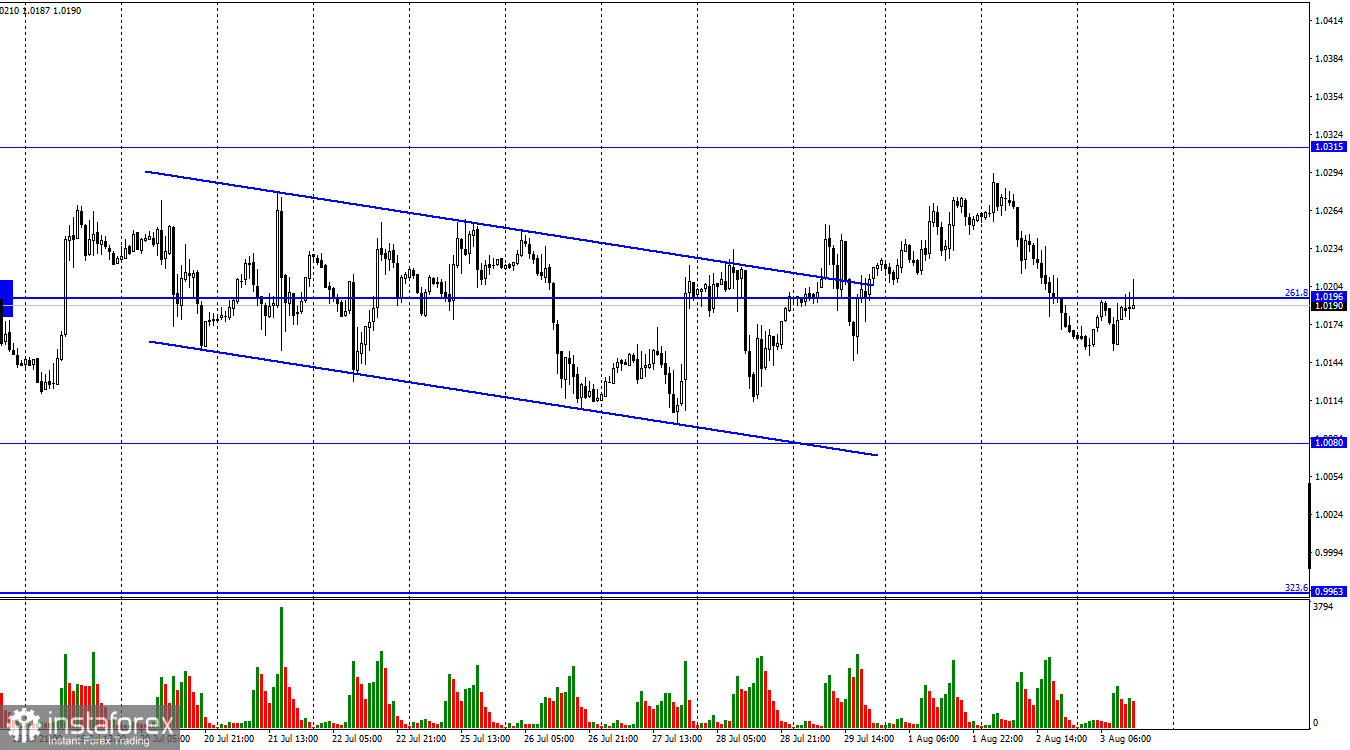

The EUR/USD pair attempted to resume growth on Wednesday but failed to gain a foothold above the corrective level of 261.8% (1.0196), which closed a day earlier. The pair's rebound from this level today will work in favor of the US currency and the continuation of the fall in the direction of the 1.0080 level. Closing quotes above the level of 261.8% will allow traders to again count on some pair growth in the direction of the 1.0315 level. There was practically no information background yesterday. Nevertheless, bear traders have been "stuck" on the European currency since the morning, and at the end of the day, I can assume that this currency's growth period is over. One has only to look at the pair's movements over the past few weeks to understand that the bulls have not been able to take advantage of all the chances for the euro to rise. For three weeks, the bulls failed to move the pair to the level of 1.0315, which was located very close. Thus, I am not surprised by the fall of the euro yesterday, when there were few reasons for this. The same picture shows that during these three weeks, the euro currency showed a fall regularly, almost daily, alternating it with growth.

