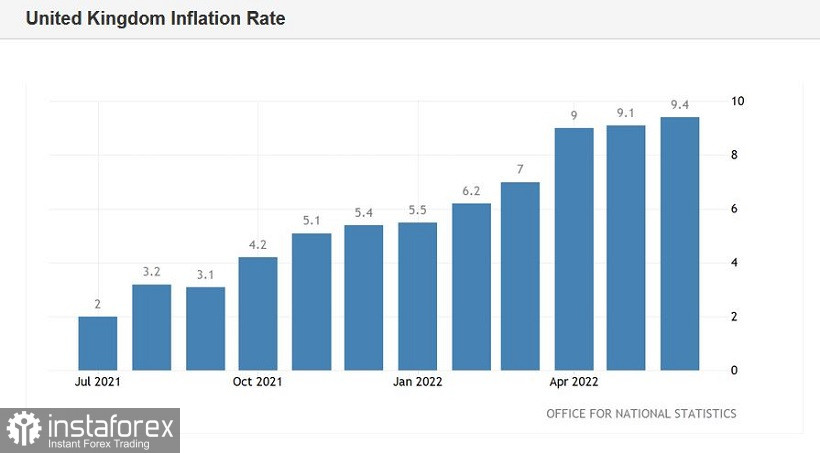

The growth of the British economy was recorded amid another jump in inflation. According to the latest data, the overall consumer price index in June rose to 0.8% on a monthly basis (while experts expected to see it at around 0.7%). In annual terms, the index also surprised traders, rising to 9.4%. This is a long-term record - the last time the index was at this height was in February of the distant 1982. The driving force behind the rise in headline inflation was energy prices. According to a number of analysts, inflation may reach 11% in autumn due to another wave of rising energy prices.

In other words, Bailey delivered hawkish rhetoric at the right moment. The British economy is slightly growing, but still, amid record growth in inflation indicators. The risks of stagflation have not gone away, but still, fears about the implementation of this scenario have obviously decreased. The BoE can focus on curbing inflationary processes. Let me remind you that following the results of the June meeting, three members of the Committee (Michael Sanders, Katherine Mann and Jonathan Haskell) voted in favor of raising the rate by 50 basis points. But then they were in the minority - the other six of their colleagues insisted on a 25-point increase. Given the latest macroeconomic reports, we can assume that there will be more supporters of a 50-point hike at the August meeting. At least Bailey made it clear that the implementation of this scenario is not at all excluded.

Many experts associate the current dynamics of the GBP/USD pair with political events in the UK. We are talking about the pre-election intra-party race in the ranks of the conservatives. Former British Chancellor of the Exchequer Rishi Sunak and current British Foreign Secretary Liz Truss advanced to the final round. They voice a lot of loud and resonant statements, which in one way or another can have an impact on the pound. In particular, Sunak brought down a stream of accusations against China, calling the PRC and the Chinese Communist Party "the biggest threat to the security and prosperity of Britain and the whole world this century." But in my opinion, all these statements are somewhat sham, propaganda, and pre-election character. The chairman of the Conservative Party (who, in fact, will also take the post of prime minister) will be elected only by the beginning of September. And about 200,000 party members across the country will have to vote for Sunak or Truss. Therefore, projecting the words of the participants in the election race on the current behavior of the British currency is perhaps premature.

Thus, the existing fundamental background, on the one hand, contributes to further corrective growth of GBP/USD to the first price barrier of 1.2100. But here it is necessary to take into account the fact that the results of the Fed's July meeting can "redraw" the fundamental picture for the pair, sharply strengthening the positions of the US currency. Therefore, the relevance of longs is of a short-term nature - just before the announcement of the Fed's verdict, it is most expedient to be out of the market.