The cryptocurrency market froze in anticipation of the Fed meeting and determining the future fate of the crypto market. The American markets are more pessimistic than others, which provoked a local sale of BTC. As a result, the level of volatility of the first cryptocurrency began to grow, and the total market capitalization decreased by 4.3%, to $963 billion. Trading volumes also began to fall, and the number of active addresses gradually decreased.

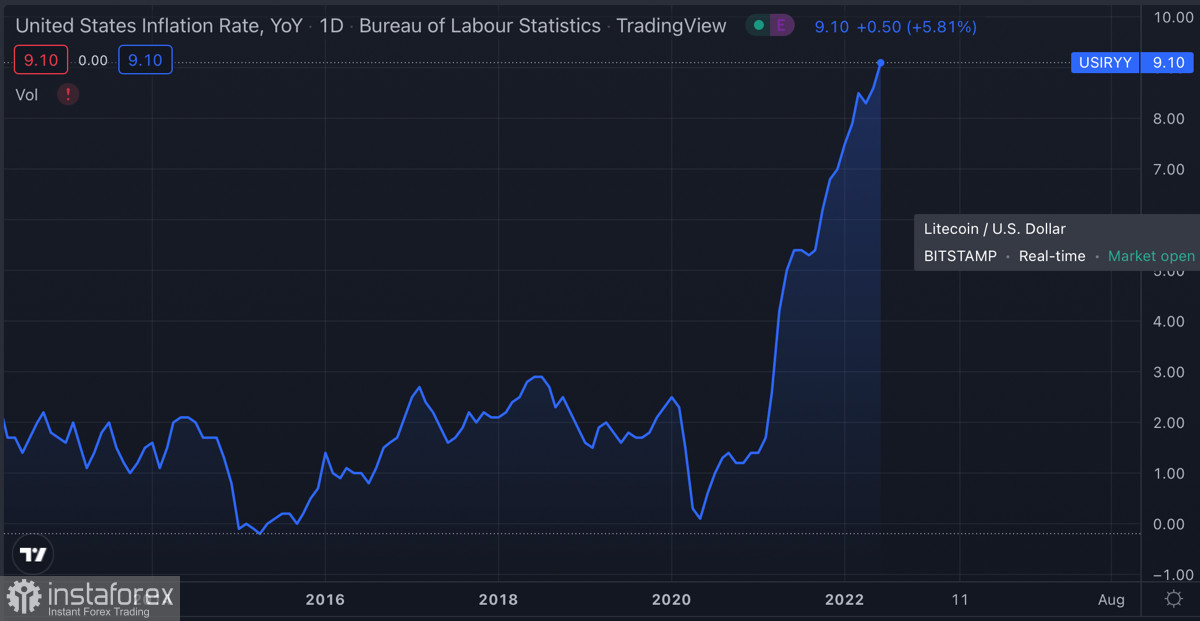

All these events are due to the upcoming increase in the key rate by 75 or even 100 basis points. Investors locally change their investment strategy, fix profits or losses, and transfer most of their capital to stablecoins. The previous increase in the key rate provoked a slight outflow of funds due to the fact that the main stage of capitulation occurred during the announcement of CPI statistics. In July, the situation changed dramatically. The market responded with growth to a record level of inflation since 1981. Despite this, reinsurance before the Fed meeting is present, but not widespread.

