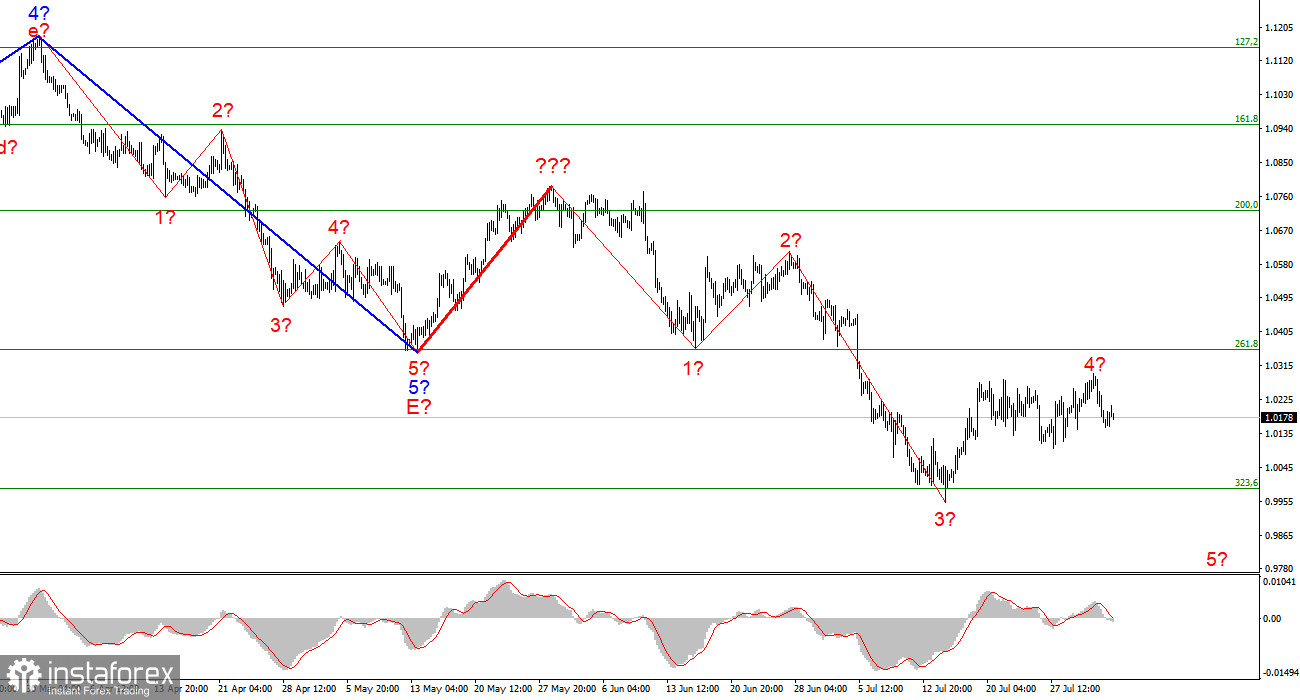

The wave marking of the 4-hour chart for the euro/dollar instrument does not require new adjustments. I recently built a new wave layout that does not yet consider the rising wave marked with a bold red line. The whole wave structure can be complicated an unlimited number of times. It is the disadvantage of wave analysis since any structure can always take a more complex and extended form. Therefore, now I propose to work on simpler wave structures that contain waves of a lower scale.

As you can see, the construction of a descending wave has presumably begun, which may be wave 5 of a new downward trend section. If this assumption is correct, the instrument will continue to decline with targets below 1.0000. The supposed wave 4 took a three-wave form and surprisingly coincided with the peak of the supposed wave 4, according to the British. Thus, perhaps this is the moment the market was waiting for. The euro and the pound are now coinciding in their wave markings, suggesting a new decline. The wave pattern may still take a more complex form, which we would like to avoid, but the wave pattern looks very convincing at the moment.

The demand for the dollar continues to increase.

The euro/dollar instrument fell by only a few points on Wednesday but lost as much as 100 yesterday. Thus, I assume that the supposed wave 4 has completed its construction. Yesterday, in general, turned out to be very nervous since all the news related only to Nancy Pelosi's visit to Taiwan. China opposed this visit and made several official warnings that Washington might regret it very much. However, the visit still took place, and Pelosi had already left Taiwan at the time of writing. At the same time, China began large-scale military exercises off the coast of Taiwan. Accordingly, Nancy Pelosi left, but the problem remained. Some analysts believe that in the near future, under the pretext of military exercises, China may try to seize the island it considers its own. And it is this new geopolitical problem that increases the demand for the US dollar, which is what we need, according to the wave markup.

