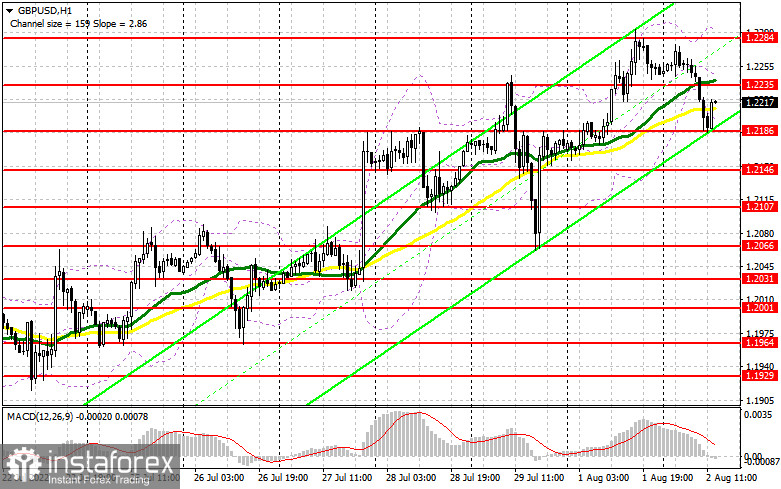

In the morning, the focus was on 1.2221, with entry points considered from this level. Let's look at the 5-minute chart to get a picture of what happened in the market. The pound failed to update yesterday's high. Moreover, it didn't even reach 1.2273 resistance. Due to a plunge in price and no bottom-top retest of the 1.2221 mark, it became impossible to go short in order to extend the bearish correction.

When to go long on GBP/USD:

During the North American session, the market will unlikely focus on macro data in the US. Still, it is worth paying attention to it as well as to the speech of the Fed's Evans. Traders hope the Fed official will hint at the regulators' further steps. Still, new fundamentals are more likely to show the bigger picture. Today, when going long, it is important to be extra careful. In the case of bearish GBP/USD after the release of macro data, it would be wiser to open long positions after a false breakout at around 1.2186. The price could get back to 1.2235 intermediate resistance, which is in line with bearish MAs. Should the quote break through the mark, the target will be seen at the 1.2284 high. A breakout and a top-bottom retest of the range could trigger a strong upward impulse and make a buy signal with a target at around 1.2329. A more distant target is seen at 1.2393, where profit-taking should be considered. Should GBP/USD fall with no bullish activity at 1.2186, pressure on GBP will mount. In such a case, it would be wiser to look for long entry points after a false breakout at 1.2146. Long positions could also be opened on a bounce from 1.2107 or 1.2066, allowing a 30-35 pips intraday correction.

When to go short on GBP/USD:

After bulls attempted to extend growth above monthly highs, bears pushed the pair further down. Clearly, for the downtrend to continue, it would be wiser to go short after a false breakout at 1.2235. It could become possible if US macro data come in disappointing. However, the market is highly unlikely to be bullish today because the pound fell too deep last month. So, a correction is now needed. A sell entry point could be made after a false breakout at 1.2235, pressure on GBP could mount, and the price could reach 1.2186 intermediate support, formed during the European session. A sell entry point with a target at around 1.2146 could be made after a breakout and a top-bottom retest of the 1.2186 mark. Profit-taking could be considered at around 1.2146. A more distant target is seen at around 1.2107. If GBP/USD shows growth and there is no bearish activity at 1.2235 during the North American session, bulls will regain control over the market. In such a case, short positions could be opened when a false breakout occurs at the 1.2284 high, with a possibility of a pullback. Should there be no bearish activity at this level, a rebound may occur. If this is the case, short positions could be opened on a bounce from 1.2329, allowing a 30-35 pips downward correction intraday.

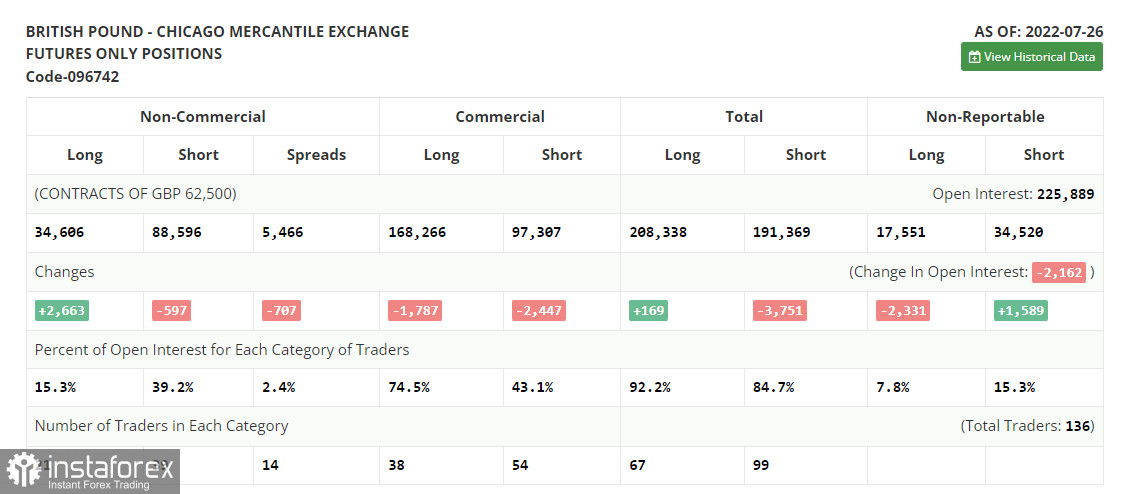

Commitments of Traders:

The COT report for July 26 logged a decrease in short positions and a surge in long ones. GBP is now in high demand. There is no doubt that the Bank of England will raise the interest rate this month. The regulator's aggressive monetary stance has had a positive effect on the pound although the British economy is in poor condition. The Fed's rate hike last week will be reflected in the BoE's future decision. Still, demand for GBP is not as high as it may seem. GBP/USD grows simply because the greenback is getting weaker. This is due to the fact that already this fall, the US central bank could slow down the pace of rate hikes. The cost of living crisis in the UK is getting more acute every day and a recession is looming. According to the COT report, the non-commercial long positions increased by 2,663 to 34,606, while non-commercial short positions dropped by 597 to 88,596. The negative non-commercial net position decreased to -53,9990 from -57,250. The weekly closing price grew to 1.2043 from 1.2013.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, showing bears' attempts to build a downward correction.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance and support are seen at 1.2284 and 1.2185 in line with the upper band and lower band respectively.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.