I also assume that yesterday's fall in the euro currency was due to a drop in risk sentiment among traders. All the media yesterday trumpeted all day about a possible conflict between Taiwan and China. The speaker of the US Congress, Nancy Pelosi, came to Taiwan on a working visit, and Beijing tried its best to prevent this, even lifting its combat aircraft into the air. But as it turned out today, it was nothing more than an attempt to intimidate Washington, which did not work. It would be strange to see the beginning of a military conflict because one politician visited the island of Taiwan, which is a partially recognized state in the world and is not under the control of China. However, traders sensed the tension and hurried to transfer their assets to a safe dollar, and they got rid of the euro and the pound. I expect the fall of the euro currency to continue in the coming days.

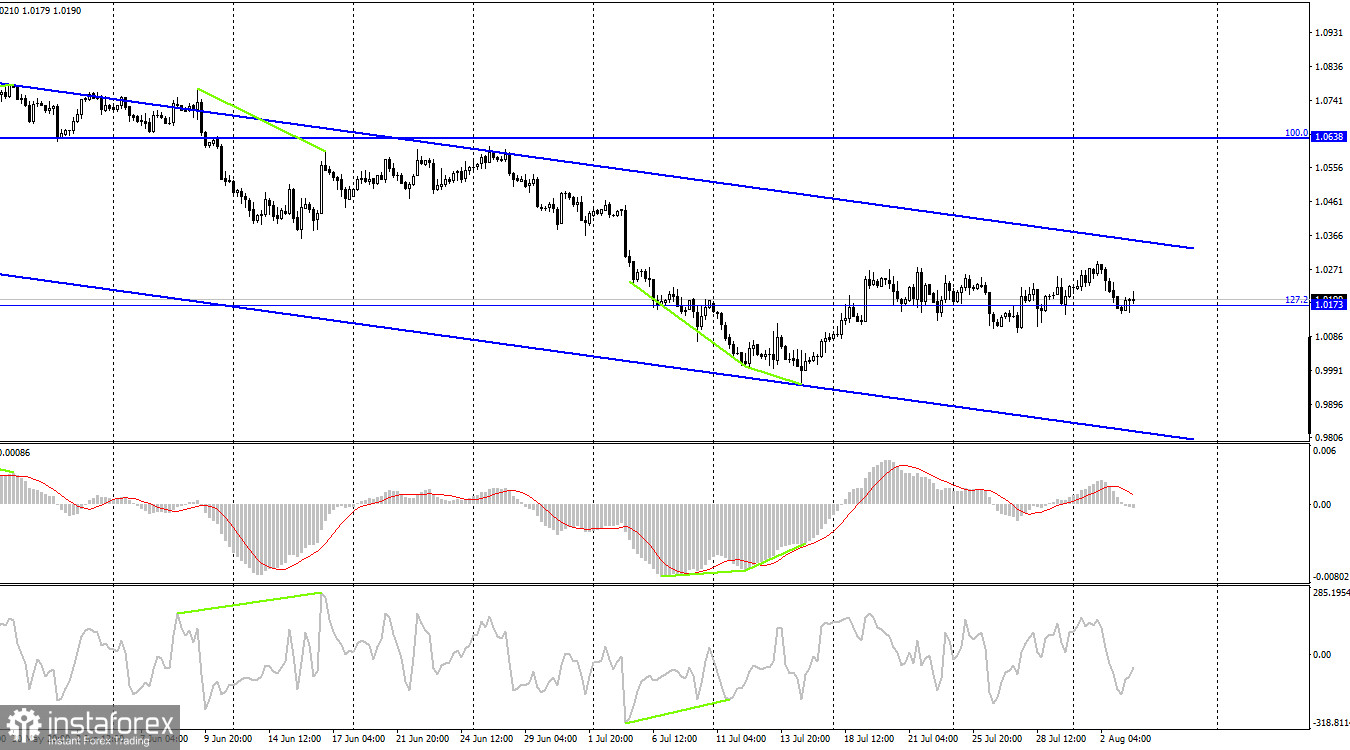

On the 4-hour chart, the pair performed a new reversal in favor of the euro and anchored above the level of 127.2% (1.0173), not the first in a row. Thus, the growth process can be continued in the direction of the upper line of the descending trend corridor. Consolidation above the corridor will increase the probability of continued growth towards the next corrective level of 100.0% (1.0638). Closing the pair's exchange rate below the level of 1.0173 will increase the chances of a resumption of the fall of quotes in the direction of the corrective level of 161.8% (0.9581).

