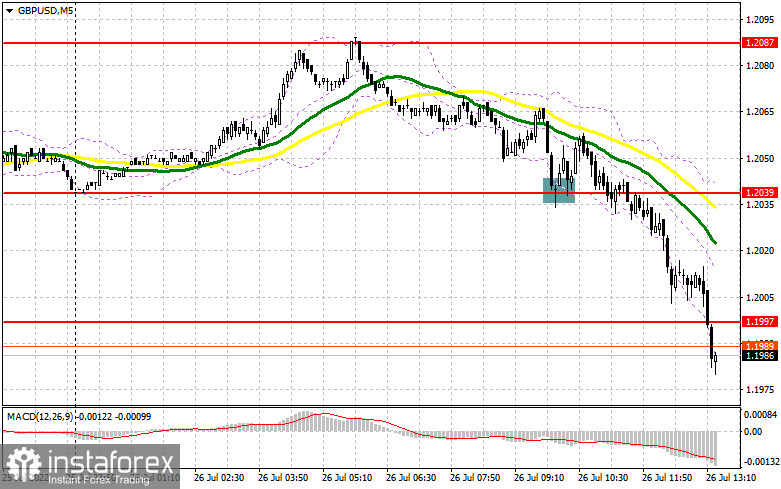

In my morning forecast, I paid close attention to the level of 1.2039 and suggested making entry decisions there. Let's examine the 5-minute chart to determine what transpired there. The collapse and construction of a false breakdown at this level and the rather robust growth that resulted in a profit of almost 20 points stopped quite fast. After the repeated update of 1.2039, the bears easily crossed this level, which intensified the pressure on the pair and led to a large sell-off in the region of 1.1997, forcing them to recoup losses from the morning purchase.

To establish long positions on the GBP/USD, you must:

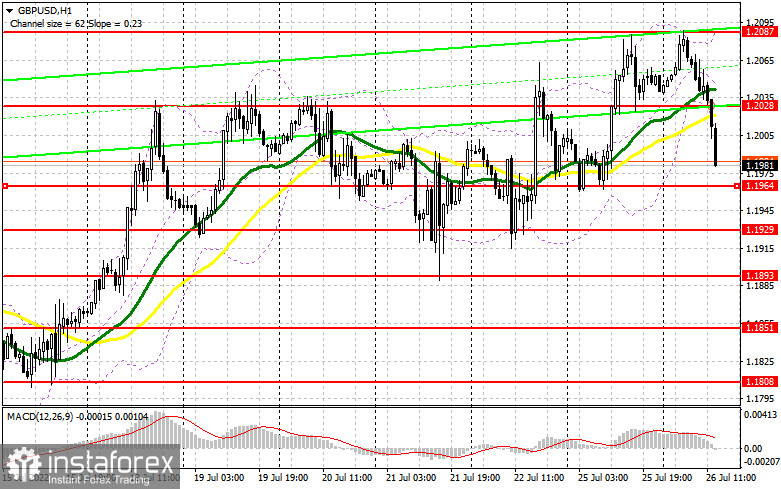

Today, buyers will still have the opportunity to demonstrate their worth, but this will require weak facts about the United States. Intriguing information is anticipated on the consumer confidence in the United States and the volume of house sales in the primary market in the United States. And suppose all is obvious with the second component. In that case, there will undoubtedly be a decline owing to high-interest rates – then positive consumer confidence data can further support the US dollar, putting pressure on the pair. In this scenario, buyers will be compelled to defend the 1.1964 support established by yesterday's price action. In the vicinity of this level, bulls will attempt to construct the lower boundary of a new ascending channel in anticipation of sustained pair expansion. In this situation, the closest morning-formed resistance of 1.2028 will serve as the objective. A breakthrough and a reversal test from the top to the bottom of this level will generate a stronger upward momentum, signaling a buy to jump and update 1.2087. A comparable breach of this level would open the door to 1.2119, where I propose locking in profits. The 1.2160 region will serve as a further-off objective. If GBP/USD falls and there are no buyers at 1.1964, pressure will rise on the pound. I suggest delaying long positions till 1.1929 with this choice. I encourage you to only purchase there on a fake decline. It is conceivable to initiate long bets on GBP/USD immediately for a rebound from 1.1893, or even lower – around 1.1851, with the goal of a 30-point-per-day drop.

