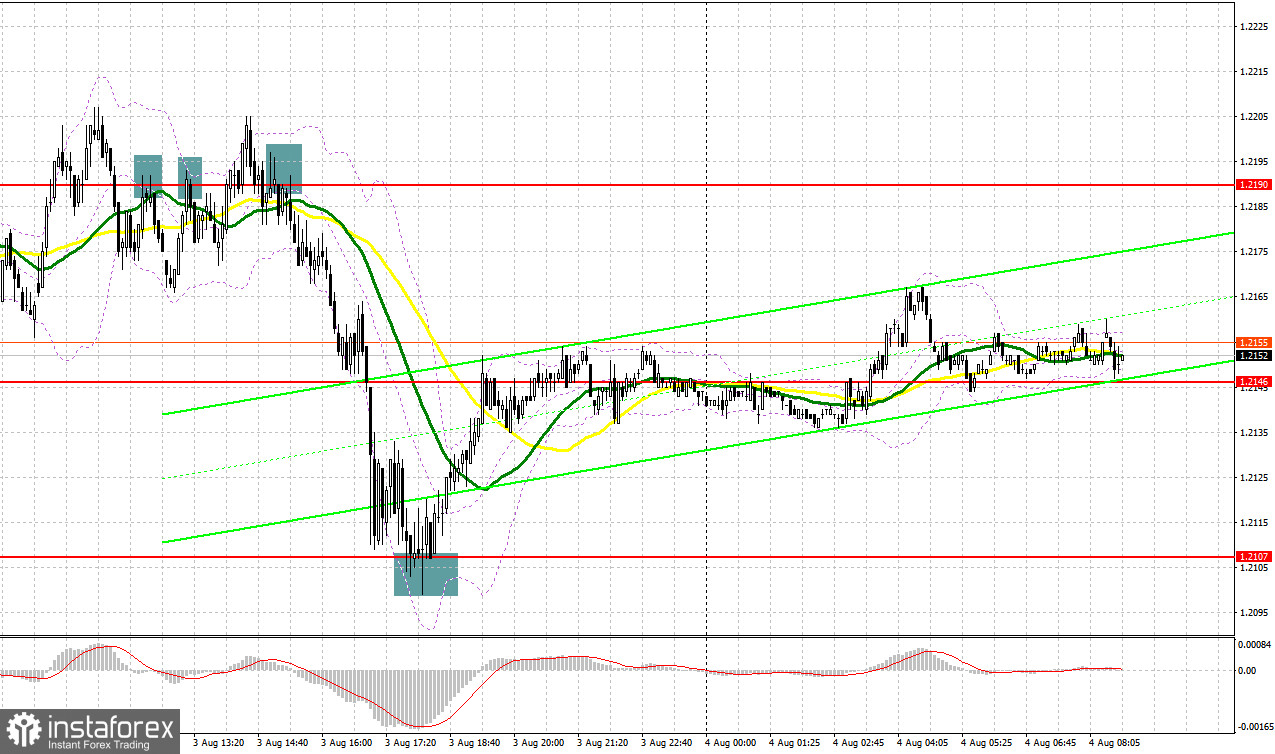

Several excellent market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.2190 level in my morning forecast and advised making decisions from it. Weak PMI reports did not allow bulls on the pound to break through above 1.2190. All attempts to settle at 1.2190 only caused the pair to return to the area under this level, which ultimately allowed us to get a sell signal. I did not see a sharp decline in the first half of the day, but another unsuccessful attempt to rise above 1.2190 during the US session and a false breakout at this level, along with a sell signal and also strong statistics from the US - all this resulted in a large fall of the pair in the 1.2107 area, allowing us to take about 80 points from the market. The bulls became more active after the 1.2107 level was tested, and a false breakout provided an excellent entry point for long positions. As a result, the pair recovered by more than 40 points.

When to go long on GBP/USD:

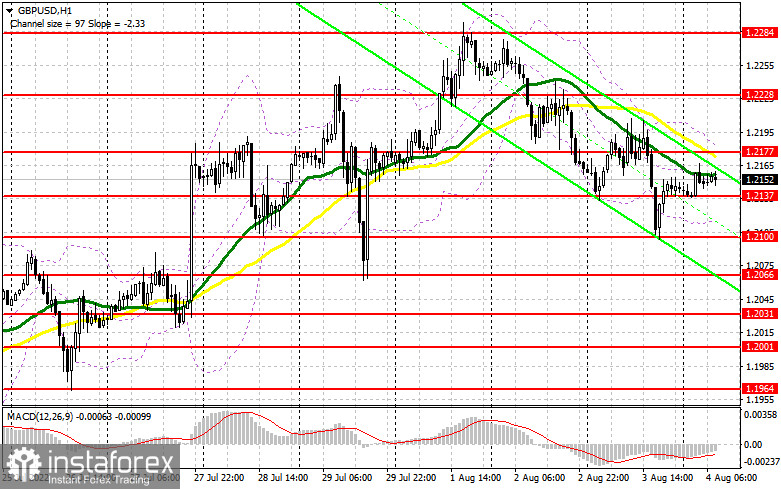

Today is a very important day, as for the first time in 27 years, the Bank of England may decide to raise interest rates by half a point at once. This will be done in response to high inflation, which has approached the level of 10.0% in the UK. There are also rumors that the central bank may decide to cut the trillion dollar program to support the economy, which of course will not please consumers and could harm the British pound even more even amid higher interest rates. The cost of living crisis continues to flare up more and more, and the reduction in support measures will only exacerbate it. Therefore, I see no prerequisites for the pound's further growth. In case the pair sharply falls after the BoE announces its decision, the best scenario for buying will be a false breakout in the nearest support area of 1.2137. In this case, you can count on a new spurt of the pair up to 1.2177, where the moving averages pass, playing on the bears' side. A breakthrough of this level opens the way to a high of 1.2228. A more distant target will be this month's high at 1.2284, where I recommend taking profits. However, a return to this level will happen only if, after raising interest rates, the BoE announces further tight monetary policy.

If the GBP/USD falls and there are no bulls at 1.2137, the pressure on the pound will increase, which will force the bulls to take profits before the meeting. If this happens, I recommend postponing long positions to 1.2100. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately for a rebound from 1.2066, or even lower - in the area of 1.2031 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

Yesterday, bears did their best to send the pound as low as possible after the ISM data was released, but the bulls seized the moment and gained long positions, counting on the pound's recovery after today's interest rate hike. If the bulls cannot offer anything around 1.2137 in the near future, you can safely bet on a larger downward movement of the GBP/USD and on the pair hanging in a wide horizontal channel. The optimal scenario for opening short positions would be a false breakout in the area of 1.2177, growth to which may occur after the BoE announces its summary. This will bring back pressure on the pound with the goal of moving to the nearest support at 1.2137, formed at the end of the Asian session. A breakthrough and reverse test from the bottom up of this range will provide an entry point for selling with a fall to 1.2100, and a further target will be the area of 1.2066, where I recommend taking profits.

In case GBP/USD grows and the bears are not active at 1.2177 in the first half of the day, the bulls will have a ghostly chance to save the situation, but much will depend on BoE Governor Andrew Bailey's speech. Only a false breakout around 1.2228 will provide an entry point to short positions, counting on the pair to bounce downward. If there is no activity there, a surge up to a monthly high may occur. With this option, I advise you to postpone short positions to 1.2284, where you can sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

COT report:

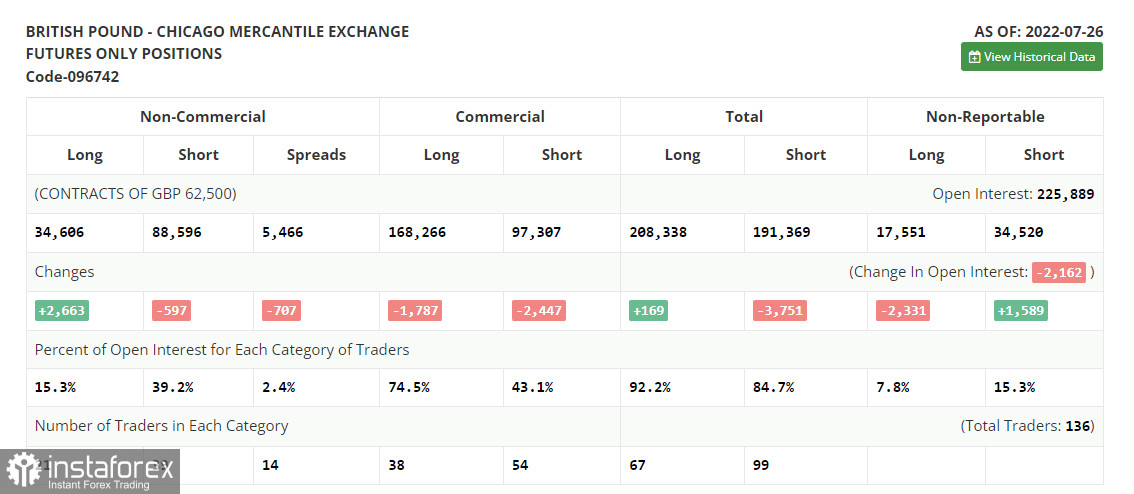

According to the Commitment of Traders (COT) report from July 26, the number of short positions dropped, whereas the number of long positions surged, reflecting the current market situation. The British pound is in demand. What is more, there is no doubt that the BoE will continue raising the benchmark rate this month. The central bank's aggressive policy has been having a positive influence on the national currency despite some economic problems. Last week, the US Fed decided to hike the key interest rate to combat surging inflation. This action is likely to affect the BoE's decision. Notably, demand for the pound sterling is not as high as it might seem. The pound/dollar pair is gaining in value amid the falling greenback. The fact is that there are rumors that the Fed may loosen its monetary policy this autumn. Even amid this backdrop, the pound sterling is unlikely to go on rising due to the cost of living crisis and economic slowdown. The COT report unveiled that the number of long non-commercial positions increased by 2,663 to 34,606, whereas the number of short non-commercial positions declined by 597 to 88,596. As a result, the negative value of the non-commercial net position decreased to 53,990 from -57,250. The weekly closing price rose to 1.2043 against 1.2013.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, which indicates a continuation of the downward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the area of 1.2177 will act as resistance. If the pair goes down, the lower border of the indicator around 1.2115 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.