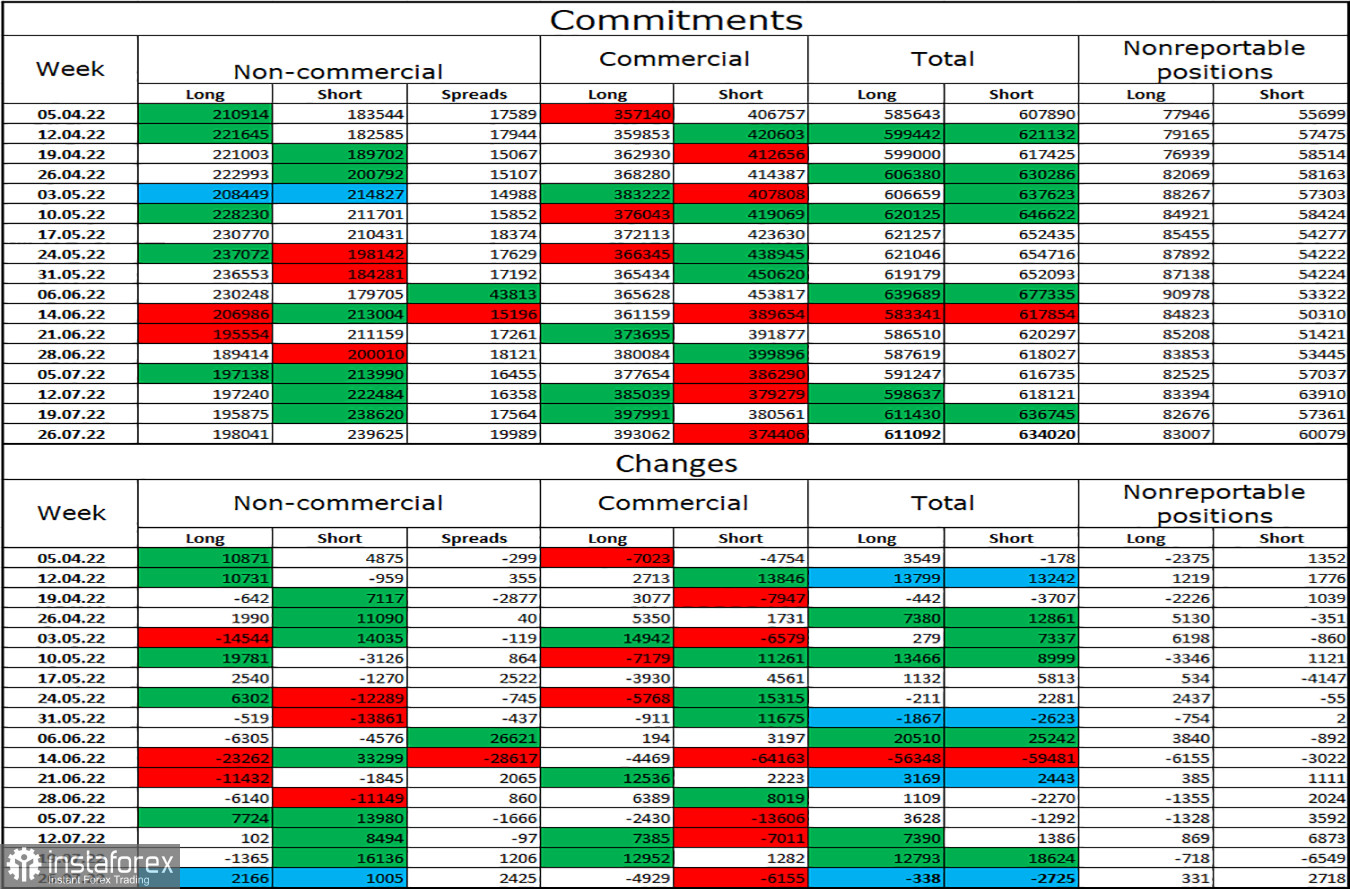

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 2,166 long contracts and 1,005 short contracts. It means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators is now 198 thousand, and short contracts – 240 thousand. The difference between these figures is still not too big, but it remains not in favor of the bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. Thus, it is still difficult for me to count on strong growth of the euro currency.

News calendar for the USA and the European Union:

EU – index of business activity in the service sector (08:00 UTC).

EU – retail trade (09:00 UTC).

US – ISM business activity index in the service sector (14:00 UTC).

On August 3, the calendars of economic events of the European Union and the United States contain few entries. In the European Union, business activity indices have already been released, but the euro did not notice them, so only the ISM index will be able to influence the information background on the mood of traders in the afternoon.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the 4-hour chart with a target of 1.0173. I do not recommend buying the euro currency now, as the probability of a new fall is too high.