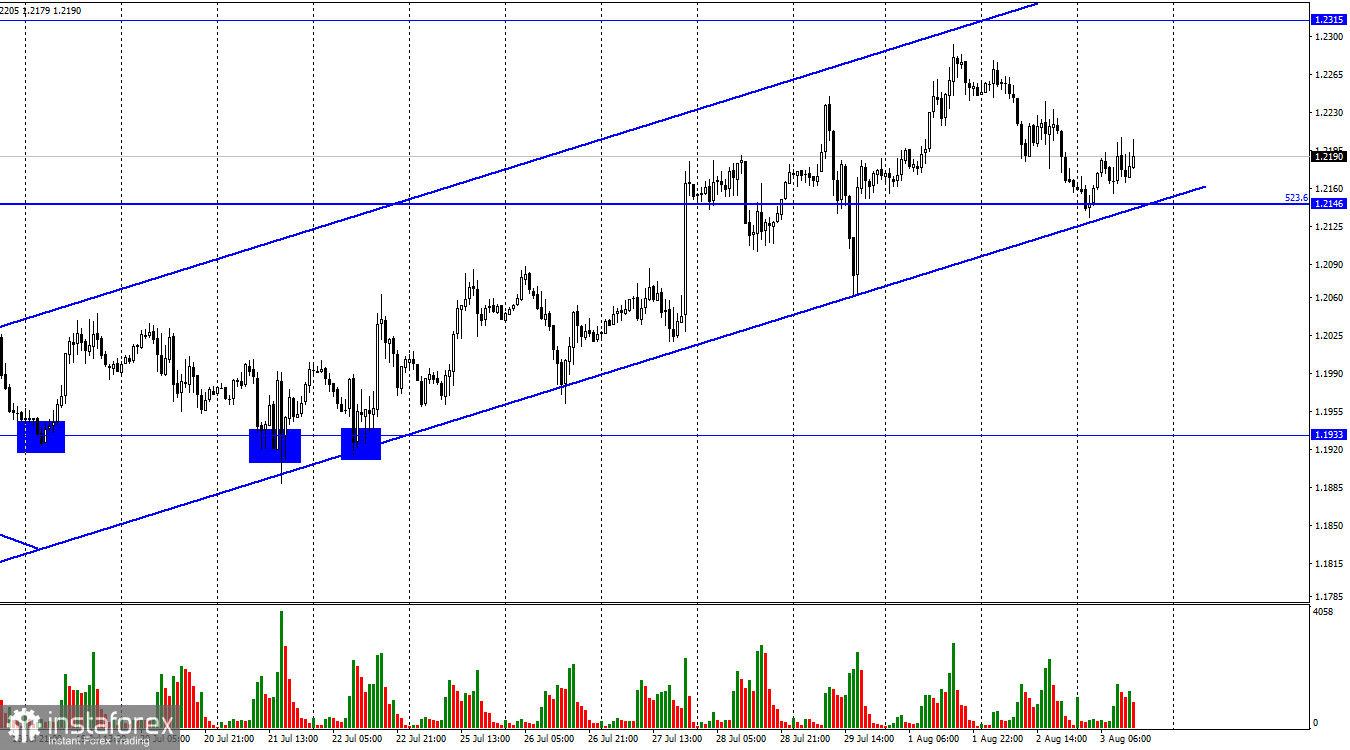

Hi, dear traders! On the 1-hour chart, GBP/USD rebounded off the 523.65% Fibonacci correction, which matched 1.2146, in favour of the pound sterling. The price began a new upward cycle towards 1.2315. Let me remind you that tomorrow the Bank of England will unveil its policy decision that could assure traders revise their sentiment. The pound sterling logged a minor growth today. It looks like the second attempt to settle below 1.2146 or below the upward trendchannel which reinforced the bullish sentiment on GBP/USD for three weeks straight. If it happens in practice, the rally of the British pound will come to an end, perhaps for long. The catalyst for the price move was the event in Taiwan which ended up in nothing. Nancy Pelosi landed in Taipei, met with Taiwan's President, spoke at a press conference, and an hour later, her private jet tookoff from the domestic airport.

All in all, the market panic around this event was obviously premature. Nevertheless, the sterling weakened, though it remains inside the upward trend channel. Tomorrow, it might lose ground considerably because the Bank of England is widely expected to raise the key policy rate by 0.50%. The question is why the sterling could fall if the Bank of England announced a rate hike by 50 basis points. From my viewpoint, like its European counterpart, the British pound has exhausted its energy for a further rally. Looking back, the sterling has been growing for more than three weeks since the last Fed's policy meeting which ended with another aggressive rate hike. The pound sterling embarked on a steady rally, neglecting macroeconomic data that could have caused its decline. After all, the steady rally cannot last forever. Traders must have priced in the rate hike by the Bank of England. If the British regulator doesn't raise the key policy rate by 0.755 at a time, the pound sterling will hardly be able to resume its growth.