Also, this morning, the European Union released a report on business activity in the service sector for July. The final value was 51.2 points, and the composite business activity index stopped at 49.9. I want to note that the service sector has been shrinking since April, and this is one of the signs of an impending recession, although the latest GDP reports have not shown a serious decline. However, I would like to remind you that the European Central Bank does not adhere to the tactics of a rapid interest rate increase, so we are now seeing the economy's reaction without the influence of the ECB. If the European regulator continues to raise the rate, the economy may shrink noticeably. It is the same picture now observed in the United States, where two-quarters have already turned out to be negative. However, so far, these are just concerns about a possible recession. The ECB has assumed that "the economy is more important than inflation," unlike the Bank of England and the Fed. Therefore, the European Union can still avoid a slowdown in the economy, but the euro currency does not have a significant value yet.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues. If so, it is now possible to sell the instrument with targets located near the estimated 0.9397 mark, which is equivalent to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. Wave 4 can already be completed.

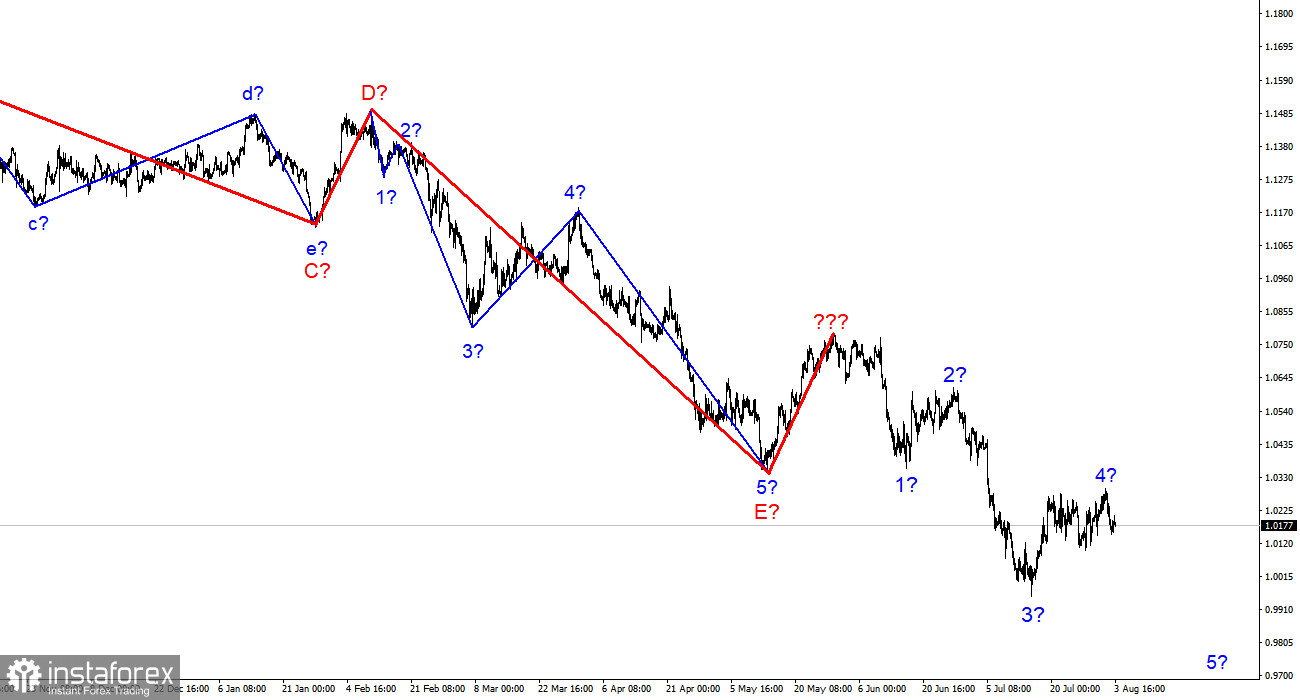

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard wave structures and work on them.