Numerous American politicians criticize bitcoin and the entire cryptocurrency market for their weakness, particularly after the reported significant decline in the spring of 2018. Even advocates of the crypto sphere, including senators, have recently expressed their discontent. Elizabeth Warren remarked, "Too many crypto businesses defrauded clients and ordinary investors, while executives made off with the cash." She emphasized the need for more regulations and urged the Securities and Exchange Commission (SEC) and Congress to regulate cryptocurrencies.

According to her, the SEC is obligated to oversee the actions of cryptocurrency companies that endanger investor funds. There is no need to go far: the cryptocurrency lender Celsius Network filed for bankruptcy last week after restricting client withdrawals. A week earlier, Voyager Digital, another cryptocurrency lender, submitted a similar application. The company cited the reasons for the crypto-hedge firm Three Arrows Capital's default on its loan as the reasons for its default. Some gave money to others in a higher proportion until the situation became so dire that the first wave of the cryptocurrency market's decline resulted in billions of dollars in losses and the loss of consumer funds.

Warren emphasized that many crypto firms have defrauded clients in recent years, leaving ordinary investors without funds while insiders have escaped with the assets. Notably, the SEC has consistently raised concerns regarding this. In May, SEC Commissioner Hester Peirce declared that the securities regulator would not oversee cryptocurrencies. We can combat fraud and contribute more positively to innovation.

In a recent interview, the head of the SEC, Gensler, stated that there is a strong likelihood that the securities regulatory agency may even require corporations producing particular tokens to divulge information. "The public benefits from a complete understanding of what is occurring within the corporation," the SEC chairman emphasized. Gensler also blasted legislators, urging them to regulate the emerging field aggressively.

Senator Warren has insisted multiple times that Gensler increase oversight of bitcoin. In July of 2017, she warned about the escalating risks of cryptocurrency trading and urged the securities regulator to "use all of its authority to eradicate these risks." She also stated that decentralized financing is the most difficult aspect of the cryptocurrency field. She urged policymakers to restrict the operations of stablecoins and DeFi platforms "before it's too late."

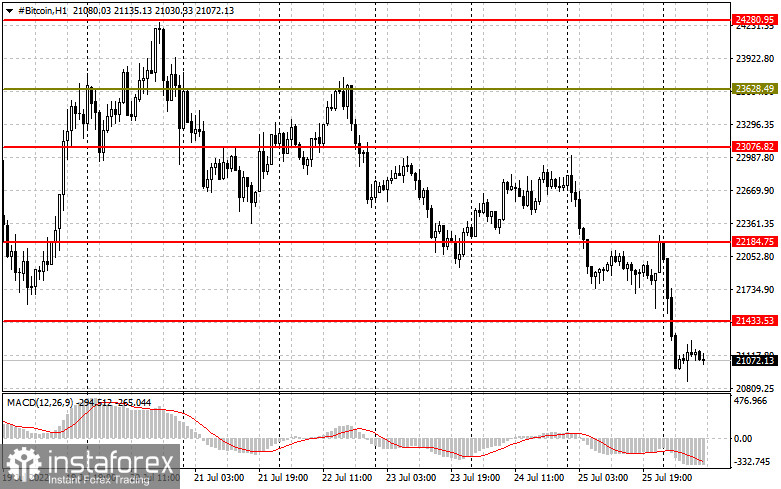

Regarding the technical outlook for bitcoin, the balance of power has shifted slightly toward sellers. In the case of a further decrease in the trading instrument, speculators will defend the closest support around $20,720, which plays an important role. Its collapse and consolidation below this range will cause the trading instrument to return to the lows: $19,960 and $19,230, which are close to $18,625. If the demand for bitcoin resumes, it will be necessary to break above $21,430 and $22,184 to establish an upward trend. Fixing higher will bring the trading instrument to the highs of $23,070 and $23,600, which are close to $24,280. A further-off objective will be the $25,780 region.

Ether purchasers missed out on a significant support level of $1,490 and must now bid farewell to $1,390 if they do not exhibit activity there. If the pressure on ETH persists and $1,390 is broken, the bulls will not proclaim themselves until $ 1,320, the next key mark. Greater support is observed at $1,150. It is only possible to discuss the continuation of ether's growth until the resistance returns to $1,490. Only after growth above this level can we anticipate a sharper surge with the repeat of the highs of $1,650 and $1,740, as well as the possibility of constructing a medium-term upswing. A return to $1,740 and consolidation on that level will spur new purchases in order to update the $1,830 resistance, for which a fierce battle will resume.