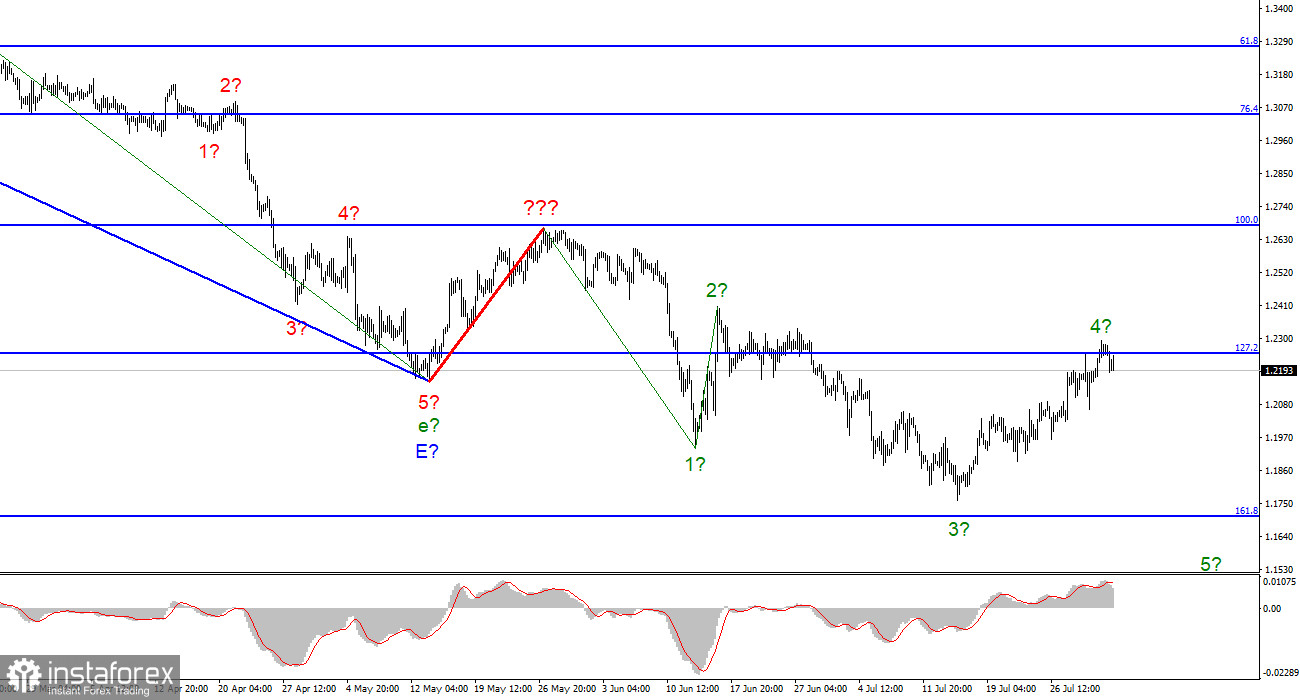

For the pound/dollar instrument, the wave marking at the moment looks quite difficult, but does not require adjustments. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, now we can say that the construction of the upward correction section of the trend is canceled, and the downward section takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a greatly lengthening trend area. Identifying rare corrective waves would be much more practical, after which new impulse structures would be built. At the moment, we have completed waves 1, 2, and 3, so we can assume that the instrument is now in the process of building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost the same way, and at this time, both instruments can complete the construction of their fourth waves simultaneously. I still expect a new decline in the British dollar in the coming days.

News from Taiwan and China comes every 5 minutes.

