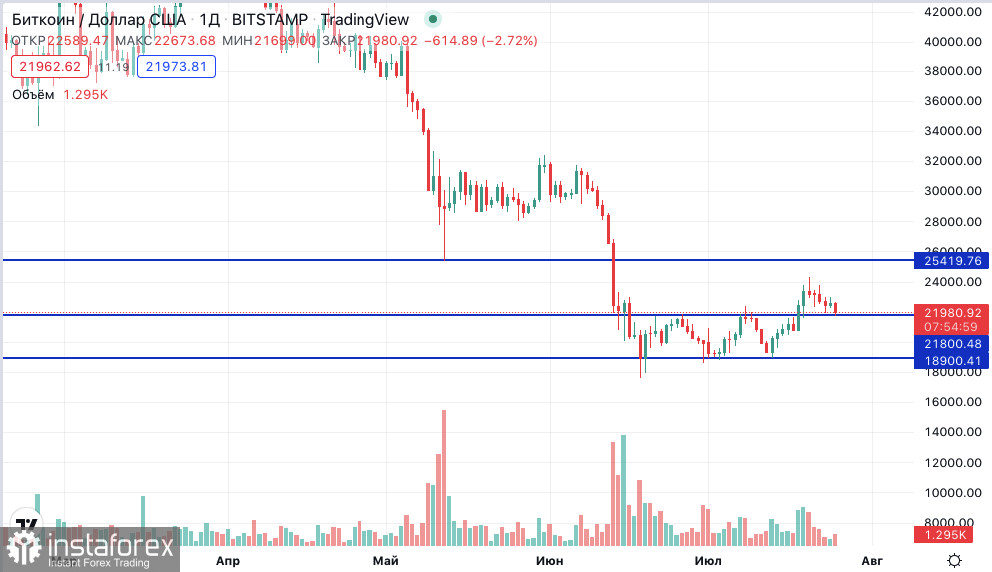

Bitcoin declined at the beginning of the new week. Quotes are testing the support level of 21,900. Will it be able to hold, given that the Fed is meeting this week with an expected interest rate hike?

Judging by technical indicators, the main cryptocurrency now has two possible scenarios. The first is a recovery if support at 21,900 remains in place. The target is still $25,000 per coin. The second is a return to the 18,900 - 21,900 range and a decline towards its support.

The Fed's interest rate decision is expected on July 27. It is not only the hike itself that will matter, but also the rhetoric regarding inflation and the central bank's future monetary policy plans.

In fact, the cryptocurrency market does not enjoy tight monetary policy and monetary restraint at a time when the crypto market is collapsing is not going to help the demand for digital assets.

Although technical indicators are important and are described above, the encouraging prediction of analyst PlanB, creator of his own method of analyzing the crypto market, is interesting.

The analyst noted that the rate at which bitcoin bounced above its 200-week moving average this month may be at odds with underlying strength lacking in similar bearish phases.

"It usually takes a lot longer for BTC to bounce above the 200-week moving average after BTC falls below the strike price. But it has already happened," he said. "Also, the 200-week moving average and the realized price have already touched (usually this also takes longer)."

In their latest study, the cryptanalytic company Arcane Research calculated the cumulative sale by institutional sources has been over 236,000 BTC since the explosion of Terra/LUNA on May 12.

"The number 236,237 BTC comes from massive institutional explosions and other large known sell-offs seen during market stress over the past two months," the statement said. "This number does not take into account other natural capitulation and hedging that typically occurs during crypto bear markets."

Meanwhile, data from another analytics platform Glassnode showed that organizations holding 1 BTC or less grew faster than ever in the total share of BTC supply. This trend has accelerated sharply in 2022.

Despite weekly inflows worth $30 million, the overall value of global crypto assets under management (AUM) dropped to $30.2 billion last week. Amid the latest crypto winter, Bitcoin, the world's most valuable digital asset, witnessed a major drop in the value of BTC assets under management.

A report from CoinShares shows that international digital asset managers now hold $19.3 billion worth of BTC assets. In November 2021, asset management companies were holding over $40 billion worth of Bitcoin assets.

Investment products related to other crypto assets like Ethereum, BNB and Litecoin have seen major challenges in the past eight months.

In terms of year-to-date performance, Ethereum investment products have suffered the most. ETH has witnessed record-breaking outflows worth $316 million since the start of 2022.

BNB came at the second spot with outflows of $22 million. As a result of the latest price dip, the total value of global ETH assets under management now stands at around $7 billion, compared to almost $20 billion in November 2021.

The latest weekly CoinShares report noted that digital asset investment products had seen inflows totaling US$27m last week, while late reporting of trades from the prior week saw inflows corrected from US$12m to US$343m, marking the largest single week of inflows since November 2021.

This brings month-to-date inflows to US$394m and total assets under management (AuM) back to early June 2022 levels of US$30bn. Bitcoin saw inflows totaling US$16m last week, with the prior week of inflows corrected to US$206m, the largest single week of inflows since May 2022.

CoinShares highlighted that a large part of the latest weekly inflows came from Switzerland. Germany and the US accounted for inflows worth $8 million and $9 million, respectively.