To open short GBP/USD positions, you must have:

The sellers proclaimed themselves correctly in the morning, having obeyed the bulls' stop orders. If US data disappoints, the ideal scenario for establishing short trades in the second half of the day will be a fake breakdown once the pair reaches the 1.2028 resistance zone. The obvious objective of the bears is the 1.1964 support level, which will be crucial today because, as stated previously, the bulls will attempt to construct the lower border of the short-term ascending channel there. If there is no buying activity at this level and GBP/USD is fixed below 1.1964, the reverse test from the bottom up will provide an extra entry point to sell with a fall to 1.1929, where I recommend securing a portion of profits. The 1.1893 region will serve as a further-off objective. With the possibility of GBP/USD growth and the absence of bears at 1.2028, I would advise against taking short positions in a hurry. Only a false breakout near the 1.2087 maximum will provide an entry point for short trades in anticipation of a pair reversal. If there is no activity there, there may be another upward jerk. With this option, I recommend delaying short positions until 1.2119, when you can sell GBP/USD immediately for a comeback, betting on a 30-35-point drop within a day.

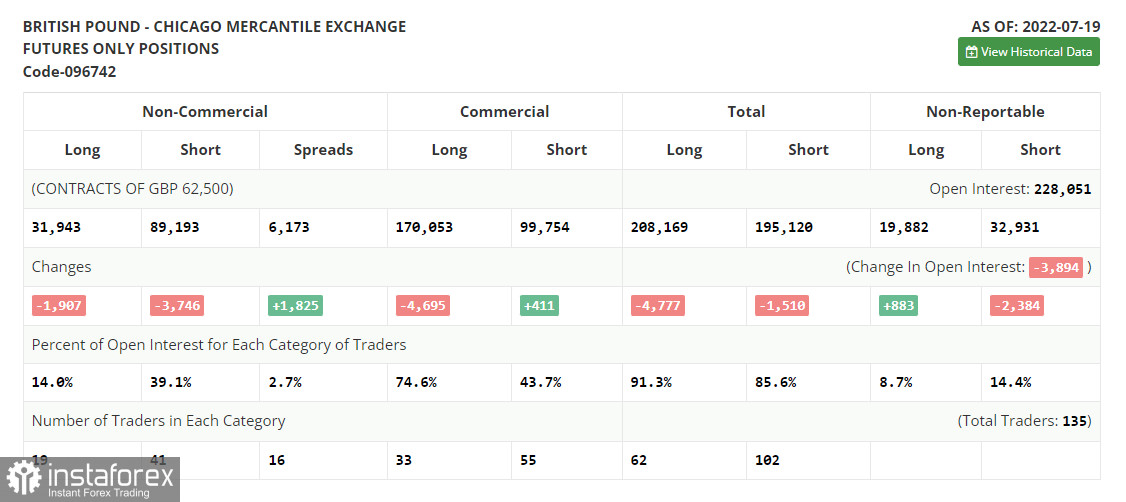

The COT report (Commitment of Traders) for July 19 revealed a decline in both short and long positions, but the reduction in short positions was significantly smaller, resulting in a small reduction in the negative value of the delta. The bulls have purchased the annual lows for the pound and are now making every effort to demonstrate that the UK economy is not in such dire straits and that the policies of the Bank of England on interest rates are rational. The future growth of the pound will depend on the judgments made by the Federal Reserve System in the middle of this week. The regulator will instantly increase interest rates by 0.75 percentage points, which may contribute to strengthening the currency, but only if the central bank maintains its strong stance. If not, the likelihood of more pound growth will increase, as the Bank of England will host a meeting in August at which interest rates may be increased. Given the problems with the UK's cost of living and the economy's steady descent into recession, it is irrational to anticipate that the bull market for the pound will persist for an extended period. According to the COT report, long non-commercial positions declined by 1,907 to 31,943. In contrast, short non-commercial positions decreased by 3,746 to 89,193, decreasing the negative value of the non-commercial net position to -57,250 from -59,089. The weekly ending price increased from 1.1915 to 1.2013.

Signals of indicators:

Moving AveragesTrading is below the 30-day and 50-day moving averages, indicating a bearish effort to reenter the market.The author considers the period and prices of moving averages on the hourly chart H1, which differs from the standard definition of daily moving averages on the daily chart D1.Bollinger BandsThe indicator's upper limit near 1.2087 will act as resistance in an upward trend.Description of indicators- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.