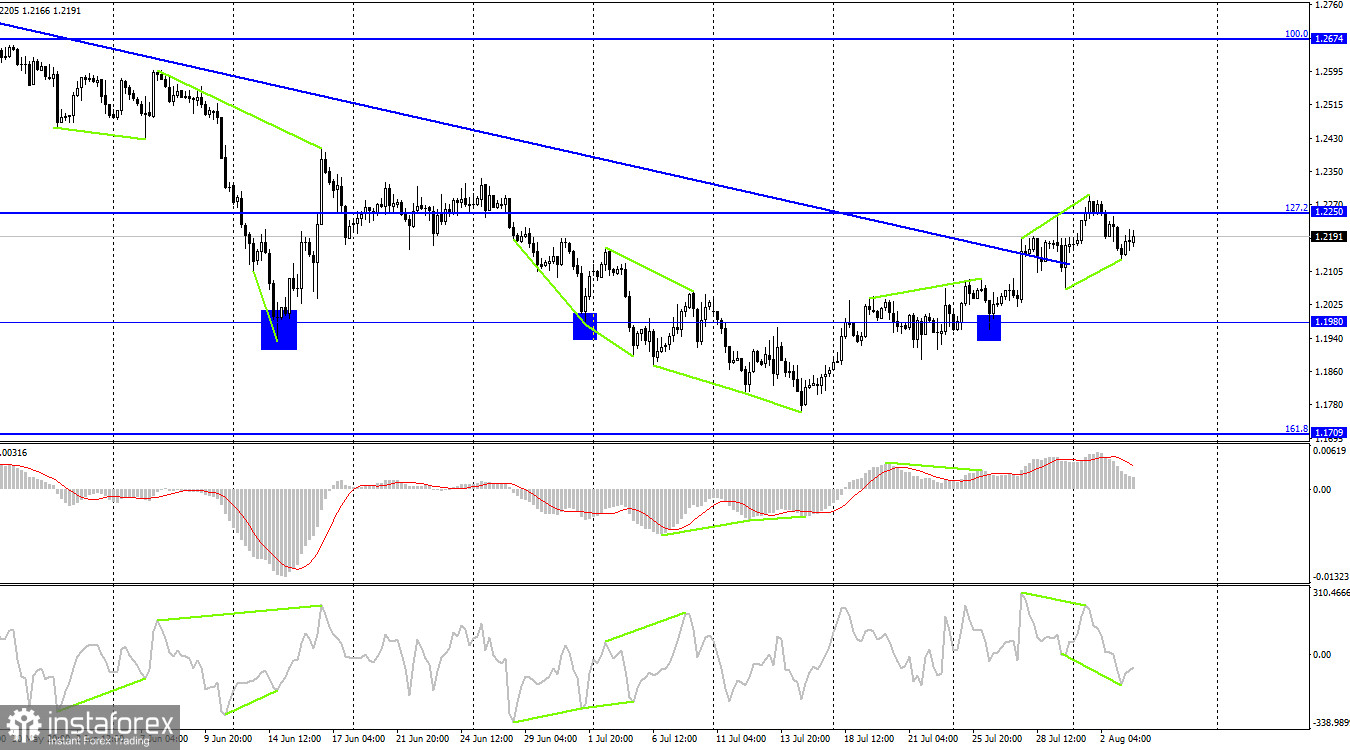

On the 4-hour chart, GBP/USD rose to the 127.2% Fibonacci correction that matches 1.2250 and settled above the downward trendline. However, after a bearish divergence was formed with the CCI indicator, the price reversed in favour of the US dollar and began its decline. The workout of 1.2250 may be considered a drop off this level. Therefore, the pound sterling could extend its fall towards 1.2980 despite a bullish divergence formed. Once the price settles above the 127.2% Fibonacci level, traders will have an excuse to predict a further climb.

