Bitcoin and ether are gradually correcting after a strong upward movement in the middle of this month. Many traders are beginning to question whether the recent growth was due to a new upward trend and a search for the market bottom or whether the observed upward jump was merely the elimination of short positions before the upcoming downward trend. Before discussing the technical picture, however, I would like to call your attention to recent statements by Gary Gensler, head of the United States Securities and Exchange Commission, in which he indicated what a security observer in the field of cryptocurrency regulation might anticipate.

Recently, Gensler stated, "Congress has authorized us to utilize our authority, which we will use to safeguard the interests of investors." Investor protection from various service providers, such as exchanges, credit platforms, and broker-dealers, will benefit the general public. The chief of the SEC elaborated: "The Securities and Exchange Commission is involved in all three of these fields: exchanges, loans, and broker-dealer activity." In addition, we frequently discuss with industry participants how to assure compliance with SEC regulations."

Many American politicians have expressed the necessity for legislation to protect the interests of crypto investors after the recent collapse of the cryptocurrency market.During the interview, the head of the SEC stated that there is a significant likelihood that the securities regulatory agency will require companies issuing particular tokens to disclose information. "The public benefits from a complete understanding of what is occurring within the corporation," the SEC chairman emphasized.

Recently, the SEC stated that it is examining tokens and stablecoins and is in negotiations with banking regulators and CFTC colleagues. Gensler thinks that bitcoin is not a security token. A month ago, the SEC chairman referred to bitcoin as a commodity. In May of this year, the chairman of the SEC recommended a unified set of regulations for crypto tokens.

As previously mentioned, following the failure of the terra (LUNA) cryptocurrency and the TerraUSD (UST) stablecoin, Gensler predicted that many crypto tokens would fail in the future because of inadequate regulation and the availability of digging.

The SEC is presently examining Celsius's decision to freeze accounts. The crypto company filed for bankruptcy last week. Also under investigation by the security authorities are Terraform Labs and UST.

Regarding the technical outlook for bitcoin, the balance of power has shifted slightly toward sellers. In the case of a further decrease in the trading instrument, speculators will defend the closest support around $20,720, which plays an important role. Its collapse and consolidation below this range will cause the trading instrument to return to the lows: $19,960 and $19,230, which are close to $18,625. If the demand for bitcoin resumes, it will be necessary to break above $21,430 and $22,184 to establish an upward trend. Fixing higher will bring the trading instrument to the highs of $23,070 and $23,600, which are close to $24,280. A further-off objective will be the $25,780 region.

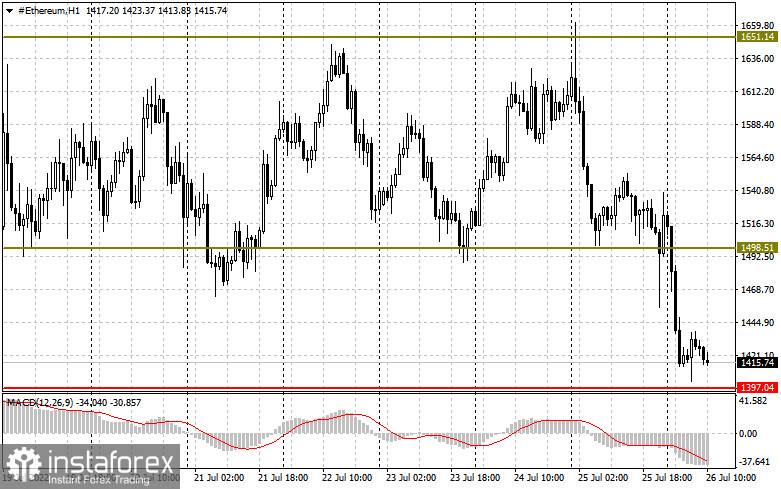

Ether purchasers missed out on a significant support level of $1,490 and must now bid farewell to $1,390 if they do not exhibit activity there. If the pressure on ETH persists and $1,390 is broken, the bulls will not proclaim themselves until $ 1,320, the next key mark. More significant support is observed at $1,150. It is only possible to discuss the continuation of ether's growth until the resistance returns to $1,490. Only after growth above this level can we anticipate a sharper surge with the repeat of the highs of $1,650 and $1,740, as well as the possibility of constructing a medium-term upswing. A return to $1,740 and consolidation on that level will spur new purchases to update the $1,830 resistance, for which a fierce battle will resume.