The exchange rate of the pound/dollar instrument decreased by 40 basis points on August 2. It is a slight decrease, but an unsuccessful attempt to break through the 127.2% Fibonacci level indicates the readiness of the market to complete the construction of the expected wave 4. And until a successful attempt to break this mark is made, I suggest considering this option as a working one. There was no news background in the European Union, the USA, or the UK today. But at the same time, the whole world is watching the movement of Nancy Pelosi's plane, which is due to land at Taipei Airport in the next half hour. And news on this topic comes every 5 minutes. It has just become known that an alert has been declared in Eastern China, and Chinese fighter jets have taken to the air and are heading towards the Taiwan Strait. At the same time, the Taiwanese authorities announced a second alarm level, and Nancy Pelosi's flight was trying to land. The degree of heat rises every five minutes, and the whole world is watching this event and hoping the irreparable will not happen. After all, it is not every day that an alarm is announced in China, and their fighters are rarely sent to intercept the enemy sides. So far, nothing catastrophic has happened, and the demand for the US dollar is growing moderately. But I do not doubt that we will receive more than a dozen news on this topic, and the market may perceive any information that differs from the standard one. And the standard information is the landing of Nancy Pelosi's plane at the airport without incident, trouble-free meetings with the Taiwanese government, and Pelosi's departure back to Washington. In the event of an emergency, the US currency can accelerate its growth.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a further decline. Thus, I advise now selling the instrument with targets near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready to continue buying the British pound.

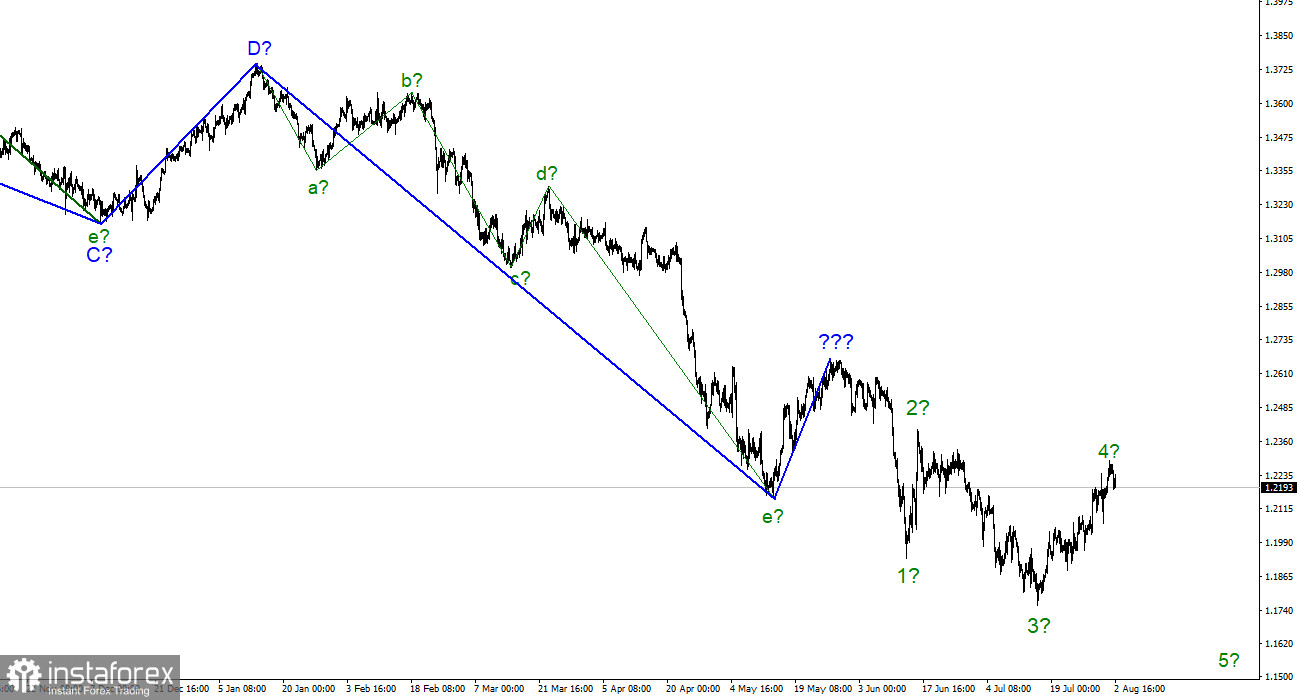

The picture is very similar to the euro/dollar instrument at the higher wave scale. The same ascending wave that does not fit the current wave pattern is the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.