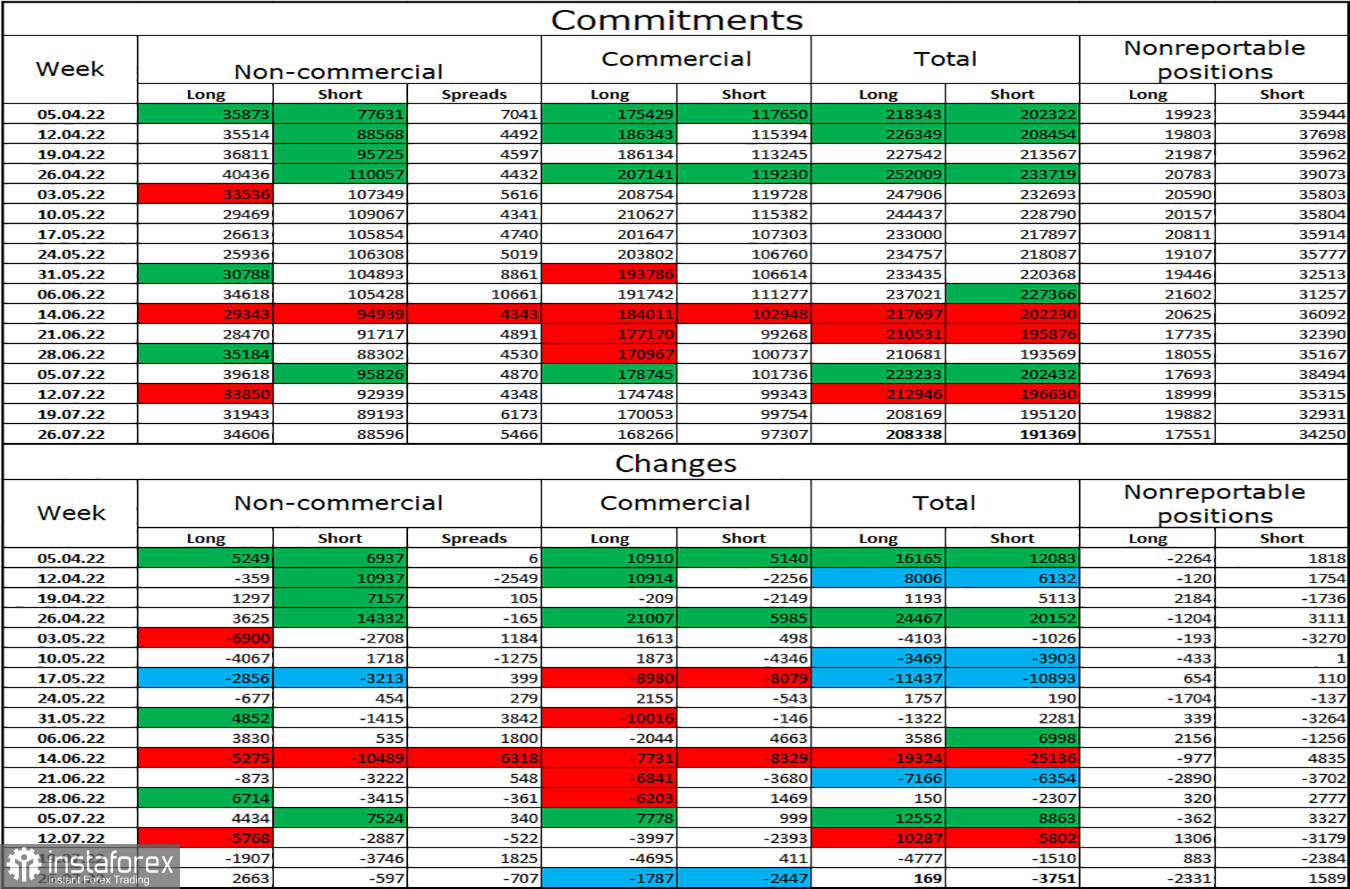

Commitments of Traders (COT):

The sentiment of the non-commercial category of traders turned less bearish last week. The number of long contracts opened by speculators increased by 2,663 whereas the number of short contracts dropped by 597. Thus, the overall sentiment of large market players remained bearish with the number of short contracts considerably exceeding the number of long contracts. Large market players are still poised to sell the pound sterling. Notably, the selling sentiment has been ruling the market for a long time. Although the sterling has been trading higher for a few recent weeks, COT reports make it clear that the British pound might resume its fall anytime soon. Indeed, the bulls are not strong enough to develop a steady uptrend.

Economic calendar for US and UK

UK – Services PMI (08-30 UTC)

US - ISM non-manufacturing PMI (14-00 UTC)

The economic calendar contains a couple of curious reports for the UK and the US. The British services PMI has been already released but it was of little importance to market sentiment. The same could happen with the US PMI.

Outlook for GBP/USD and trading tips

I would recommend opening new sell positions on GBP/USD when it settles below the upward channel on the 1-hour chart with the target at 1.1933. Besides, we could sell the pair at a drop from 1.2250 on the 4-hour chart. Alternatively, I would advise opening buy positions at a bounceoff the lower border of the upward channel on the 1-hour chart with the target at 1.2315, though I consider such positions risky for the time being.