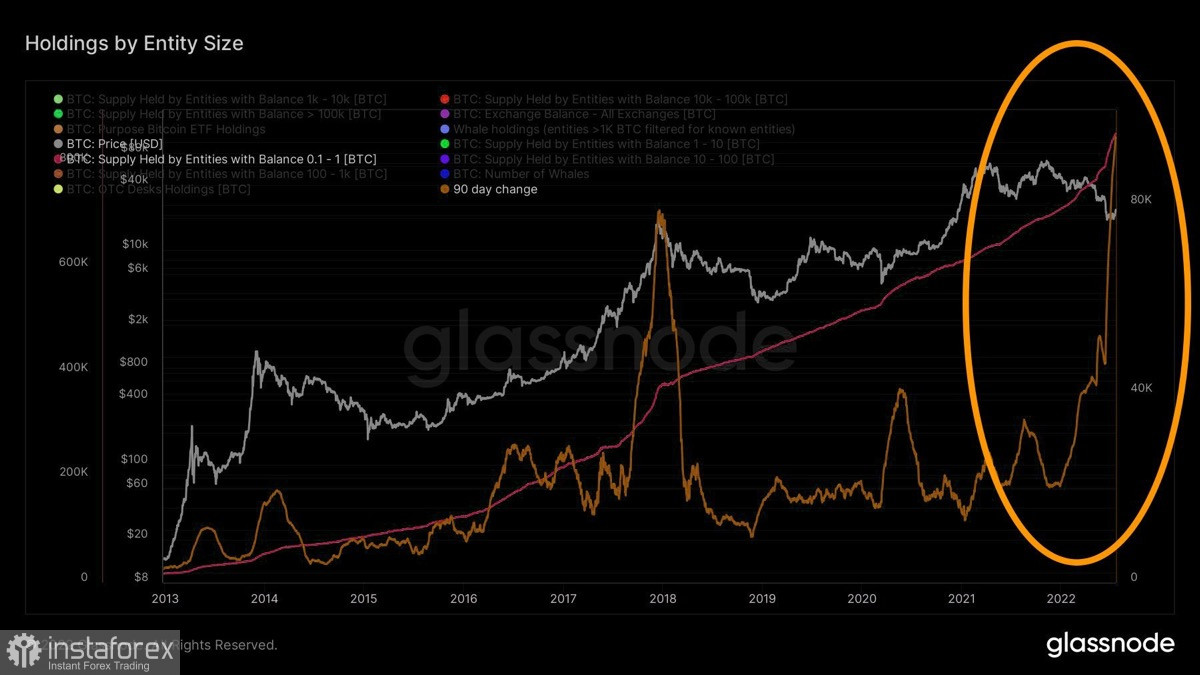

I would like to separately dwell on the reasons for the fall of Bitcoin below the level of $21.5k. Most likely, the wave of profit/loss fixation after the weekly trading was supplemented by bearish sentiment ahead of the key rate increase. In the coming days, we should expect investors to reorient themselves to short positions due to the fall in prices during the last rate increase. However, fundamentally, we see an active accumulation of BTC coins. Wallets with balances of 0.1–1 Bitcoin are accumulating cryptocurrency at the rate of 2017. At the same time, CoinShares notes an inflow of $24 million into crypto funds.

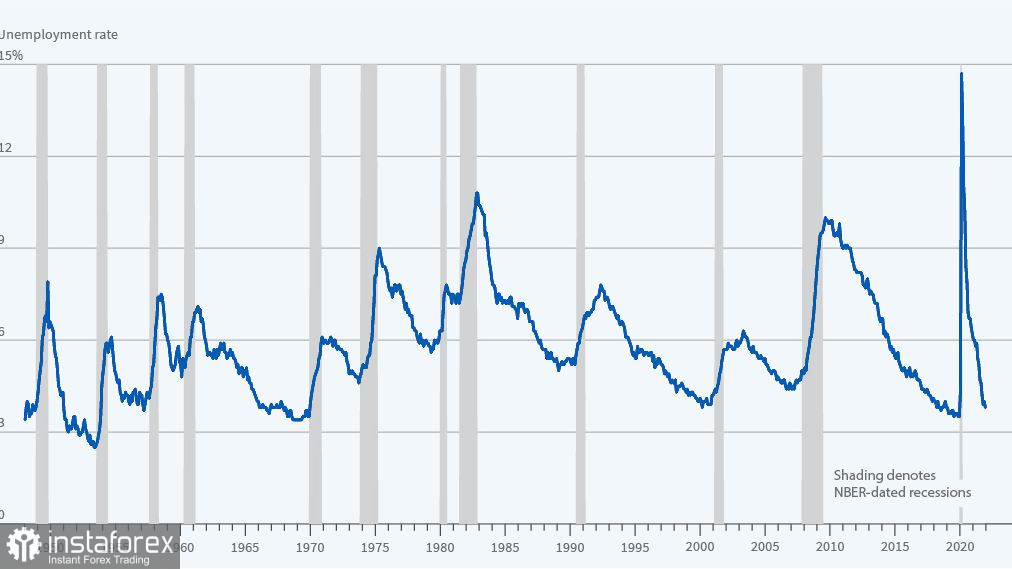

In addition to raising the key rate, investors are very concerned about the likely announcement of a recession following the meeting on Thursday. In the first quarter of 2022, US GDP contracted by 1.6%. If the indicator shows the continuation of downward dynamics or a zero indicator, this will mean the beginning of a recession (GDP does not grow and does not fall for half a year). However, the head of the US Treasury said that even if the statistics are bad, it will not mean a recession. Also, the NBER should announce a recession, but according their representatives, even if GDP falls for two quarters in a row, this does not mean the onset of a recession.

Also, we have already noted that there is a flow of large transactions in the Bitcoin network. This indicates that fundamentally the asset is preparing for growth, and 80% of BTC in the hands of long-term owners indicates preparations for a continuation of the upward movement. Despite clear positive or neutral fundamentals and on-chain indicators, the number of short positions continues to grow. Given the market's adaptation to new realities and a calm reaction to rising inflation, there is a high probability that the market will play against the mood of the crowd.

Bitcoin is in a strong support zone, but most likely, it will be broken. On the daily chart we see a gradual increase in bearish volumes, complemented by the downward direction of the main technical indicators. With this in mind, the $21.1k level will be broken, after which the price will head towards the $20k–$20.5k area. Most likely, by this time, the Fed meeting will take place, and we will see the reaction of the market.

In a favorable situation, the asset will resume its upward movement and break through the $22.4k level, where the main stop cascade will take place. However, it is important to consider two factors here. A similar stock market reaction that will be additional fuel for Bitcoin. In the absence of a combination of these factors, a full-fledged upward momentum of BTC may not take place due to increased correlation with SPX and NDX, as well as inverse correlation with DXY.